- RBA Monetary Policy Meeting Minutes: Tuesday, 0:30. The RBA minutes will provide details of the policy meeting from earlier this month. At the meeting, policymakers maintained rates at 0.75%.

- CB Leading Index: Tuesday, 15:30. The Consumer Board index is based on 7 economic indicators. The November release came in at -0.3%. Will we see an improvement in the December release?

- Wage Price Index: Wednesday, 0:30. Wage growth is released every quarter, magnifying the impact of each release. The index dipped down to 0.5% in Q3, down from 0.6%. This matched the forecast. No change is expected in the Q4 release.

- Employment Reports: Thursday, 0:30. The economy created 28.9 thousand jobs in December, well above the estimate of 12.2 thousand. A much smaller gain is forecast for January, with an estimate of 10.0 thousand. The unemployment rate dropped to 5.1% in December, its lowest level since March. The estimate for January stands at 5.2%.

- PMIs: Thursday, 22:00. The manufacturing sector has been stagnant, as Manufacturing PMI has posted three straight readings just below the 50-level, which separates contraction from expansion. Services PMI fell to 48.9 in January.

AUD/USD recorded a winning week, the first time that has occurred since late December. The upcoming week has five events. Here is an outlook at the highlights and an updated technical analysis for AUD/USD.

In Australia, NAB Business Confidence remained in negative territory, with a reading of -1 in January. This was slightly better than than the reading of -1 in the previous release. Westpac Consumer Sentiment bounced back in February, with a gain of 2.3%. This followed back-to-back declines.

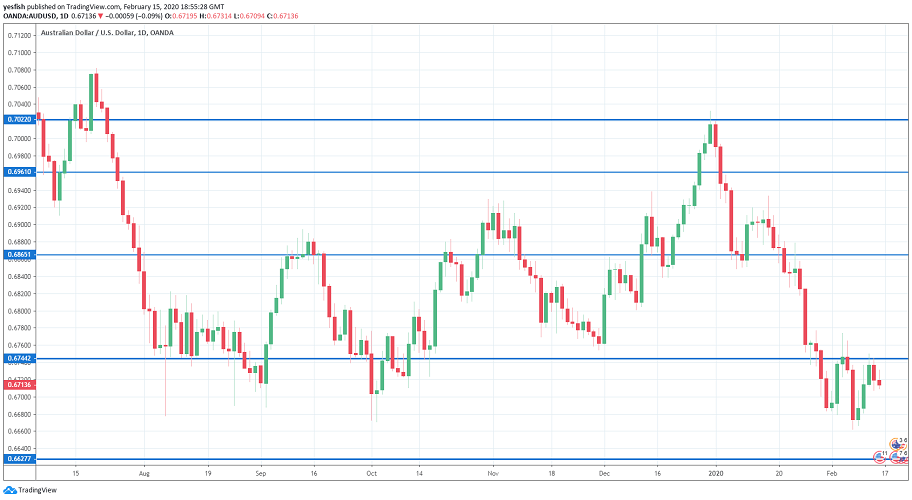

AUD/USD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 0.7022.

0.6960 has held in resistance since the first week in January, when AUD/USD went on a sharp slide.

0.6865 (mentioned last week) is the next resistance line.

0.6744 remains relevant. The line is currently an immediate resistance line.

0.6627 has held in support since March 2009 but is under pressure. 0.6456 is next.

0.6380 is the final support line for now.

I remain bearish on AUD/USD

The coronavirus continues to weigh on investor risk appetite, and there is no sign that the outbreak is under control. With China’s economy expected to take a sharp hit from the virus, the Australian economy will also be damaged.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!