- The Aussie remains under pressure under 0.7300, and talk of a rate hike in Australia grows louder.

- A firmer Treasury yield and cautious mood snap a two-day downtrend in the US dollar.

- AUD/USD will be watched for Fedspeak, US inflation, and Chinese property sector concerns.

The AUD/USD price analysis suggests a mildly positive overview while the cautious market sentiment may hamper the gains in Aussie. In a relatively quiet Friday session, bears and bulls battle for dominance as AUD/USD hesitates.

–Are you interested to learn more about forex options trading? Check our detailed guide-

At the time of writing, the pair is trading at 0.7285, up 0.05%.

Despite the US dollar index losing its breath, the Australian dollar traded sideways for most overnight sessions. This is because Australian dollar earnings are likely to be held back by the market’s “revenue growth” mode in the days ahead.

At the same time, market participants are once again optimistic about the rate hike announcement from the Reserve Bank of Australia (RBA). However, the RBA politicians have repeatedly warned investors that the long-awaited rate hike will not be announced anytime soon.

RBA Governor Philip Lowe said on Nov. 16 that “the economy and inflation must be very different from those benchmarks before the Board of Directors considers raising rates next year.” He goes on, “it will likely be some time before we meet our rate hike conditions, and the Board is patient.”

The Chinese real estate market is also causing investors to worry over the Australian one. The S&P Ratings reported Thursday that the China Evergrande Group is still very likely to file for bankruptcy despite recent coupon payments on bonds. Furthermore, Moody also reiterated its concerns regarding Chinese developers, adding, “The risk will persist as credit conditions tighten and sales decline.”

The Australian also reported that Victoria spoke of the ease of isolating from COVID-19 on Thursday, which will give the economy a much-needed boost in the fourth quarter.

Aside from Fedspeak, no significant dates or events will drive the AUD/USD market. Nonetheless, investors will remain on edge due to the RBA rate hike and inflation expectations in the US.

–Are you interested to learn about forex bonuses? Check our detailed guide-

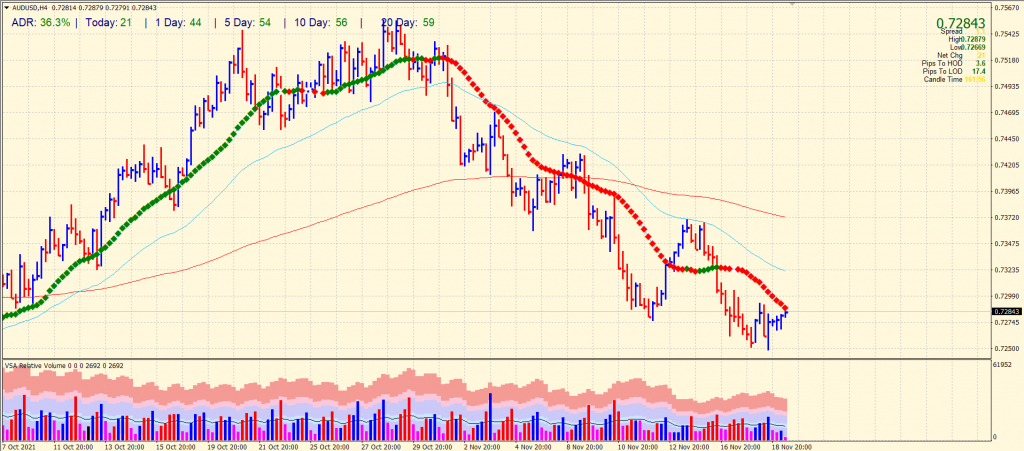

AUD/USD price technical analysis: Bulls shy of 20-SMA

The AUD/USD price remains slightly supported after posting a bottom reversal bar. However, the pair is capped by the 20-period SMA on the 4-hour chart ahead of the 0.7300 round number. Further resistance can be seen around 50-period SMA at 0.7325 and then 200-period SMA at 0.7370. On the downside, the pair may find support at 0.7250. The volume data is not favoring the bulls at the moment.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.