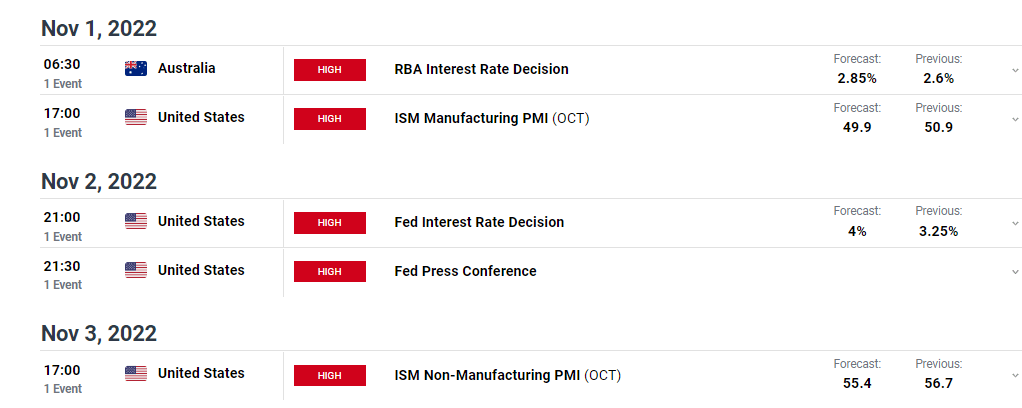

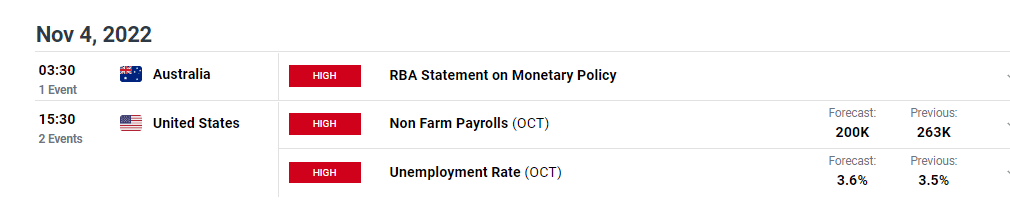

- Australia’s inflation came in higher than expected in the September quarter.

- Investors are waiting to see if the RBA will get more aggressive after the inflation data.

- Markets are expecting a 75bps rate hike from the Fed.

The AUD/USD weekly forecast is bullish as markets expect a possible surprise hike from the RBA. However, the dollar’s strength may undermine the bulls.

-Are you looking for automated trading? Check our detailed guide-

Ups and downs of AUD/USD

The pair had a busy week with news releases from Australia and the US. More attention was given to Australia’s inflation which will determine the RBA’s next move. Australian inflation raced to a 32-year high last quarter as the cost of home building and gas surged, a shock result that stoked pressure for a return to more aggressive rate hikes by the country’s central bank.

Next week’s key events for AUD/USD

The Reserve Bank of Australia is under pressure ahead of its policy meeting on Tuesday.

Investors started to believe peak rates may be approaching due to its decision to cut raises to a quarter-point pace earlier this month.

However, data released on Wednesday showing a startling increase in Australian inflation to a 32-year high implies the RBA has fallen behind and persuades Governor Philip Lowe to make an embarrassing U-turn.

When the Federal Reserve meets on November 1-2, a fourth consecutive big 75bps interest rate increase is largely anticipated. Investors are now concentrating on whether the Fed will limit the pace of future hikes.

AUD/USD weekly technical forecast: Footing above 30-SMA after a bullish divergence

The daily chart shows the price trading above the 22-SMA and the RSI around 50. Bulls have taken control by pushing the price above the 22-SMA, which has been respected as resistance for some time. The price collapsed to the 0.6204 level, where it found strong support. The RSI showed weakness in the bearish trend when it made a bullish divergence.

-If you are interested in forex day trading then have a read of our guide to getting started-

Bulls took control at this level and will hold on to that control until the price returns to trading below the 22-SMA. The price has paused at the 0.6483 resistance level and has retested the recently broken SMA. In the coming week, if bulls keep control, the price will likely push off the 22-SMA and break above 0.6483.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.