- Flash Manufacturing PMI: Sunday, 23:00. The index continues to post readings just over the 51-level, which points to stagnation. The August release came in at 51.3 and little change is expected in the September reading.

- Flash Services PMI: Sunday, 23:00. The services PMI slipped to 49.2 in August, the first time the index has been in contraction territory since May. This soft reading points to weakness in the business sector. Will we see any improvement in September?

*All times are GMT

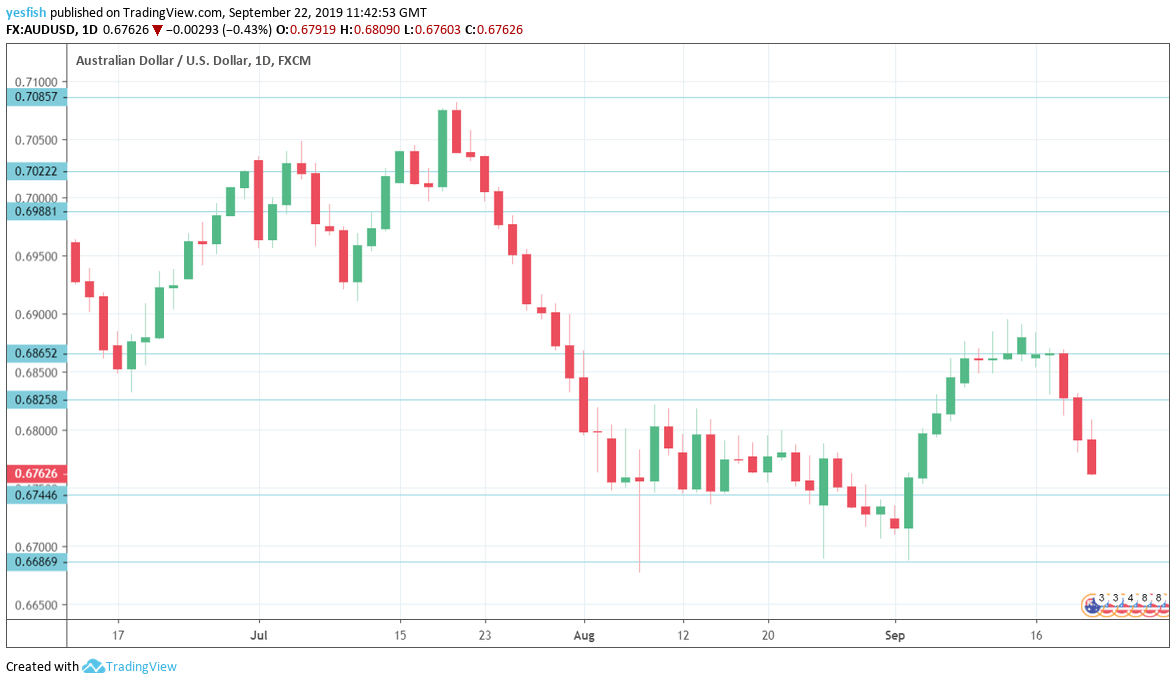

Technical lines from top to bottom:

We start with resistance at 0.7165. This line has held firm since early April.

0.7085 was a low point in September. 0.7022 is next.

0.6988 marked the low point in April.

0.6865 has some breathing room in resistance, with AUD/USD recording sharp losses this week.

0.6825 (mentioned last week) has some breathing room, following losses by AUD/USD last week.

0.6744 is under pressure in support.

0.6686 was a cap back in January 2000.

0.6627 has held in support since March 2009. 0.6532 is next.

0.6456 is the final support level for now.