- Business conditions in Australia remained solid in April.

- The Reserve Bank of Australia shocked markets last week by raising rates.

- Investors believe that the dollar may have peaked along with US interest rates.

Today’s AUD/USD forecast is bullish. Despite high inflation and rising interest rates, business conditions in Australia remained solid in April, driven by strong sales and a strong labor market. However, cost pressures continued to be a problem for businesses.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

In April, the National Australia Bank Ltd. survey’s measure of business conditions dropped two points to +14, but it remained much higher than its long-term average.

The Reserve Bank of Australia shocked markets last week by raising rates to an 11-year high of 3.85% and cautioned that more tightening might be necessary. Traders had looked for an extended pause. The still robust economic activity explains the reason behind the surprise hike.

Markets have factored in a slim possibility of another rate increase by August, but they are still leaning toward a halt in June.

On Monday, traders wagered that the dollar may have peaked along with US interest rates, putting pressure on the currency at the start of the week.

The Fed increased rates by 25 basis points last week. Still, it adopted a cautious tone compared to other central banks.

US rate futures have a one-third chance of a rate cut in July. However, Friday’s stronger-than-expected US jobs report raises the possibility that this is premature.

The Fed’s loan officer survey, scheduled to be released later on Monday, might reveal whether and how much banks are tightening credit after three US banks collapsed in recent weeks. This could hurt the dollar if it puts downward pressure on interest rates.

AUD/USD key events today

Investors are not awaiting any key economic releases from The US or Australia. Therefore, they will keep digesting recent releases, including the US nonfarm payrolls report.

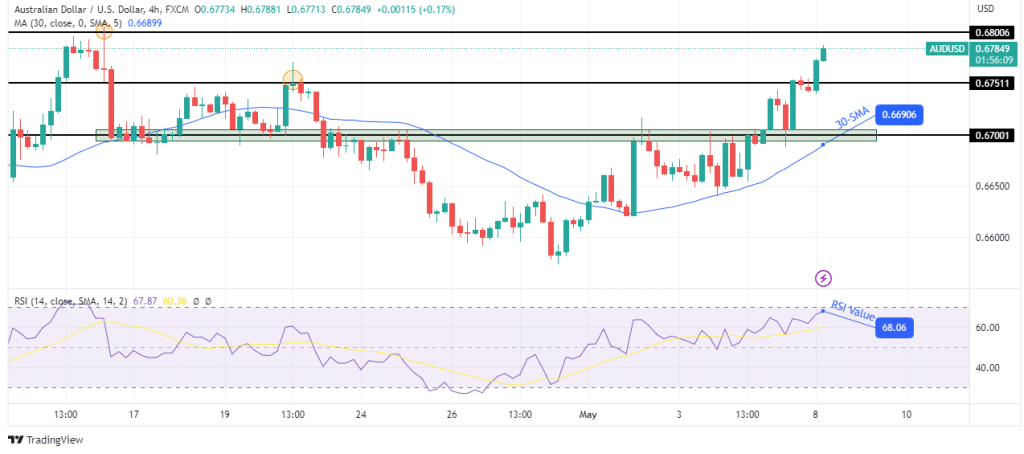

AUD/USD technical forecast: Bulls prepare to retest the 0.6800 resistance.

In the charts, AUD/USD is climbing after breaking above the 0.6751 resistance level. The price is trading well above the 30-SMA, indicating a bullish trend. The RSI also supports the bullish bias as it heads toward the overbought region.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

The bullish bias is strong. Therefore, we might soon see the price retest the 0.6800 resistance level. It will likely pause or pull back at this level before the uptrend continues by breaking above 0.6800.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money