- Shanghai is opening up soon, and this could push the pair higher.

- The commodity pair could move after the EU summit.

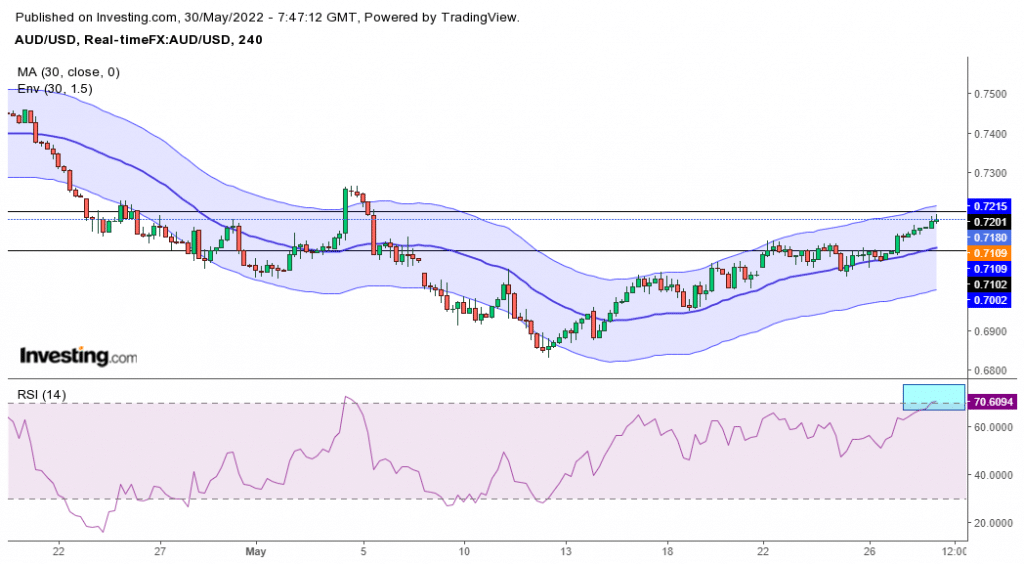

- The bulls are looking to push the price to 0.7200 on the charts.

The AUD/USD forecast remains bullish as the risk sentiment improves. Meanwhile, the Fed’s pause in the rate hike cycle may also provide some support.

-Are you interested in learning about the forex signals telegram group? Click here for details-

The risk-sensitive Australian dollar extended its Friday gains as it pushed past 0.7189, rising by 0.4%. A return of risk sentiment has seen the dollar weaken and the Australian dollar soars. The dollar index dropped to around 101.430, a 0.2% change on Monday after hitting a 20-year high earlier in May at 105.010.

The reopening will boost Australia and China’s trade activities as Shanghai said that unreasonable curbs on businesses will be done away with from June 1 as the COVID-19 lockdown is lifted. The Chinese economy and its trading partners have been damaged by the two-month lockdown that will end on Wednesday.

Vice mayor Wu Qing told reporters that they would coordinate the resumption of work and production of businesses in various industries and fields.

The AUD/USD, being a commodity pair, is quite sensitive to commodity price movements, including oil. A ban on Russian oil could mean supply pressures which would push oil prices higher in the global market. This ban could see the Australian dollar seeking higher prices.

AUD/USD key events today

Investors will be looking at the outcome of the EU meeting today, which could move AUD/USD prices. These talks will be overshadowed by the struggle that has gone on for over a month to agree.

“After Russia attacked Ukraine, we saw what can happen when Europe stands united.” German Minister Robert Habeck said on Sunday. “With a view to the summit tomorrow, let’s hope it continues like this. But it is already starting to crumble and crumble again.”

AUD/USD technical forecast: Bulls eying 0.7200 breakout

The 4-hour chart shows bullish momentum that could push prices to 0.7200. RSI is also bullish as it is currently in the overbought region above 70. Therefore, the bias for this pair remains bullish for the week ahead. Prices could hit highs above 0.7200 and then return to the 30-SMA, which has supported this uptrend.

-Are you interested in learning about forex indicators? Click here for details-

Bears looking at this chart should wait for prices to break below the 30-SMA and RSI to return to the oversold region below 30.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money