- AUD/USD price started the week with bearish dominance.

- Gold prices rise, offsetting the bears in Aussie.

- Market participants are eying at US NFP next week.

The AUD/USD weekly forecast suggests a bullish picture as Thursday’s US yields plummeted from the multi-month top.

AUD/USD weekly fundamental analysis: US data eyed

After falling to 0.7169, the AUD/USD pair ended a second straight week with little or no change in the 0.7260 price range. Aussie’s value is typically weakened by the US currency and sharp drops in stocks, although a good recovery in gold prices partially offsets the negative impact.

-If you are interested in forex day trading then have a read of our guide to getting started-

A speculative interest arose when the Federal Reserve Chairman attended several events. First, despite a persistently high inflation rate forecast for 2022, the Fed chairman said the rate is likely to be temporary.

According to him, the current rise in inflation is due to supply constraints due to steady demand. It has everything to do with the economic recovery, a process with a beginning, middle, and end.

A slight increase in gold prices on Thursday added about $40 to the price per ounce. The yellow metal hit a monthly low of $1,721.59, now trading around $1,760 a troy ounce on Wednesday. Due to gloomy market sentiment, gold has outperformed the dollar as a safe haven.

In Australia, retail sales for August were up 1.7% better than expected, and building permits for the same month were up 6.8% m/m.

The critical employment data have disappointed investors, especially since Fed Powell said he wanted to see another good employment report before tightening monetary policy. In the week ended September 24th, 362,000 initial jobless claims were filed. In addition, the ISM manufacturing employment sub-component of the ISM reported a value of 50.2 for September, which is worse than the expected 50.9 but better than 49 in August.

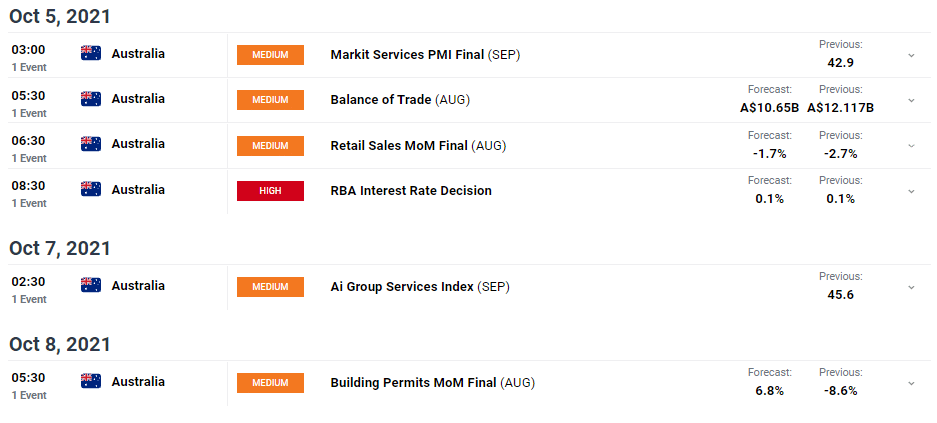

Key dates/events in Australia next week

For September, Australia will publish official PMI Commonwealth Bank Services and AIG data and TD Securities inflation data.

On Tuesday, October 5th, the Reserve Bank of Australia will hold its monetary policy meeting. It is expected that the central bank will maintain the status quo until February 2022. Market participants will be looking for clues from Governor Philip Lowe and policymakers’ assessments of the economic situation.

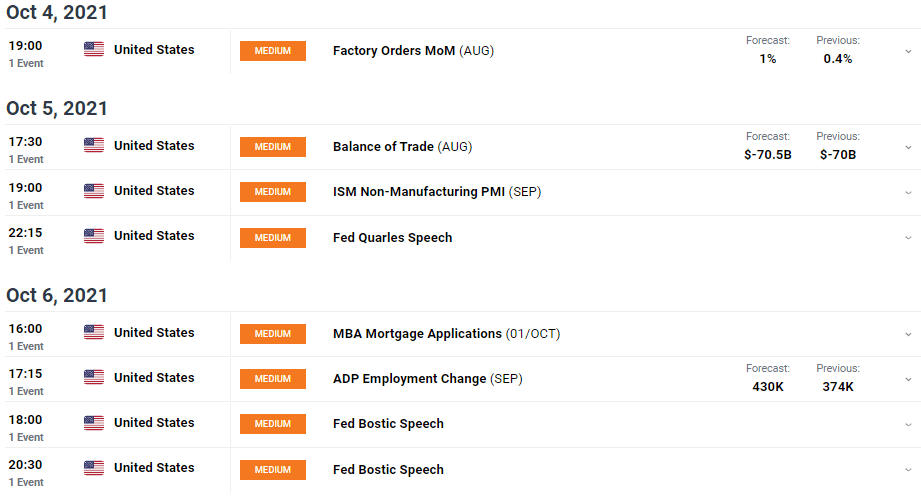

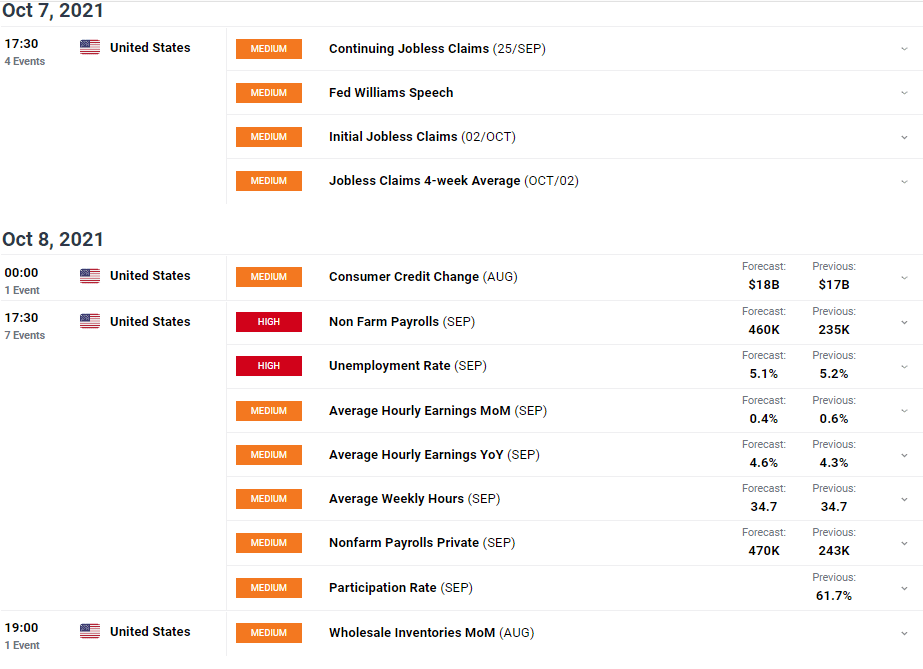

Key dates/events in the US next week

It’s going to be a busy week as the US releases its official September forecast for the ISM Services PMI at 61.3 next week, although the focus will be on job creation. The ADP survey is expected to reveal that 475,000 private-sector jobs were created in September, more than the previous 374,000. On Friday, the country will release a report on non-farm employment. Over a month, the country is expected to create 500,000 new jobs, and the unemployment rate will decline to 5.1%.

-Are you looking for automated trading? Check our detailed guide-

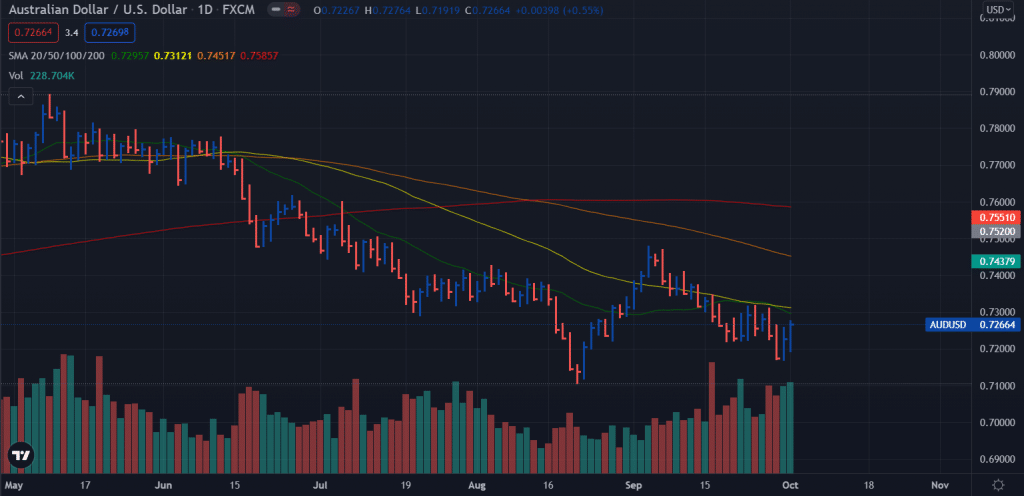

AUD/USD weekly technical forecast: Bulls looking to intensify

The AUD/USD price managed to gain from the multi-week lows and surged to 0.7260 area. The price is still below the key moving averages on the daily chart. However, the next hurdle is at 0.7283 (a horizontal level). Moving ahead, the confluence of 50-day and 20-day moving averages may bar the upside near the 0.7300 area. On the flip side, 0.7200 will be the key support of monthly lows at 0.7169 and then YTD lows near 0.7100.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.