- CB Leading Index: Monday, 15:30. This index is based on 7 economic indicators. In September, the index posted a small gain of 0.2%. We will now receive the October data.

- RBA Monetary Policy Meeting Minutes: Tuesday, 0:30. The minutes will provide details of the RBA policy meeting earlier in November, when the RBA maintained rates at 0.75%. The Australian economy is weak and investors will be looking for hints regarding further rate cuts.

- MI Leading Index: Tuesday, 23:30. This Melbourne Institute indicator has struggled, with only one gain in the past six months. Will we see a gain in the October release?

*All times are GMT

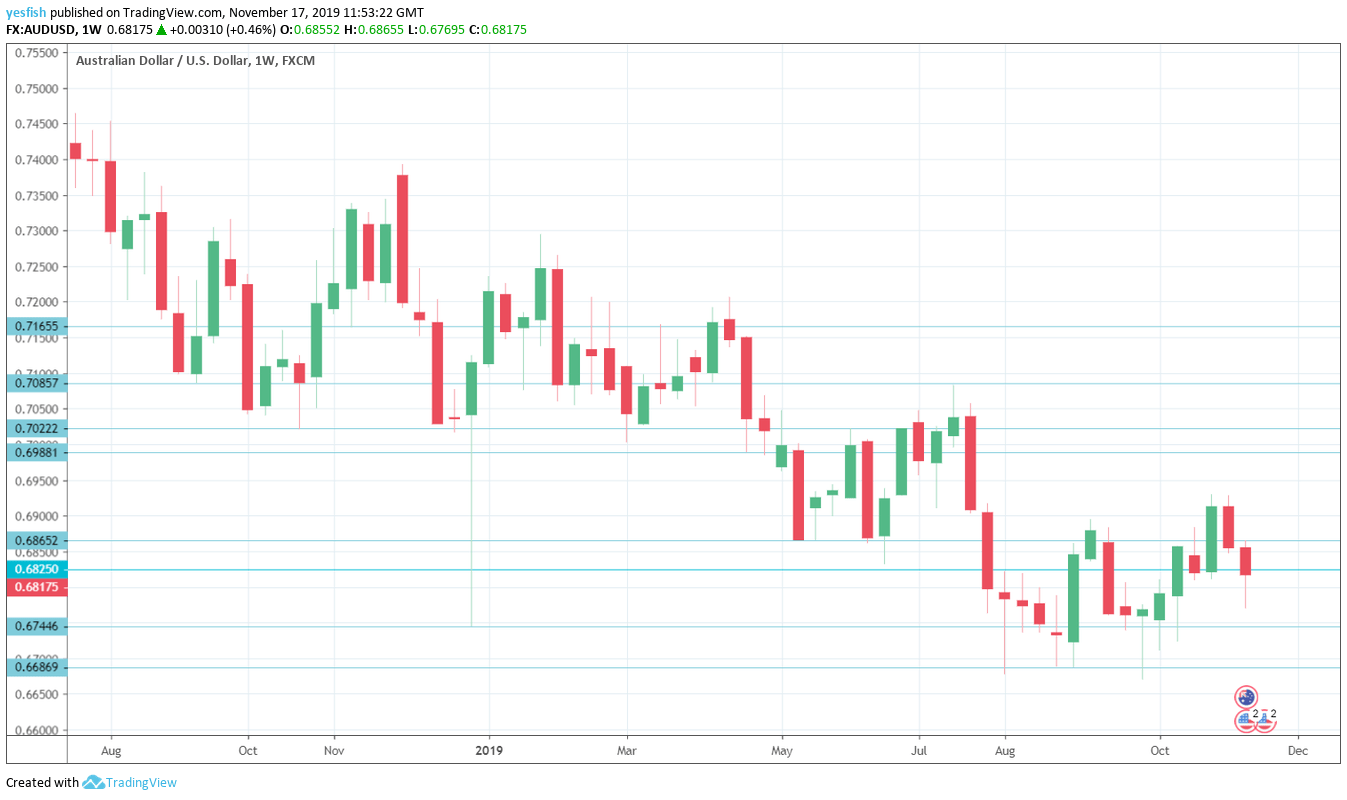

Technical lines from top to bottom:

We start with resistance at 0.7240.

0.7165 has held firm since early April.

0.7085 has held since July. 0.7022 is next.

0.6988 is protecting the symbolic 70 level.

0.6865 (mentioned last week) is next.

0.6744 is providing support.

0.6686 was tested in early October.

0.6627 has held in support since March 2009.

0.6532 is the final support level for now.

.

I remain neutral on AUD/USD

Recent interest cuts have failed to boost the Australian economy. However, if a trade deal is reached between the U.S. and China, risk appetite would climb, which would be bullish for minor currencies like the Aussie.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!