The Australian dollar had a tough week, surrendering to the strength of the US dollar and falling to fresh 21-month lows. What’s next? A mix of events awaits Aussie traders. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Reserve Bank of Australia left interest rates unchanged as expected and Australian retail sales rose by 0.3% as expected. The Australian Dollar suffered from the disappointing manufacturing PMI’s, both the official and the unofficial figures pointed to a significant slowdown. China is Australia’s No. 1 trading partner. The US Dollar enjoyed robust data, the breakout of US 10-year yields to the highest levels since 2011, and hawkish words by Fed Chair Powell, which opened the door to tight monetary policy.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- ANZ Job Advertisements: Monday, 00:30. This gauge of Australian employment precedes the official jobs report released by the government. The number of job advertisements dropped by 0.6% in August and we may see a bounce in September.

- NAB Business Confidence: Tuesday, 00:30. The National Australia Bank’s monthly survey of 350 businesses fell to 4 points in September and the trend is generally to the downside. Another drop cannot be ruled out.

- Westpac Consumer Sentiment: Tuesday, 23:30. This bank survey focuses on consumers. The 1,200-strong survey fell sharply in the past two months. After a slide of 3% in September, we could see a bounce back in October, as spring begins in Australia.

- Luci Ellis talks Wednesday, 22:30. The RBA Assistant Governor will talk in Melbourne and may provide hints on monetary policy. The event is titled “Delivering Growth with Equity.”

- MI Inflation Expectations: Thursday, 00:00. The Melbourne Institute’s Inflation Expectations measure showed expectations for an annual increase of 4% in August, above the current level of price increases. MI’s measure complements official inflation data which is released only once per quarter. We will now get the data for September.

- RBA Financial Stability Review: Friday, 1:30. The central bank publishes a report on financial stability twice per year. Apart from the assessment on stability, the publication also provides economic figures and may hint about monetary policy.

- Home Loans: Friday, 00:30. New loans increased by 0.4% in July after a substantial drop of 1.1% in June. While this is a volatile economic indicator, the data provides a snapshot of the housing sector. A drop of 0.9% is projected.

- Chinese trade balance: Friday, 2:00. Australia’s No. 1 trading partner is showing signs of a slowdown but still enjoys a high trade surplus that stood at 27.9 billion in August. Apart from the bottom line number, the level of imports matters to Australia that supplies China with metals for construction and industry. China’s trade surprlus is expected to stand at 24.6 billion USD.

*All times are GMT

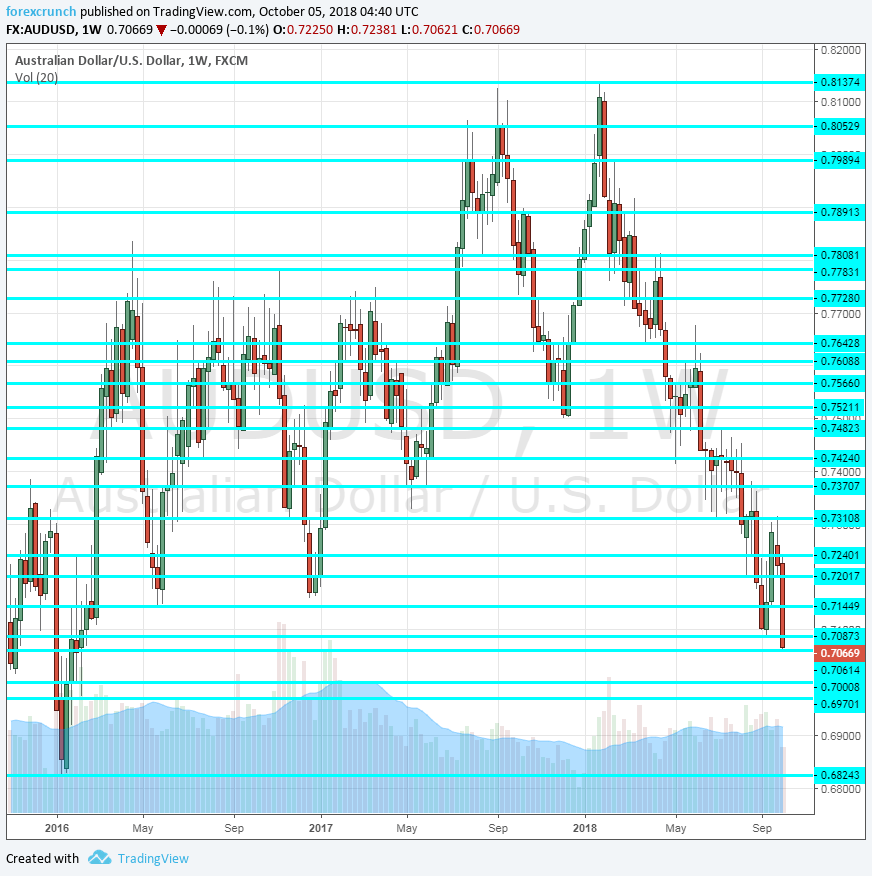

AUD/USD Technical Analysis

Aussie/USD failed to recapture the 0.7240 level (mentioned last week) and the rejection at resistance sent it all the way down to new 2018 lows.

Technical lines from top to bottom:

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July.

0.7310 is the low of July 2018. 0.7240 was a swing low in late August and the pair attempted to reach it in mid-September.

The round number of 0.7200 was a temporary low. 0.7150 was a stepping stone on the way down in early September. 0.7060 was a stepping stone on the way down in early October and is close to a level seen in January 2017.

The round number of 0.70 is closely watched by many market participants. Close by, 0.6970 played a role back in January 2017. Below, the only noteworthy level is only 0.6825 that supported the pair in late 2016 and early 2017.

I remain bearish on AUD/USD

The Fed’s hawkish policy boosts the dollar and the trade tariffs weigh on risk currencies such as the Australian dollar. Australia’s struggling housing sector does not help.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!