The Australian dollar changed course and made a move to the upside, enjoying the great jobs report. Will it continue higher? The RBA meeting minutes stand out. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australia reported a gain of no less than 61.6K jobs in November, far better than expected and with an upwards revision. Chinese industrial output was OK and the USD wobbled on positive retail sales and the upcoming tax bill while suffering from a second dissenter amid the Fed’s ranks and subdued inflation.

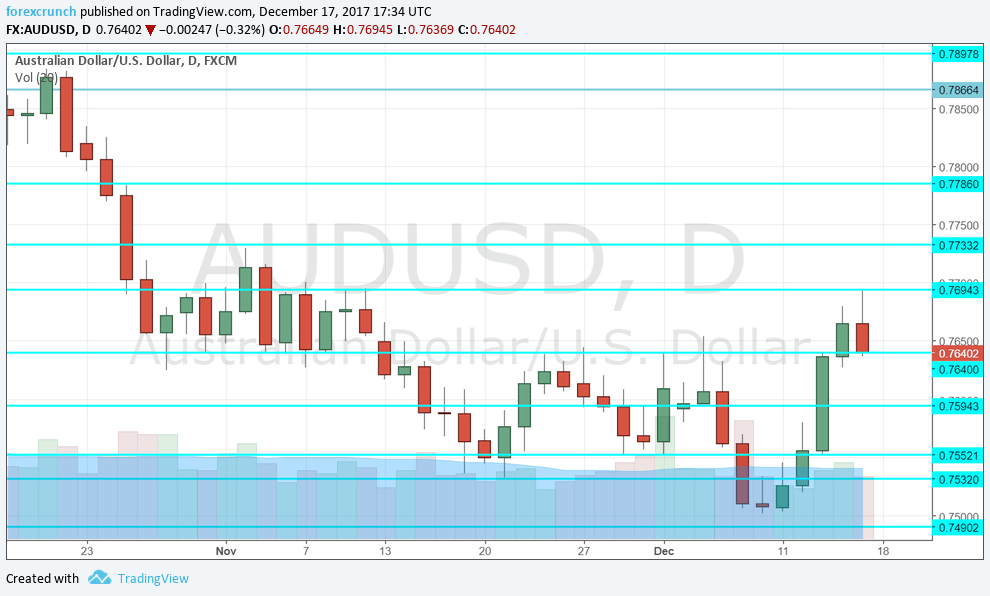

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- New Motor Vehicle Sales: Monday, 00:30. Sales of new cars and trucks serves as a gauge for the wider economy. Sales remained flat in October, a somewhat worrying sign.

- Mid-Year Economic and Fiscal Outlook: Monday, 1:15. The Australian Treasury publishes an update on the economic situation. Any change in growth forecasts will be watched closely. Announcements about new investments can also provide a boost to the Aussie.

- Monetary Policy Meeting Minutes: Tuesday, 00:30. The RBA left the interest rate unchanged in its last decision, early in this month. As the central bank takes a break in January, the meeting minutes carry more weight now. Are the members worried about low inflation? How do they see growth prospects into 2018? The tone of the document has an impact on the Aussie.

- CB Leading Index: Tuesday, 3:30. This composite index by the Conference Board rose by 0.2% in September, in line with previous movements. A similar change is likely for October.

- MI Leading Index: Tuesday, 23:30. The Melbourne Institute releases its own leading index, composed of 9 separate economic indicators. Recent figures were a “see-saw” between increases of 0.1% and slides of the same scale. After a rise of 0.1% last time, a slide cannot be ruled out this time.

AUD/SD Technical Analysis

The Aussie flirted with the lows of 0.75, mentioned last week, before changing course and rising towards 0.77.

Technical lines from top to bottom:

The psychological round level of 0.80. Below, we find 0.7940, which capped the pair in August.

0.7860 served as support during September and is another line to watch. 0.7785 was a stepping stone on the way up.

Below, we find 0.7730, that was a high point in June 2017 and also beforehand, working as resistance in November. The round number of 0.77 capped the pair in mid-December. 0.7640 worked as resistance in November.

0.7595 was a swing high in early December and capped the pair. 07550 provided support in late November.

0.7530 is the cycle low, very close to the previous line and the last stop before the round number of 0.75.

Even lower, we find 0.7440 and then 0.7375.

I am neutral on AUD/USD

The Australian dollar got a significant boost from the jobs report and could stabilize at current levels. Weak inflation may limit its gains.

Our latest podcast is titled What does 2018 have in store for financial markets?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!