- Investors await the RBA meeting minutes.

- The pair has rallied since Wednesday’s upbeat jobs data from Australia.

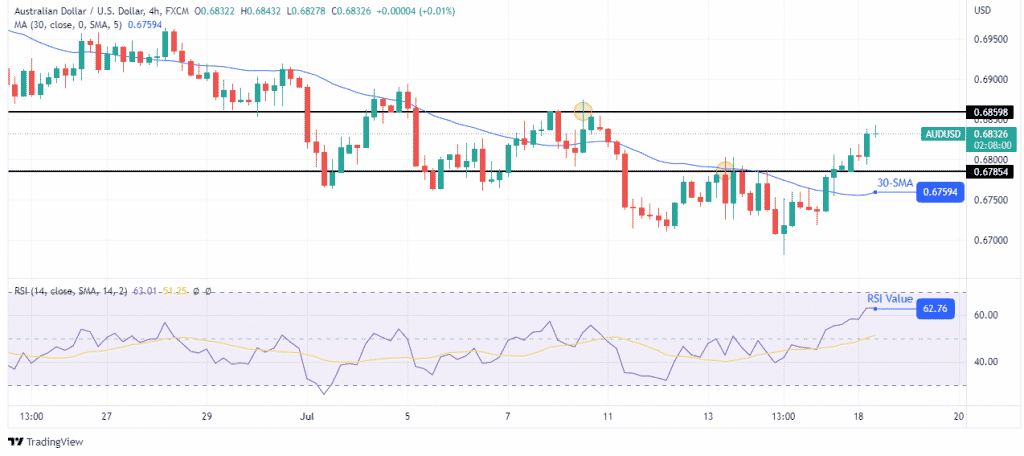

- The price trades well above the 30-SMA in the charts.

Today’s AUD/USD outlook is bullish as investors expect the RBA meeting minutes for the last meeting, where the bank hiked rates by 50bps. Markets expect a hawkish report as the bank continues its fight against inflation. Employment in Australia increased in May, showing the labor sector was doing well amid rising interest rates.

–Are you interested to learn more about forex signals? Check our detailed guide-

The latest jobs report for June also showed a rise in employment, further confirming growth in the labor market. It could mean the RBA has more room to hike rates, especially since unemployment was at 3.5%, a significant drop from the previous 3.9%.

The Australian dollar is also getting support from the recent softening of consumer inflation expectations in the US. Speeches from Fed policymakers have hinted at the Federal Reserve’s sticking to a 75bps rate hike next week.

AUD/USD key events today

From the US, the Treasury International Capital will report Long-Term Net Transactions. This report measures the difference in value between long-term foreign securities bought by US citizens and US long-term securities bought by foreigners. A rise in the demand for US securities will point to a rise in demand for the US dollar, pushing the Australian dollar lower.

From Australia, investors expect the RBA meeting minutes to give more details on the July 5 meeting. It will show why the bank decided to raise rates by 50 bps and what it might do in the future. Investors will also pay attention to RBA Assistant Governor Bullock, who will speak later today.

AUD/USD technical outlook: Bulls’ next target at 0.68598

Looking at the 4-hour chart, we see a change in the trend. The price is now trading well above the 30-SMA, and the RSI is heading for the overbought region. This is a sign that there has been a change in sentiment.

–Are you interested to learn more about automated trading? Check our detailed guide-

At this point, the bulls are showing a lot of strength, and they might head for 0.68598. This level acted as resistance on July 8 and is a crucial level. It would confirm this new trend if the price started retesting the 30-SMA as support. However, the downtrend will resume if it retests and breaks below the SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money