- MI Inflation Gauge: Monday, 0:00. This indicator continues to point to low inflation levels. In September, inflation came in at 0.1% and little change is expected in October.

- Retail Sales: Monday, 0:30. This key gauge of consumer spending rebounded in August with a gain of 0.3%, after a decline of 0.1% a month earlier. Another gain is expected in September, with a forecast of 0.3%.

- AIG Services Index: Monday, 21:30. The index was little changed in September, with a reading of 51.5. This points to weak expansion in the services sector. We will now receive the October release.

- RBA Rate Decision: Tuesday, 3:30. The RBA lowered rates to 0.75% earlier in October, as the bank tries to kick-start the domestic economy. The bank is expected to maintain rates at the upcoming meeting, which will put the focus on the rate statement – a dovish message could put pressure on the Australian dollar.

- AIG Construction Index: Wednesday, 21:30. The index continues to point to significant contraction, and the September release slowed to 42.6 points. Investors are braced for another reading in negative territory.

- Trade Balance: Thursday, 0:30. Australia’s trade surplus narrowed for a second straight month, falling to A$5.93 billion in August. This was down sharply from the July release of A$8.04 billion. The downturn is expected to continue in September, with an estimate of A$5.10 billion.

- RBA Monetary Policy: Friday, 0:30. Investors will be looking for hints of future monetary policy in the RBA’s quarterly report. It provides a broader view of the economy than the short rate statement. Any hints about changes in interest rates could affect the movement of the Aussie.

*All times are GMT

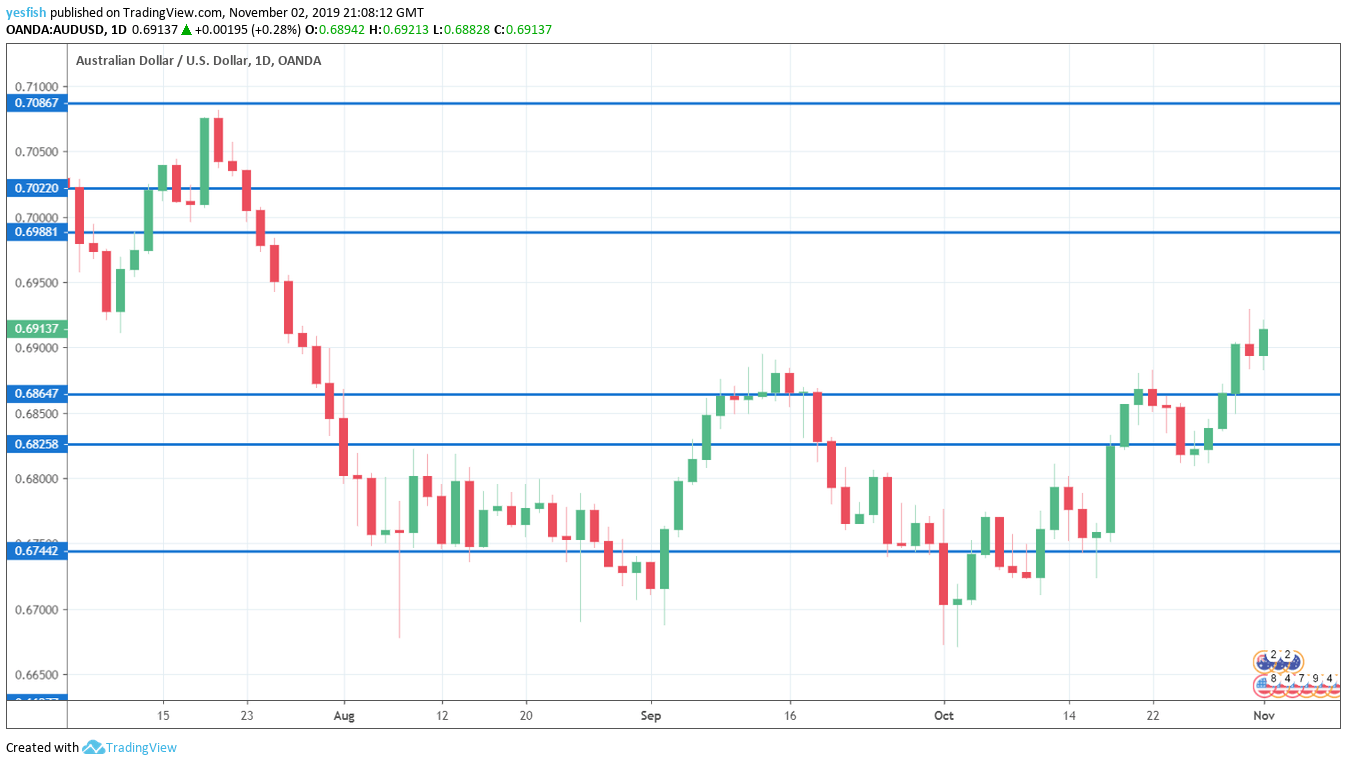

Technical lines from top to bottom:

We start with resistance at 0.7240.

0.7165 has held firm since early April.

0.7085 has held since July. 0.7022 is next.

0.6988 is protecting the symbolic 70 level.

0.6865 (mentioned last week) has switched to support after strong gains by AUD/USD last week.

0.6744 is next.

0.6686 was tested in early October.

0.6627 has held in support since March 2009.

0.6532 is the final support level for now.

I am neutral on AUD/USD

Risk appetite has been steady of late, which has benefited minor currencies like the Australian dollar. Still, the U.S-China trade war continues to cast a dark shadow, and investors could get restless and stick with safe havens if there is no progress in the current round of trade talks. Investors will be especially interested in the upcoming rate statement and comments from the RBA Governor regarding the rate outlook – a hint of more cuts to come could send the Aussie lower.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!