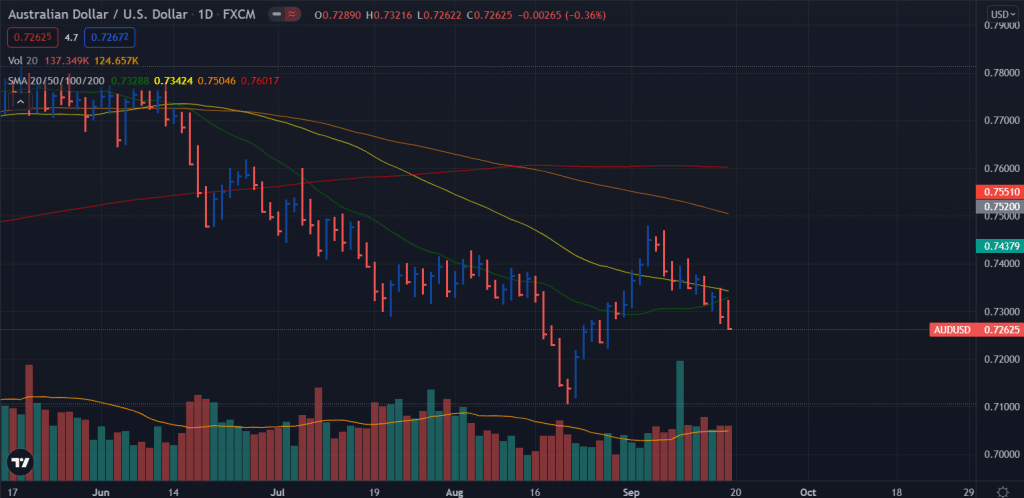

- The AUD/USD pair opened the week at 0.7349, and the pair kept on falling the whole week despite mixed US economic data.

- The AUD/USD pair is particularly susceptible to changes in the risk environment and Chinese factors.

- A tapering announcement is likely at the Federal Reserve’s meeting on Wednesday, even if no specific date is set.

The weekly forecast for the AUD/USD pair is bearish as the price pierced key support of 0.7300 level after the Greenback pumped up amid upbeat US retail sales.

-Are you looking for the best CFD broker? Check our detailed guide-

The AUD/USD pair opened the week at 0.7349, and the pair kept on falling the whole week despite mixed US economic data. The Aussie closed the week at lows around 0.7260, with a negative change of 90 pips.

In August, China’s economy was in trouble as retail and industrial production fell short of expectations, and closures and restrictions in multiple locations have appalled Australia.

As many Chinese companies seek to profit in Beijing and real estate developer Evergrande might default, the risks for China and thus Australia, the largest raw materials supplier for China, have increased.

The AUD/USD pair is particularly susceptible to changes in the risk environment. For example, the uncertainty surrounding China, the world’s second-largest economy, plays an important role in the US dollar’s safe-haven status.

Fed policy remained ambiguous after US economic data. For example, retail sales were higher than expected in August, but consumer inflation was slightly lower.

According to the Federal Reserve, a tapering announcement is likely at the Federal Reserve’s meeting on Wednesday, even if no specific date is set. But, likely, a taper schedule will also be announced during the meeting, so markets are likely to remain quiet until then.

What’s next for the AUD/USD weekly forecast?

The only significant release in Australia is the Commonwealth Bank Purchasing Managers’ Index for September. It won’t affect the market, though.

As soon as the Federal Reserve ends its monetary support or sets a decline timetable, the US dollar will rise against the Australian dollar. Furthermore, Canberra’s Covid policy is likely to have a further negative economic impact, thus lowering the AUD/USD trend bias.

On Wednesday, the Federal Reserve will meet to conclude the week. Till then, the markets are expected to remain calm.

Should the Fed announce its tapering plan, Treasury yields will rise. How much the tapering will depend on how and when it should be made. The AUD/USD pair may dip towards 0.7200 area. One can expect a rise in the yield on 10-year bonds to 1.50%.

Powell may repeat his year-end promise, but his actions would largely be influenced by US data.

The sharp drop in bonds yields will almost be instantaneous if Mr Powell doesn’t follow through on his pledge to taper assets purchases.

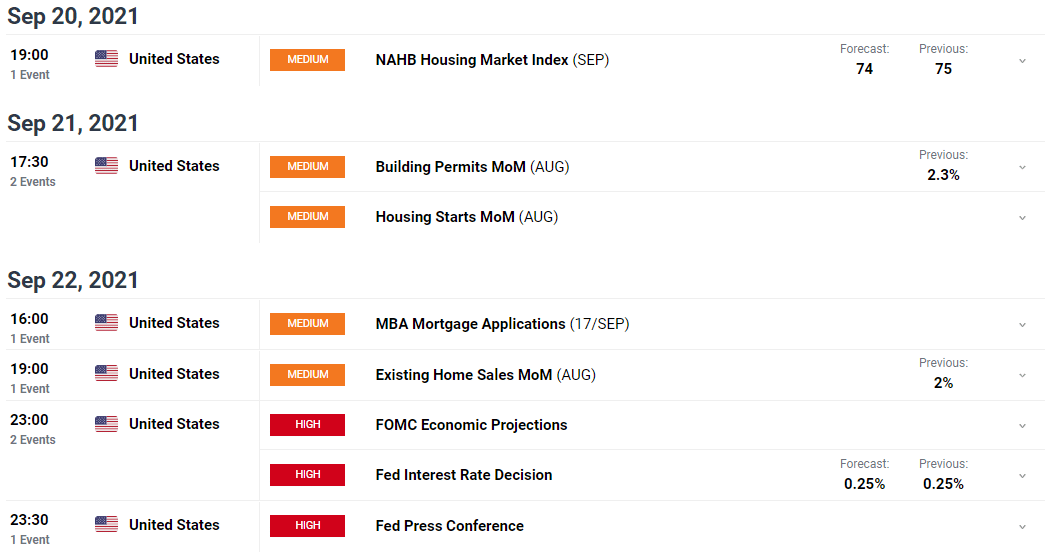

Currently, the US housing market is experiencing constant pressure. As a result, sales of existing and new apartments are expected to be strong, with up-to-date information on price increases available.

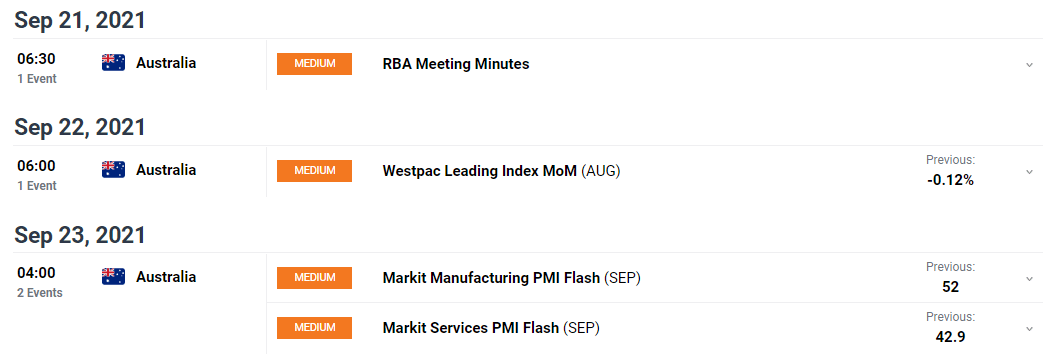

Key data events from Australia next week

There is no significant data for Aussie next week. Only the RBA meeting on Tuesday may provide some clues about economic recovery and coming up with a schedule for a rate hike.

-Are you looking for forex robots? Check our detailed guide-

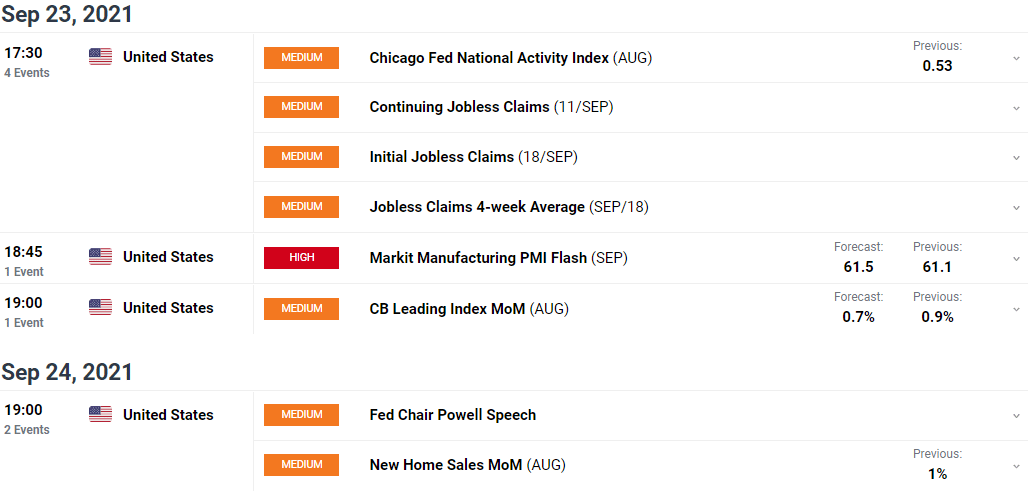

Key data events from the US next week

The week’s major event is the FOMC interest rate decision, followed by the press conference on Wednesday. Investors will likely look for clues of rate hikes and tapering from the press conference. The next important event is Market Flash PMI data on Thursday.

AUD/USD weekly technical forecast: Bearish crossover

The bears pounced on the 0.7300 level, and the week closed at 0.7262. The volume significantly rose while the price was dropping. The 20-day and 50-day moving averages make a bearish crossover that may further support the bearish price action. On the downside, 0.7200 may serve as immediate support, followed by an Aug 20 swing low of 0.7100.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.