Best Forex Brokers 2024 – Compare Top Brokers

If you’re planning to trade currencies online – you’ll need a great forex broker on your side. The broker should offer plenty of currency markets, low fees, and commissions, and have a solid regulatory framework. In this guide, we review the Best Forex Brokers in 2024 and provide a step-by-step walkthrough of how to get started with an account today.

Best Forex Brokers 2024 List

Below you will find a breakdown of the 11 best forex brokers for 2024. Scroll down to read our full review of each forex brokerage site!

- Capital.com – Best Forex Broker for Beginners ($20 Minimum Deposit)

- AvaTrade – Top-Rated Forex Broker With Support for MT4 and MT5

- Go Markets – MT4 and MT5 Forex Broker with High Leverage

- Libertex – Online Forex Broker With ZERO Spreads

- Vantage FX – One of the Best Brokers for Forex ECN Accounts

- IG – Best Forex Broker for Spread Betting (UK and Ireland Only)

- Forex.com – Best Broker for Forex Traders in the US

- TD Ameritrade – Best Forex Broker for Advanced Traders

- FXTM – Best Forex Broker for Low Fees and MT4 Trading

- Charles Schwab – Best Broker for Long-Term Forex Trading

Best Forex Brokers

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$50

Spread min.

-

Leverage max

50

Currency Pairs

52

Trading platforms

Funding Methods

Regulated by

FCACYSECASICCFTCNFABAFIN

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

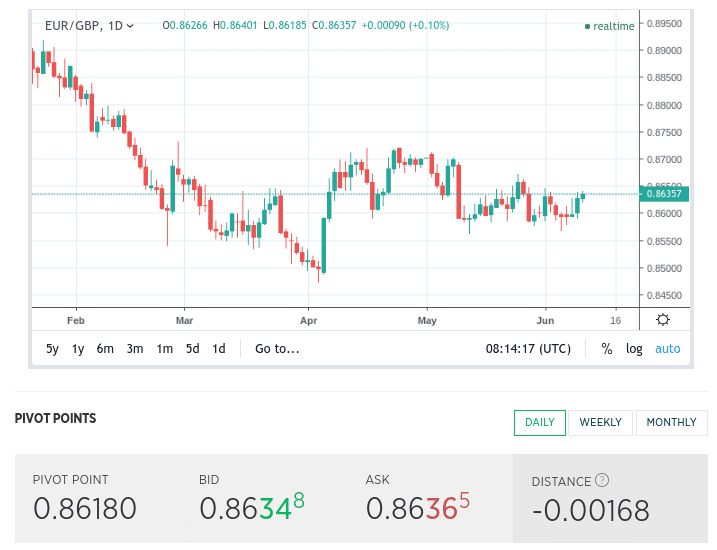

EUR/GBP

2.5

EUR/USD

1

EUR/JPY

2

EUR/CHF

5

GBP/USD

2

GBP/JPY

3

GBP/CHF

4

USD/JPY

1

USD/CHF

1.5

CHF/JPY

2.7

Additional Fee

Continuous rate

-

Conversión

-

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

Yes

CFTC

Yes

NFA

Yes

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

Min.Deposit

$20

Spread min.

0.0 pips

Leverage max

20

Currency Pairs

100

Trading platforms

Funding Methods

Regulated by

FCACYSECASICCFTCNFABAFIN

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

1.4

EUR/USD

0.6

EUR/JPY

1.5

EUR/CHF

2.2

GBP/USD

0.8

GBP/JPY

1.9

GBP/CHF

2.4

USD/JPY

1.3

USD/CHF

1.3

CHF/JPY

2.6

Additional Fee

Continuous rate

-

Conversión

0.0 pips

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

Yes

CFTC

Yes

NFA

Yes

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

Min.Deposit

$0

Spread min.

-

Leverage max

2

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSEC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

from 0,0003%

EUR/USD

from 0,0003%

EUR/JPY

from 0,0003%

EUR/CHF

from 0,0003%

GBP/USD

from 0,0003%

GBP/JPY

from 0,0003%

GBP/CHF

from 0,0003%

USD/JPY

from 0,0003%

USD/CHF

from 0,0003%

CHF/JPY

from 0,0003%

Additional Fee

Continuous rate

-

Conversión

-

Regulation

No

FCA

Yes

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

70.8% of retail investor accounts lose money when trading CFDs

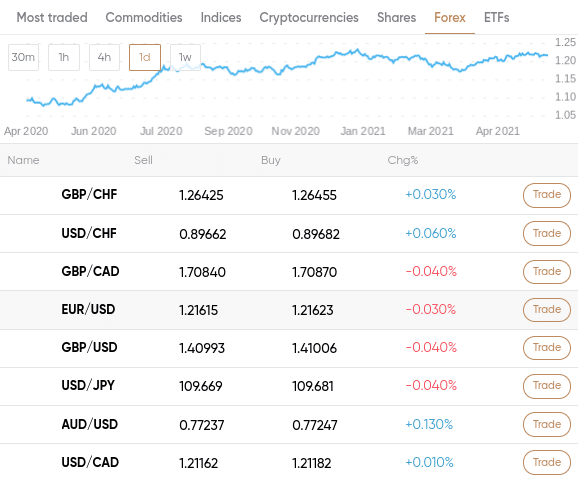

Find the Best Forex Brokers – Comparison

Top 10 Forex Brokers Reviewed

Currency trading is a multi-trillion-dollar arena – so it makes sense that there are now hundreds of forex brokers to choose from. Many are aimed at the average retail investor, so the process of getting started with an account is easy.

You do, however, need to assess where the forex broker stands with respect to regulation, commissions, markets, trading tools, payments, customer support, and more. To save you from having to perform countless hours of research, below we review the top 10 forex brokers in the world!

1. Capital.com – Best Forex Broker for Beginners ($20 Minimum Deposit)

First and foremost, the platform supports all major and minor pairs alongside dozens of exotics. Each and every forex market offered on the Capital.com platform can be traded with leverage. Most importantly, this forex broker charges 0% in commissions and is considered one of the best low spread forex brokers because of its competitive spreads. Once you register with Capital.com, you might decide to start off with a free demo account.

This allows you to test your forex trading strategies risk-free. As the Capital.com forex demo account mirrors live forex market conditions, this is a great way to learn the ropes. With that said, the minimum deposit at Capital.com is just $20 – which is an inconsequential amount for most. The platform supports e-wallets and debit/credit cards for instant deposits.

On the other hand, this is also considered one of the best AI Trading Brokers. Capital.com uses a powerful AI system to monitor how you perform in the market, analysing your trading behaviour and providing insight that can help you make better trading decisions.

In terms of its regulatory standing, Capital.com is licensed by the FCA and CySEC. As such, the platform ensures your money is safeguarded at all times. If you’re interested in trading other asset classes, Capital.com also offers markets on ETFs, indices, hard metals, energies, and digital currencies. There is also support for over 2,000 stock CFDs from a variety of international exchanges.

| Account minimum | $20 |

| Fees | Variable spread on Forex, Stocks & Crypto; Free of inactivity and withdrawal fees |

| Features | Low spreads, over 3,000 shares, spread betting & AI trading platform |

- 0% commission and tight spreads

- Thousands of markets on offer

- CFD asset classes include crypto, stocks, forex, and commodities

- Minimum deposit of just $20

- Supports debit/credit cards and e-wallets

- Great for beginners

- MT4 supported

- Leverage available – limits depend on your location

- You can’t invest in the underlying asset – CFD instruments only

67.7% of retail investor accounts lose money when trading CFDs with this provider

2. AvaTrade – Top-Rated Forex Broker With Support for MT4 and MT5

Both of the aforementioned third-party platforms will give you access to an abundance of forex trading tools. This is inclusive of advanced order types, technical indicators, and chart drawing tools. Once you have connected your AvaTrade account to either MT4 or MT5, you can then buy and sell currency pairs without paying a single cent in commission.

Instead, AvaTrade will simply charge you a variable spread. This is typically very competitive at the platform, with EUR/USD starting at 0.9 pips. In addition to forex, AvaTrade also offers markets on stocks, indices, and a good selection of digital currencies. These all come in the shape of CFD instruments, so you will be able to apply leverage with ease. If you’re also looking for Islamic forex brokers, you should know that this broker is considered one of the best in this matter.

In terms of safety, AvaTrade is regulated in six different jurisdictions. This includes licenses with ASIC, the Central Bank of Ireland, and the FSA in Japan. Getting started with an account requires a minimum deposit of just $100. Or, you might decide to start off with the AvaTrade demo account facility – which requires no deposit at all. The broker supports debit and credit cards – so your deposit will be processed instantly.

| Account minimum | £100 |

| Fees | Variable spread on CFDs & Forex; Commission of 0.25% for Bitcoin trading; $50 inactivity fee per quarter after three months of inactivity |

| Features | Supports MT4/5, commission-free platform, a wide range of tradable instruments, educational materials, islamic trading account, ASIC regulated |

- Regulated in 6 different jurisdictions

- Supports CFD markets on forex, stocks, cryptocurrencies, and more

- 0% commission and low spreads

- Compatible with MT4 and MT5

- Minimum deposit of just $100

- Leverage offered on all markets

- Stock CFD department is limited in comparison to other platforms

71% of retail investor accounts lose money when trading CFDs with this provider

3. Go Markets – MT4 and MT5 Forex Broker with High Leverage

Go Markets offers 2 account types: a commission-based account with reduced spreads and a spread-only account. Spreads for the commission account start from 0 pips and the trading fee is just $3 per lot per side. Spreads for the spread-only account start from 1.0 pips for major forex pairs.

Another reason to choose Go Markets is that it accepts a wide range of base currencies: USD, AUD, EUR, GBP, NZD, CAD, SGD, CHF, and HKD. Traders can fund an account with a debit card, credit card, bank transfer, or e-wallet.

Go Markets doesn’t offer its own forex trading platform, but instead gives traders access to MetaTrader 4 and 5. To supplement these already powerful trading platforms, Go Markets also offers Autochartist for automated technical analysis and its own daily forex signals. Go Markets traders also get access to Myfxbook and a VPS for algorithmic trading.

| Account minimum | $200 |

| Fees | Variable spread on forex; commission account $3 per lot per side |

| Features | 49 currency pairs offered, leverage up to 500:1, spread-only account, MT4 & MT5, Autochartist |

- Trade 49 major and minor forex pairs through CFDs

- Apply leverage up to 500:1

- Spreads start from 0.0 pips with a commission account ($3 per lot per side)

- Includes MT4 and MT5

- Trading tools include Autochartist, Myfxbook, and a VPS

- Spreads are often slightly above average

62% of retail investor accounts lose money when trading CFDs with this provider

4. IG – Best Forex Broker for Spread Betting (UK and Ireland Only)

Best of all, when spread betting forex at IG, any profits you make from your forex trading endeavors are free from capital gains tax.

You will also have access to leverage of up to 1:30 and even more if you are classed as a professional trader. Getting started at IG requires a minimum deposit of £250 – which you can fund with a debit/credit card or bank transfer. Once registered, you can trade via the IG website, MT4, or ProRealTime.

| Account minimum | $250 |

| Fees | 2 cents per share for US stocks; variable spread on Forex & Crypto; £12 a month after 24 months as an inactivity fee |

| Features | More than 80 currency pairs offered, spreads start at just 0.8 pips and no commissions charged, trade on the IG website or via the app |

- Established in 1974 and listed on the London Stock Exchange

- Offers CFD and spread betting markets

- Most assets can be accessed at 0% commission

- Forex spreads start from just 0.6 pips

- Supports MT4

- Offers traditional stocks and funds for UK investors

- More suited for experienced traders

71% of retail investor accounts lose money when trading CFDs with this provider

5. Libertex – Online Forex Broker With Tight Spreads

This allows you to buy and sell currency pairs in super cost-effective conditions – especially if you are looking to scalp or for a day trading forex broker. On the flip side, you will need to pay a small commission per slide – but this is very competitive at Libertex. For example, The likes of EUR/JPY, USD/CHF, and even USD/CLP can be traded at a commission of just 0.006%.

| Account minimum | $100 |

| Fees | Variable commission scheme for stock and Forex trading; $5 a month after 180 days as an inactivity fee |

| Features | Zero spread CFD trading, very competitive commissions – starting from 0% upwards, good educational resources, long-established broker |

- Tight spreads on all markets

- Low trading commissions

- Minimum deposit of just $100

- Supports CFD instruments on stocks, crypto, ETFs, forex, commodities, and more

- Debit/credit cards and e-wallets accepted

- Heavily regulated and more than 20+ years in the trading space

- MT4 and MT5 supported

- CFD instruments only – no traditional ownership

83% of retail investor accounts lose money when trading CFDs with this provider

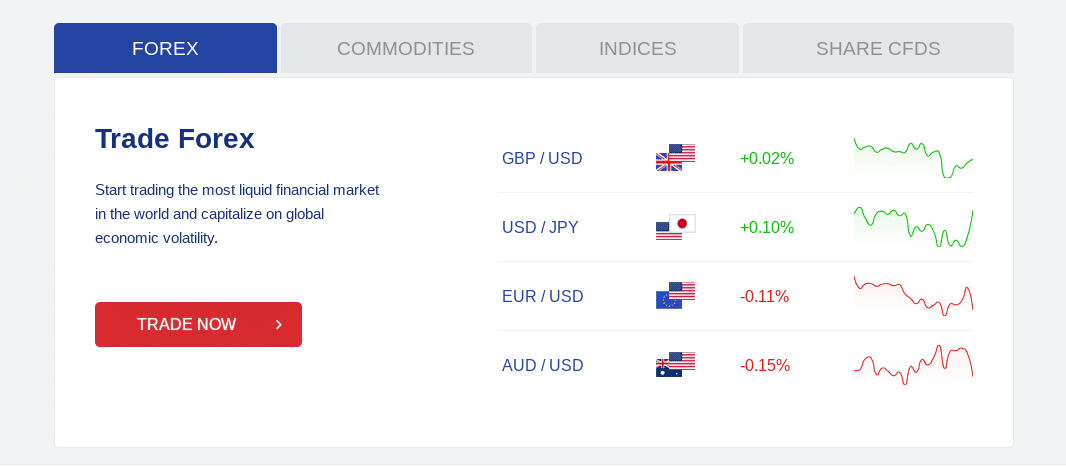

6. Forex.com – Best Forex Broker For Traders in the US

Forex.com claims to be the number one forex broker in the US – and it might not be wrong. This heavily regulated brokerage firm is super popular with Americans that wish to buy and sell currencies from the comfort of their home. In total, you will have access to over 80+ forex trading markets.

This covers all majors, minors, and heaps of exotics. Best of all, there are plenty of account types to choose from – each of which is aimed at a specific type of forex trader. For example, if you’re a beginner, the Standard Account allows you to trade forex on a 0% commission basis – where you will only pay the spread.

If you’re an experienced trader that is looking to place larger value positions, the DMA account at Forex.com offers 0 spreads alongside a small commission. When it comes to leverage, US traders can apply 1:50 on major forex pairs and less on other currency markets. Getting started at Forex.com takes minutes and you can trade via the broker’s web platform, MT4, or MT5. VPS hosting is also supported for automated trading.

| Account minimum | £100 on debit/credit cards and Paypal |

| Fees | Variable spread on CFDs and Forex; Inactivity fee of $15 a month after 365 days |

| Features | Specialist forex trading app, access to dozens of currency pairs, particularly strong when it comes to exotic currencies, no minimum deposit when opting for a bank wire |

- Great forex broker for US traders

- 1:50 leverage on major forex pairs

- Multiple account types are available

- Trade online or via MT4/MT5

- More than 80+ pairs supported

- Permits automated trading

- US clients do not have access to guaranteed stop-loss orders

Your capital is at risk when trading financial instruments at this provider

7. TD Ameritrade – Best Forex Broker for Advanced Traders

If you’re a serious forex trader that knows your way around advanced trading tools – then TD Ameritrade could be the best forex broker for you. This age-old brokerage firm has an excellent reputation for trust and security – and now serves millions of traders around the world.

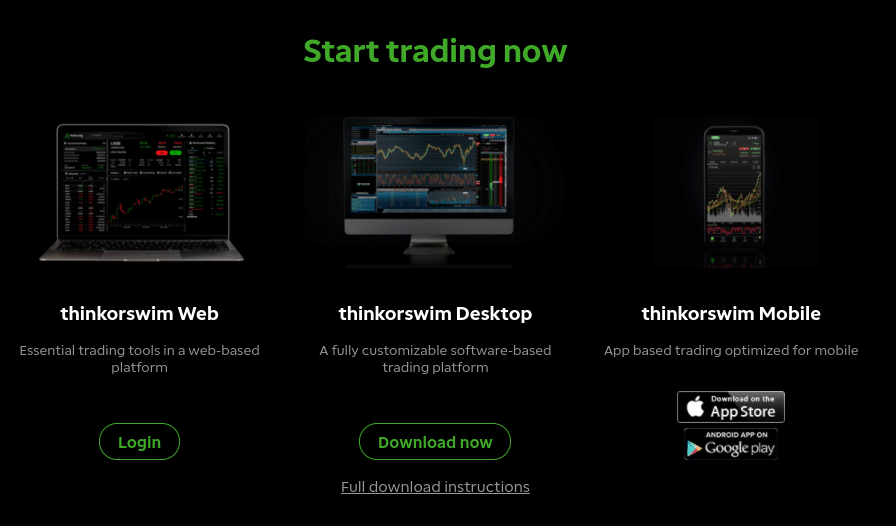

The forex trading department at TD Ameritrade – which covers dozens of popular pairs, is best accessed via the broker’s native platform – thinkorswim. This is one of the most sought-after trading platforms for experienced forex speculators – as it comes packed with notable features.

For example, you can view economic data and forex news in real-time, as well as view social sentiment levels. You can also customize your trading screen, deploy dozens of technical indicators, and access chart drawing tools. The thinkorswim platform can be accessed online, but for the full experience, you might consider downloading the desktop version to your device.

If you are new to thinkorswim, TD Ameritrade offers a free paper trading account that comes with $100,000 in virtual capital. This will allow you to get to full grips with how the platform works before trading with real money. When it comes to forex trading fees at TD Ameritrade, there are no commissions to pay. Instead, you simply need to cover the spread.

| Account minimum | FREE |

| Fees | None on stocks; Variable spread in Forex; Free for ACH withdrawals, $25 for wire transfer withdrawals |

| Features | Established US brokerage firm, huge asset library that includes thousands of stocks and funds, commission-free trades on US stocks and ETFs |

- Great for experienced traders

- Thinkorswim platform comes packed with advanced trading tools

- Fees are competitive on most assets

- Thousands of financial instruments supported

- Solid regulatory standing

- No minimum deposit

- Not suitable for beginners

Your capital is at risk when trading financial instruments at this provider

8. Vantage FX – One of the Best Forex Brokers for ECN Accounts

When looking at the best ECN Brokers, then VantageFX is our top pick. It is also one of the best scalping forex brokers. ECN accounts come with many benefits from trading forex online – as you will be buying and selling currencies direct with other market participants. In fact, large-scale traders from hedge funds and financial institutions will often execute positions via the electronic communications network.

From your perspective, this means that you will be able to access some of the best forex spreads in the industry. Vantage FX is one of the best brokers for ECN accounts, as the minimum deposit is just $500. This is much lower than other ECN brokerage firms which often demand an account balance that runs into the thousands of dollars.

By opening an ECN broker account with Vantage FX, you will often be able to trade forex at 0 pips. Crucially, this will result in a small commission of just $3 per slide. This MT5 broker offers heaps of forex markets, alongside share CFDs, precious metals, and energies. The platform offers leverage of up to 1:500 – albeit, your limits will depend on whether you are a retail or professional trader and your country of residence.

| Account minimum | $500 |

| Fees | Free for stocks trading; Variable spread on Forex & Crypto; $10 a month after one year as an inactivity fee; $5 as withdrawal fee |

| Features | Super user-friendly trading platform, buy stocks without paying any commission or share dealing charges, 2,400+ stocks, and 250+ ETFs listed on 17 international markets |

- ECN broker accounts

- Trade from 0 pips and a commission of $3 per slide

- Regulated in various jurisdictions

- Offers markets on forex, shares, energies, indices, and more

- Supports MT5

- Leverage of up to 1:500

- Mobile app isn’t the easiest to use

Your capital is at risk when trading financial instruments at this provider

9. FXTM – Best Forex Broker for Low Fees and MT4 Trading

FXTM is a popular forex broker that stands out for a number of key reasons. First and foremost, the platform allows you to trade currencies in a low-cost manner. For example, spreads on EUR/USD start from 0 pips, and on AUD/USD – this goes as low as 0.3 pips.

With that said, FXTM offers several account types – so the fees that you pay will depend on which one you select. For example, if you are planning to trade small amounts – the Micro Account offers 0% commission trading and a minimum deposit requirement of just $50. If opting for the Advantage Account, spreads start from 0 pips and you will pay a commission of between $0.40 and $2.

We also like the fact that FXTM offers full support for MT4. This means that you can deploy an automated trading strategy and access advanced chart reading tools. On top of being able to trade standard forex pairs, FXTM also offers six currency indices. This allows you to trade a basket of forex pairs linked to a specific currency – such as the British pound or Australian dollar.

| Account minimum | $50 |

| Fees | Variable spread on Forex |

| Features | Provides heaps of educational resources, great for market insights and market research, several account types supported, extensive forex department |

- Various account types

- Starts start from 0 pips

- Zero or low commissions depending on account

- Heaps of forex markets

- Trade stocks, indices, commodities, and more

- Heavily regulated

- Low minimum deposit

- Does not offer traditional investment products

67% of retail investors lose money trading CFDs at this site

10. Charles Schwab – Best Broker for Long-Term Forex Trading

Forex trading is typically associated with short-term speculation – where investors will typically open and close a position for a matter of hours. However, there might come a time where you are bullish on a currency and wish to invest in the long-term.

If this is something that interests you, then you might want to consider Charles Schwab. In a nutshell, Charles Schwab offers currency exchange-traded funds (ETFs). This means that you can invest in a currency for as long as you wish without getting hit with overnight financing fees.

In fact, if your chosen currency ETF is listed on a US stock exchange – then you won’t need to pay any dealing commissions. Instead, you will simply need to cover the maintenance fee charged by the respective ETF provider. There are plenty of currencies that you can gain long-term exposure to at Charles Schwab. Although the setup process at Charles Schwab can be a bit long-winded, there is no minimum deposit requirement.

| Account minimum | FREE |

| Fees | None |

| Features | Trusted US-based trading platform, top-rated investment app available on iOS and Android, $0 commission on stocks and ETFs |

- One of the largest brokers globally

- Regulated in various jurisdictions – including the US

- Supports thousands of financial instruments

- Offers long-term investments and short-term trading markets

- No minimum deposit

- Commission-free US-listed stocks and ETF

- KYC process can be long-winded

Your capital is at risk when trading financial instruments at this provider

Best Forex Brokers Comparison

Below you will find a table that summarizing our forex broker reviews – covering commissions, minimum spreads, deposit fees, and maximum leverage for retail clients.

| Forex Broker | Trading Commission | EUR/USD Spread (Min) | Deposit Fee | Max Leverage (Retail) |

| Capital.com | 0% | 0.8 Pips | FREE | 1:30 |

| Avatrade | 0% | 0.9 Pips | FREE | 1:30 |

| Go Markets | 0% | 1.0 Pips | FREE | 1:500 |

| IG | 0% | 0.6 Pips | Up to 1% on Credit Cards | 1:30 |

| Libertex | From 0.006% | ZERO on All Markets | FREE | 1:30 |

| Forex.com | 0% | From 0 Pips | FREE | 1:50 |

| TD Ameritrade | 0% | Variable Model | FREE | 1:30 |

| VantageFX | 0% | From 0 Pips | FREE | 1:100 |

| FXTM | 0% | From 0 Pips | FREE | 1:30 |

| Charles Schwab | 0% on US-Listed Assets | Variable Model | FREE | 1:2 |

Take note, you might be able to get higher leverage limits than the above table states – depending on your country of residence. Once you open an account with the forex broker in question, you will be able to display your maximum leverage limit.