The Australian dollar continued grinding lower surrendering to the might of the US dollar. The jobs report is the highlight of the week. Will the Aussie continue falling? Here are the highlights of the week and an updated technical analysis for AUD/USD.

The RBA left the interest rate unchanged as expected and sounded a bit more optimistic. Retail sales rose by 0.5% and it also provided an early cushion to the Aussie. However, the GDP report missed by rising by only 0.6%, weighing on the A$. In the US, the jobs report was mixed, but the greenback enjoyed the advances made on tax cuts.

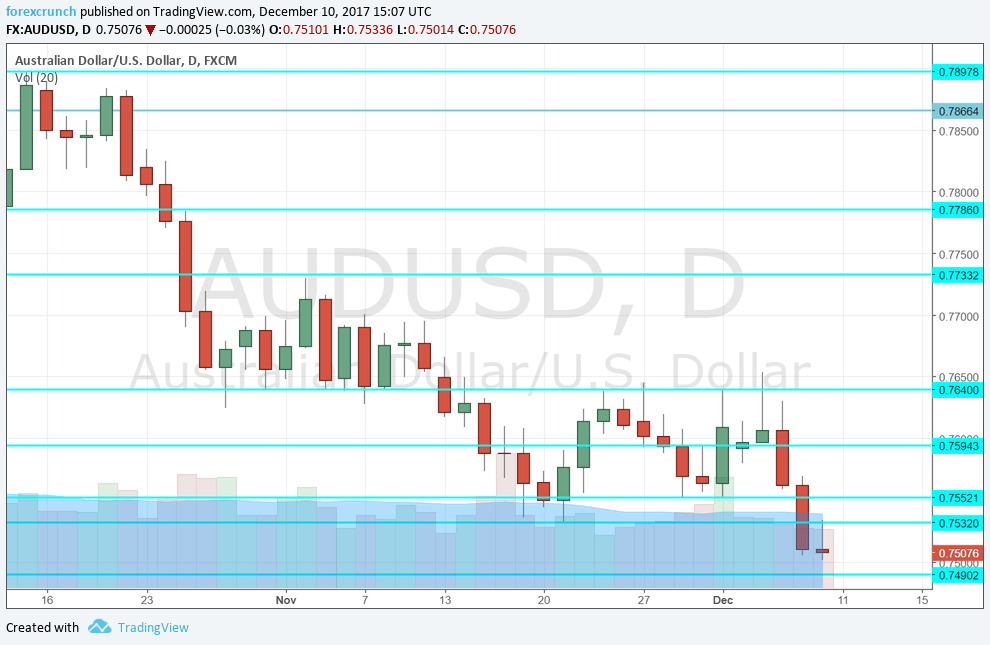

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- HPI: Tuesday, 00:30. Prices of home surprised with significant gains of 1.9% back in the second quarter of the year. A more modest rise is on the cards now: 0.6%.

- NAB Business Confidence: Tuesday, 00:30. The National Australia Bank’s measure of business confidence was steady at 8 points in the past two months after a few volatile months beforehand. A similar number is likely now.

- Phillip Lowe speaks Tuesday, 22:!5. The governor of the RBA will speak at the Australian Payment Summit and the theme is digitization, or in Australia’s case: eAUD. This is of interest to those trading in bitcoins but could also move the Aussie of course.

- Westpac Consumer Sentiment: Tuesday, 23:30. The bank’s measure of consumer confidence fell by 1.7% last time, after two months of healthy gains. We could see a resumption of rises this time.

- Christopher Kent talks: Wednesday, 00:00. The RBA Assistant Governor will be speaking about business, and this is an opportunity to talk about the economy and future monetary policy.

- MI Inflation Expectations: Thursday, 00:00. The Melbourne Institute fills in the gap for the government that publishes inflation data only once every quarter. The inflation expectations gauge stood at 3.7% last time. It could tick down now.

- Jobs report: Thursday, 00:30. Australia had a disappointing jobs report for October, with gains of only 3.7K. A bigger rise of 19.2K is on the cards now, and that would put the growth rate at levels we got used to earlier in the year. The unemployment rate is expected to remain unchanged at 5.4%.

- Chinese Industrial Production: Thursday, 2:00. The economic giant is Australia’s No. 1 trading partner. Growth in China’s industrial output implies growth in its imports of Australian commodities. An annual growth rate of 6.2% was seen in October and the same rate is on the cards for November.

AUD/USD Technical Analysis

The Aussie failed to break above the 0.7840 level (mentioned last week). It then dropped to the lower ground, hardly holding onto the 0.75 level.

Technical lines from top to bottom:

The psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

0.7860 served as support during September and is another line to watch. 0.7785 was a stepping stone on the way up.

Below, we find 0.7730, that was a high point in June 2017 and also beforehand, working as resistance in November. 0.7640 worked as resistance in November.

0.7595 was a swing high in early December and capped the pair. 07550 provided support in late November.

0.7530 is the cycle low, very close to the previous line and the last stop before the round number of 0.75.

Even lower, we find 0.7440 and then 0.7375.

I remain bearish on AUD/USD

The jobs report could disappoint for the second time in a row and even if it doesn’t the trend remains clear: to the downside. The US dollar is expected to remain stable amid the expected rate hike by the FED.

Our latest podcast is titled A December to remember for EUR/USD

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!