- Philip Low of the RBA noted discrepancies between its expectations and the market’s expectations.

- Inflation in the US spurred speculation about a 50-basis point rate hike in March.

- Technically, the AUD/USD pair is bearish and may break 0.7100.

The weekly AUD/USD forecast is bearish as the US dollar recovers amid strong US CPI and Fed’s rate hike speculations.

The AUD/USD pair advanced for the second week in a row despite a sharp drop from a monthly high of 0.7248, set after the dollar entered a selling spiral following US inflation data, only to later recover amid a strong one-day drop.

–Are you interested in learning more about day trading brokers? Check our detailed guide-

Market participants were forced to rethink their positions after data out of the US caused the US dollar to maintain its bearish sentiment over the past week. US consumer price index rose 7.5% y/y in January, the highest level in almost five decades, fueling speculation that the US Federal Reserve will raise interest rates by 50 basis points in March. While the dollar was struggling to strengthen, yields soared, and stocks dropped.

Despite continued weakness in global indices, the AUD/USD dropped as low as 0.7108 on Friday but managed to get back into the 0.7160 range before the close. Markets seem to be unsure of what to do with a new era of central bank tightening.

RBA’s Lowe reduces buying interest

Philip Lowe, the Reserve Bank of Australia Governor, is largely responsible for the decline in AUD/USD ahead of the weekend. But, as Lowe told the Standing Committee on Economic Affairs of the Australian House of Representatives, the board is ready to be patient with monetary policy while acknowledging the risk of waiting.

Market expectations differ greatly from those of the central bank, he said. Finally, Lowe warned that making “dramatic adjustments” to the US Federal Reserve’s monetary policy would put the financial markets at risk.

In February, Australia’s consumer inflation expectations rose to 4.6%, as Lowe strongly condemned rumors that the RBA would begin tightening sooner than expected. Additionally, TD Securities’ inflation estimate for January was 0.4%, up from 0.2% previously.

Australian employment comes to the fore

In Australia, there were mixed data. Despite improved business confidence, NAB business conditions in January were worse than expected at 3. In addition, the Westpac Consumer Confidence Index remained low in February, at -1.3.

A better-than-expected deficit of $80.73 billion was shown by the US trade balance for goods and services in December. On the other hand, the Michigan Consumer Sentiment Index preliminary estimate for February showed a disappointing figure of 61.7.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

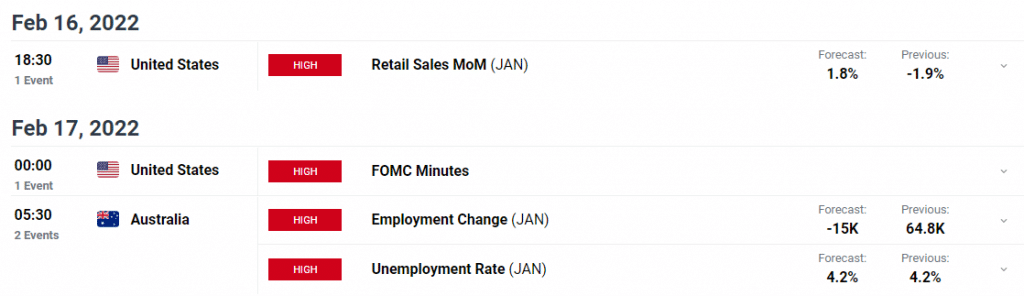

Next Thursday, Australia is scheduled to release its January employment figures. The country is expected to lose 15,000 jobs for the month. Meanwhile, the US will release its January retail sales, which rose 1.7% m/m, and the FOMC will release its latest meeting minutes.

AUD/USD weekly technical forecast: Bears gaining strength

Based on the daily chart, the pair has faced sellers around the bearish 100-day SMA, while technical indicators lack directional strength. In addition, the 20-day SMA holds the bearish slope below the current levels. Two successive widespread down bars closing near the lows indicate a bearish perspective. Meanwhile, the volume for the last two bars has increased. The key levels on the downside are 0.7100 ahead of 0.7025 and then 0.6965. On the upside, key levels are 0.7200, 07250, and 0.7300.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money