- RBA Monetary Policy Meeting Minutes: Tuesday, 1:30. The minutes provide details of the RBA meeting earlier this month. At the meeting, the RBA held the benchmark rate at an even 1.0%. RBA Governor Philip Lowe noted concerns about global trade tensions as well as soft spots in the domestic economy. Will the minutes reiterate these concerns?

- MI Leading Index: Wednesday, 0:30. The Melbourne Institute’s composite indicator is based on nine economic figures, mostly published. Nevertheless, it provides a good overview of the economy. The indicator has been steady, posting three straight declines of 0.1%.

*All times are GMT

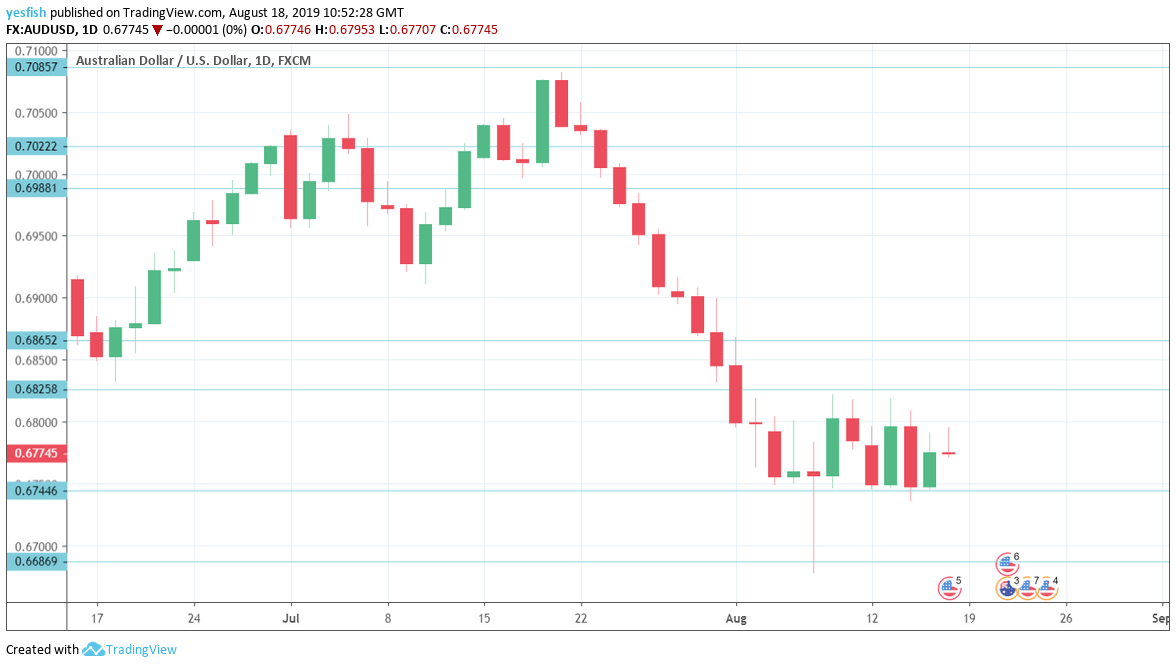

Technical lines from top to bottom:

We start with resistance at 0.7165. This line has held since early April.

0.7085 was a low point in September. 0.7022 is next.

0.6988 marked the low point in April.

0.6865 is next.

0.6825 (mentioned last week) is the next resistance line. It was under pressure last week.

0.6744 remains relevant. It was tested in support during the week and remains a weak support level.

0.6686 was a cap back in January 2000.

0.6627 has held in support since March 2009. 0.6532 is next.

0.6456 follows.

0.6341 has held in support since 2003.

I remain bearish on AUD/USD

Trade tensions remain high between the U.S. and China, which has soured investor risk appetite. Domestically, the economy is struggling, and fears of a recession in the U.S. sent the stock market sharply lower. This means that risk currencies like the Aussie could be in for a rough week.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!