The Australian dollar suffered one of its worst weeks of the year, slipping 1.9%, and closing just above the round number of 70. Australian markets are closed for two days next week and there are no Australian events. Traders can expect U.S indicators to have a magnified impact on the movement of the pair.

The global trade war shows no signs of letting up, and a slowdown in China’s economy is grim news for Australia, as China is the country’s number biggest trading partner. The U.S. has threatened to impose higher tariffs on March 1 if the sides don’t reach agreement on a wide range of trade issues, and unless there is a sudden breakthrough, the Aussie is likely to struggle early in the New Year.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

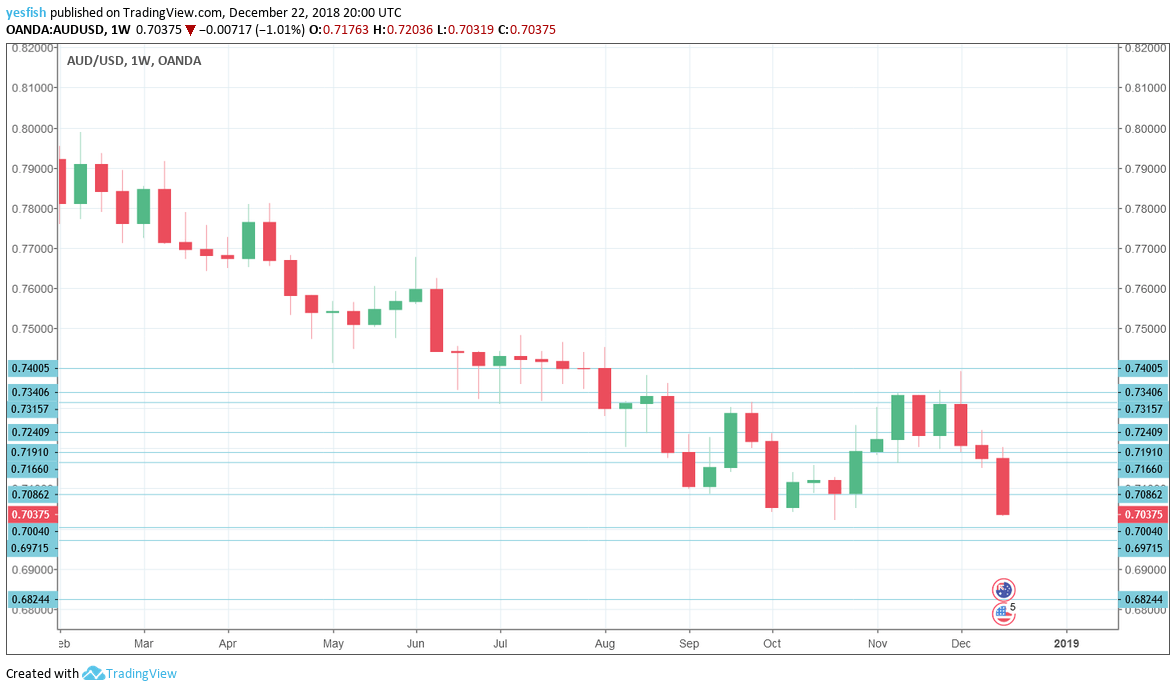

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

*All times are GMT

AUD/USD Technical Analysis

It was a dismal week for AUD/USD, which posted losses of over 1.0% on two separate days. The pair is down 3.7% this month, wiping out all the gains seen in November. On Friday, AUD/USD broke below 0.7085, mentioned last week).

Technical lines from top to bottom:

The round number of 0.74 was the high point reached at the wake of December. Next is 0.7340, which the pair breached in late November.

0.7315 was a swing high seen in late September and it remains relevant. Further down, 0.7240 separated ranges in September and in October. 0.7190 marked a low point in the first week of December.

Lower, 0.7165 was a swing low after a recovery in mid-November. 0.7085 was a low point in September and protected the symbolic round number of 0.70.

Close by, 0.6970 played a role back in January 2017. Below, 0.6825 supported the pair in late 2016 and early 2017.

0.6775 is the next support level. Below, 0.6686 was an important cap back in January 2000.

0.6532 is the final support level for now.

I am bearish on AUD/USD

The Aussie’s rough ride over the past few weeks could continue, as investor risk apprehension remains high after sharp declines on global stock markets. The shutdown of the U.S government could further sour investor sentiment, making risk currencies like the Australian dollar less attractive.

Our latest podcast is titled What to expect from the Fed, trade, and the Brexit saga

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!