- The effects of the Fed’s hawkish policies are becoming more apparent.

- Employment in Australia surprisingly decreased in December.

- There is also a 60% chance that the RBA will increase interest rates.

The AUD/USD weekly forecast is bullish as investors expect a rise in Australia’s inflation, which warrants more rate hikes.

–Are you interested to learn more about Forex apps? Check our detailed guide-

Ups and downs of AUD/USD

Australia and the United States released a ton of data last week, influencing price changes for the AUD/USD pair. The US retail sales and housing figures indicated a slowing economy as the effects of the Fed’s hawkish policies became more apparent. The PPI report came in lower than anticipated, indicating further easing inflation.

While the unemployment rate remained close to five-decade lows, employment in Australia surprisingly decreased in December after a large increase the previous month.

According to Lauren Ford, chief of labor statistics at the ABS, strong employment growth through 2022, high participation, and low unemployment continue to suggest a tight labor market.

This resilience is a significant factor in the market’s willingness to anticipate that the Reserve Bank of Australia (RBA) will increase its 3.1% cash rate by another quarter point at its upcoming meeting.

Futures suggest a 60% chance of an increase, but there is also a 40% chance that the RBA will halt.

Next week’s key events for AUD/USD

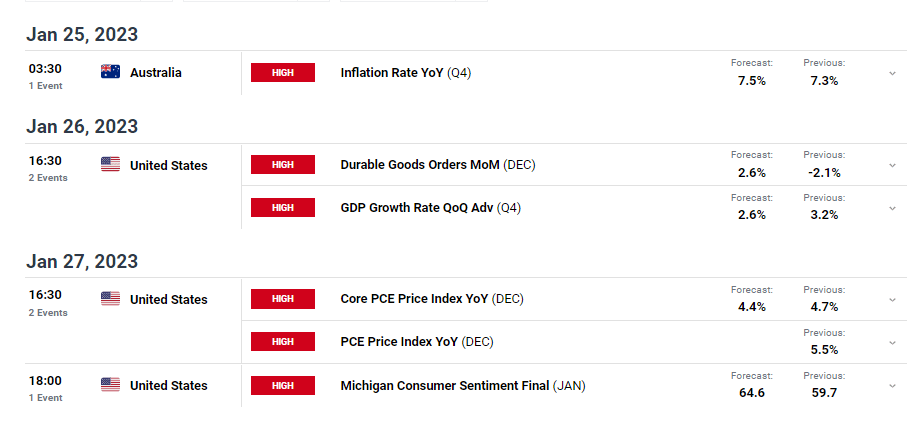

Next week, investors will pay attention to inflation data from Australia that will affect the RBA’s next move. Markets expect Australia’s inflation to go up 7.5% from 7.3%. There will also be GDP data from the US that will show the state of the economy amid rising interest rates.

AUD/USD weekly technical forecast: Bulls gearing up for another week

The daily chart shows AUD/USD in a bullish trend, with the price staying mostly above the 22-SMA and the RSI above 50. Bulls gathered enough strength to break above the 0.6875 resistance level before pausing at the 0.7051 key level.

–Are you interested to learn more about STP brokers? Check our detailed guide-

At this point, bears came in for a retracement move that saw the price retesting the recently broken 0.6875 resistance as support. The price is pushing off this support, showing that bulls are still in charge.

Therefore, the price will likely retest and break above the 0.7051 resistance in the coming week. A bullish bias will remain if the price stays above the 22-SMA and the RSI above 50.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.