- AUD/USD plummets in the week amid poor Aussie data and a stronger US dollar.

- RBA left interest rates unchanged; on the other hand, FOMC announced tapering.

- US NFP data came better than expected that further weighed on the pound.

The AUD/USD weekly forecast is mildly bearish amid the strong US dollar that stemmed from Fed’s tapering decision and upbeat US NFP figures.

-If you are interested in knowing about ETF brokers, then read our guidelines to get started-

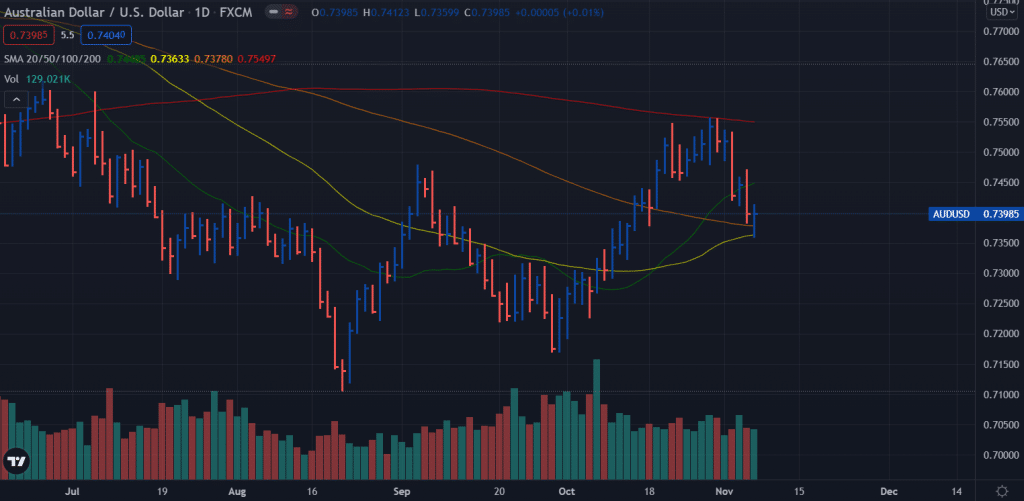

The AUD/USD pair has been downtrend for the past few days, ending the week just below 0.7400 after hitting a multi-month high of 0.7555 in late October. However, the surge in equity prices partially offset the weakening of the Australian dollar.

It was expected that the Reserve Bank of Australia would leave the monetary rate at 0.10% on Tuesday. As a result, the central bank will continue issuing government bonds worth $4 billion until February 2022.

Likewise, the Federal Reserve left its interest rate unchanged at 0.25%, as expected, and cut monthly bond purchases by $15 billion. In addition, Fed will cut pandemic-related spending by $120 billion later in November, cut Treasury bond purchases by $10 billion and mortgage-backed securities by $5 billion.

As far as inflation is concerned, Federal Reserve Chairman Jerome Powell & Co said they still believe hyperinflation will be temporary. However, Powell noted that supply chain problems will likely persist into the next year, so inflation will also remain high.

In its October report, the US revealed that it had created 531,000 new jobs in October, well above expectations and in line with Powell’s expectations. While the unemployment rate fell to 4.6%, the activity rate remained at 61.6%. While the numbers did not spark much activity on the forex market, Wall Street reached new record highs.

The Aussie was also affected by the poor data from China when the official October NBS manufacturing PMI was announced on Monday, which dropped to 49.2. Also, the service index dropped to 52.4 in the same month, which did not meet market expectations.

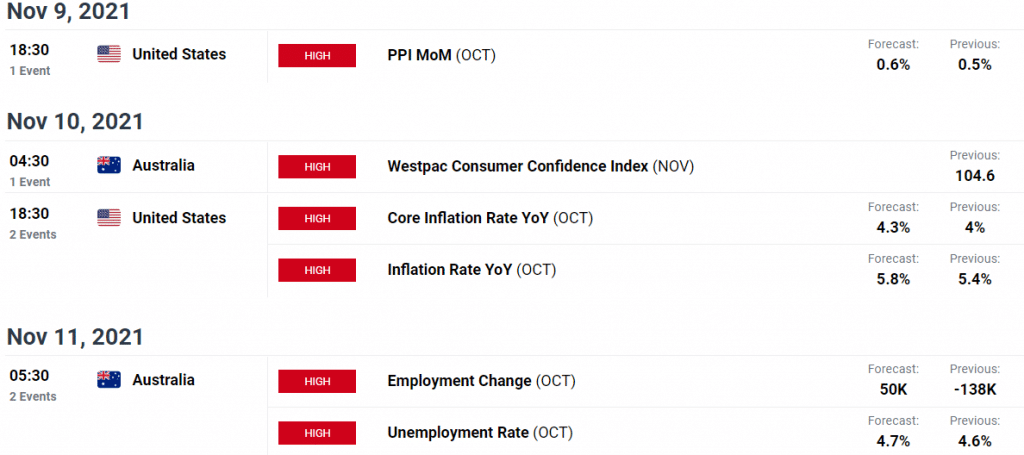

Key events/data for AUD/USD

- Next week, there could be some action in the foreign exchange market as China releases its October trade balance. On Monday, NAB will publish the NAB Business Confidence Report and Business Conditions for October, and on Wednesday, Westpac will publish the Consumer Confidence Report for November.

- An employment report for October will be released on Thursday, along with consumer inflation expectations for November.

- On Monday, the US will release final inflation data for October and the Michigan Consumer Sentiment Index for November, previously at 71.7.

-Are you looking for high leveraged forex brokers? Take a look at our detailed guideline to get started-

AUD/USD weekly technical forecast: Key SMAs to support

The AUD/USD price found rejection near 200-day SMA and fell down below 0.7400 area where it found support by the 50-day and 100-day SMAs. However, further weakness may result in testing the horizontal level and ascending trendline around 0.7230-50 area. The volume data is now neutral. Upside bias will only be confirmed if the price finds acceptance above 20-day SMA (0.7450).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.