The Australian dollar managed to weather the risk-off sentiment and to hold its ground The upcoming week features Australian Capital Expenditure and Chinese PMI data. What’s next for the Aussie? Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australia’s Construction Work Done measure disappointed by rising by only 0.2% q/q but an upwards revisions softened the blow. RBA Governor Phillip Lowe did not provide any earth-shattering news. In the US, the FOMC Meeting Minutes confirmed that a rate hike is coming in June but the Fed may take a break afterward. The mood in markets soured as trade relations between the US and China, that had seemed to improve, worsened again. Trump’s cancellation of the Summit with Kim also weighed on sentiment. Nevertheless, the Aussie weathered the storm.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

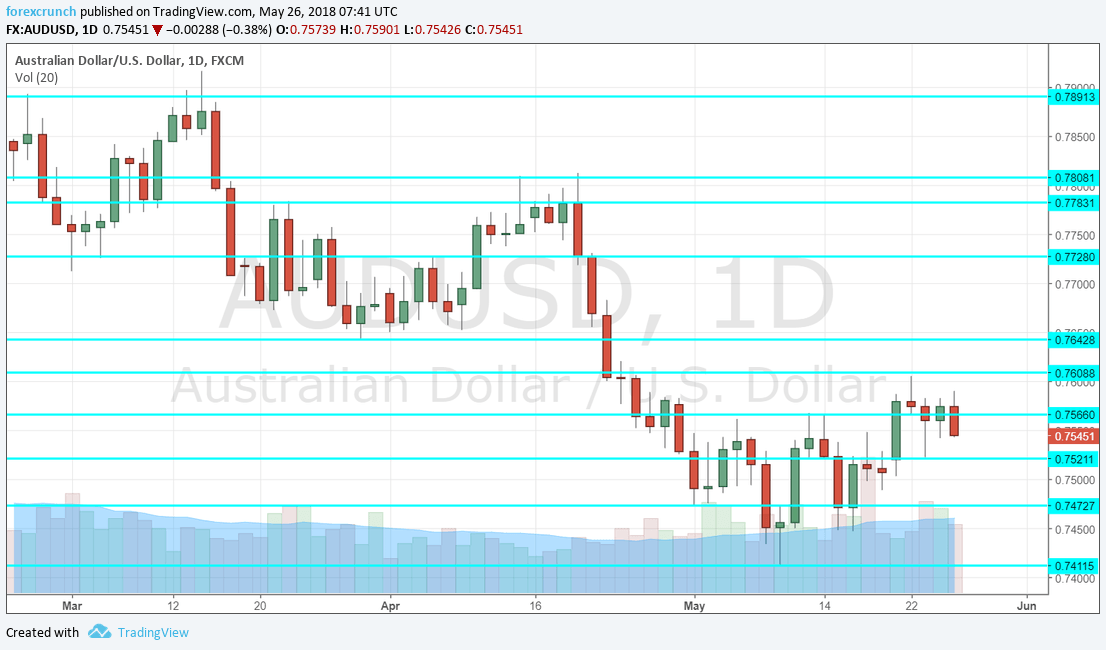

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Approvals: Wednesday, 1:30. This gauge of the housing sector is quite volatile. Building consents rose by 2.6% in March and are expected to drop by 2.9% in April.

- Chinese Manufacturing PMI: Thursday, 1:00. China is Australia’s No. 1 trading partner and any change in manufacturing indicates a change in the consumption of Australian metals. The government PMI has shown OK growth with a score of 51.4 points in April. A repeat of the same number is on the cards for May.

- Private Capital Expenditure: Thursday, 1:30. This quarterly figure reflects investment and is closely watched by the Reserve Bank of Australia. A disappointing drop of 0.2% was seen in Q4 2017 after several quarters of strong growth. A bounce back is expected now: 1.1% in Q1 2018.

- Private Sector Credit: Thursday, 1:30. Rising credit results in enhanced economic growth. After a rise of 0.5% in March, a similar increase of 0.4% is projected.

- AIG Manufacturing Index: Thursday, 22:30. The Australia Industry Group reported upbeat prospects for the manufacturing sector with a score of 58.3 points in April, representing robust growth. A similar number is likely for May.

- HIA New Home Sales: Friday, early in the day. The Housing Industry Association reported a drop of 2% in sales of new homes in March, a third consecutive drop. April may see a bounce back up.

- Chinese Caixin Manufacturing PMI: Friday, 1:45. The independent gauge of China’s manufacturing sector stood at 51.1 points in April. This important survey is now predicted to advance to 51.3 points.

- Commodity Prices: Friday, 6:30. Daily changes in commodity prices have some impact on the Aussie but this monthly figure matters as well. Year over year, commodity prices dropped by 1.4% in April.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD did not go anywhere fast and remained close to the 0.75 level (mentioned last week).

Technical lines from top to bottom:

0.7730 capped the pair in early April. 0.7675 provides some support in March and is another stepping stone.

Further below, 0.7640 was a stubborn cushion in March and April. The fall below this line proved its strength. 0.7610 was the peak of an upwards move in late May.

0.7560 is the next level to watch after it was the recovery level in early May. 0.7520 was a swing low in late May.

0.7430 was an initial low in late April and it is followed by 0.7410, an old line from 2017. Further down, 0.7375 is notable.

I remain bullish on AUD/USD

Australia’s latest economic figures are OK and the nation is on good terms with both the US and China. This could help the Aussie dollar maintain relative strength even if the mood further worsens.

Our latest podcast is titled Truce in trade and dollar domination

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!