- Good Friday didn’t bring good luck for the Aussie, as it finished the second week in the red.

- Hawkish Fed and the Ukrainian-Russian crises are providing support for the safe-haven greenback.

- The dovish stance adopted by the RBA is a headwind for the Aussie.

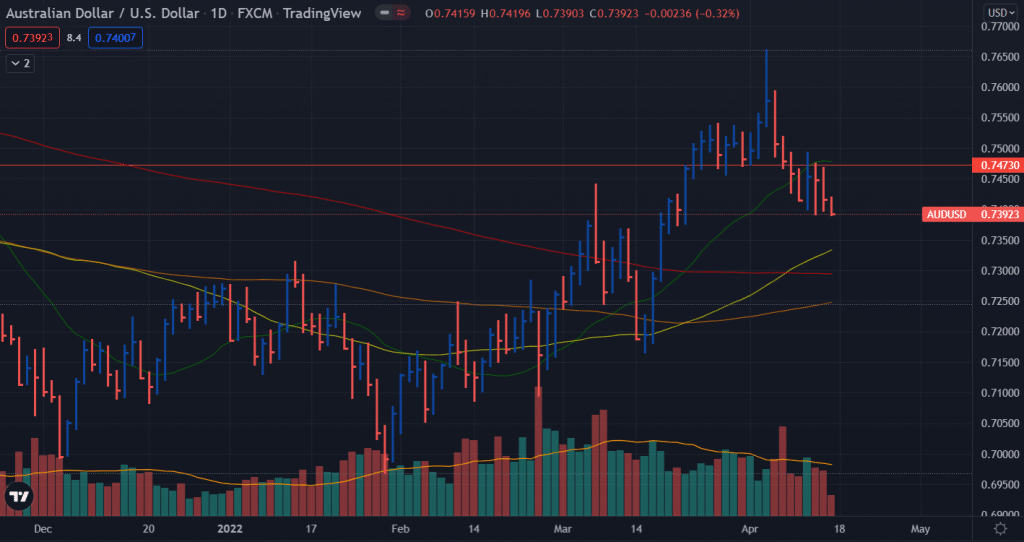

The weekly AUD/USD forecast remains negative as the USD bulls look stronger. The Aussie has been trading in the red for the previous two weeks.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

The Australian docket had mixed findings this week, led by the surprise in the Employment Change data. Even though it demonstrated the production of 17K new employment in the economy, it was less than the 40K predicted. At the same time, the unemployment rate increased to 4%, which is in line with the RBA’s aim.

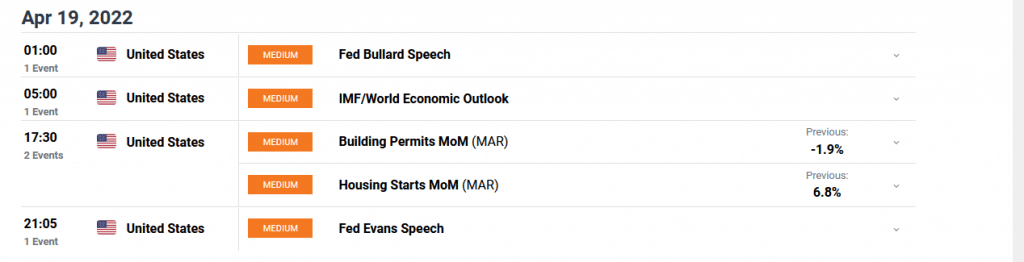

Meanwhile, the US economic docket indicated that consumer inflation in March surpassed the 8% mark, reaching 8.5 percent year on year, the highest level since 1981.

The AUD/USD fell further on Thursday due to conflicting US economic data. However, the Reserve Bank of Australia’s dovish approach supports the greenback, which has pushed back rate hikes. Meanwhile, the DXY is trading at 100.49.

The crisis on the hands

Global record inflation continues to deteriorate as a coronavirus epidemic in China causes local lockdowns and the Ukraine-Russia crisis. Both are increasing supply chain challenges, one of the primary causes of rising pricing pressures.

A dead-end

President Vladimir Putin has stated that diplomatic discussions have reached a stalemate since Kyiv violated the deal established in Turkey. Nevertheless, the attacks continue, and Western governments continue to impose sanctions on Russia.

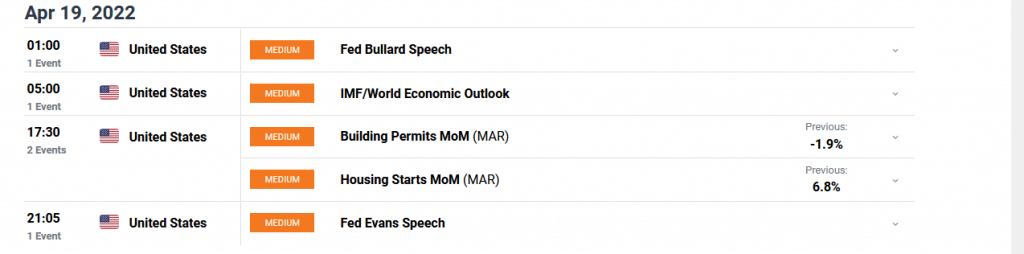

AUD/USD Forecast: Week Ahead

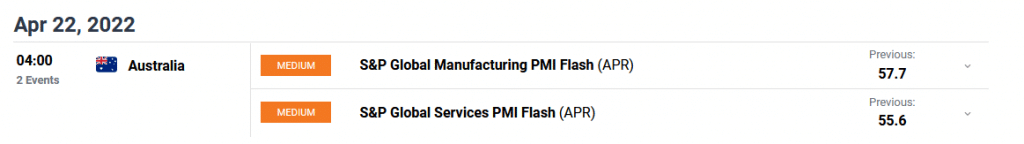

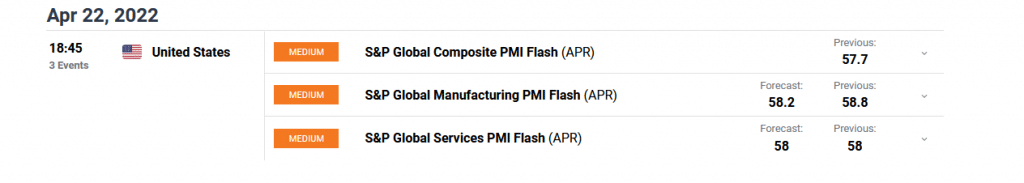

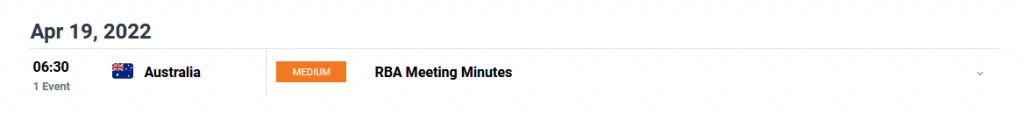

The RBA Minutes and the Global Manufacturing PMI Flash will be on the Australian docket.

What to look for?

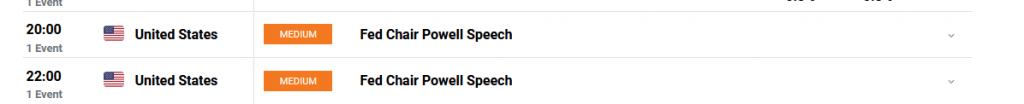

The greenback strength will be a key factor, as we have already seen its bullish run this week. In addition, geopolitical factors and growing coronavirus cases in China will provide fresh impetus to the Aussie.

AUD/USD weekly technical forecast: Down we go

The AUD/USD is in red after hitting 0.7661 on April 5. The 20-day SMA appears to be rejecting the bulls. However, we are seeing a bullish crossover of 50 and 100-day SMAs. It signifies a bullish trend moving on.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

0.7390 would be the first support level for the AUD/USD. A sustained breach below this level can bring the Aussie at 0.7230.

The initial level of resistance for the AUSD/USD is around 0.7500. If the AUD/USD pair settles above this level, it can go to 0.7575, the next resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money