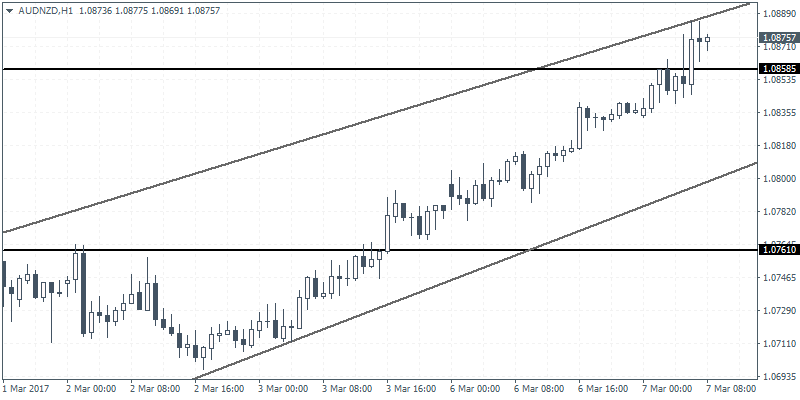

AUDNZD intra-day analysis

AUDNZD (1.0875): The Australian dollar is seen some strong gains this morning following the RBA’s rate decision. The Kiwi, on the other hand, is trading subdued with data from earlier this week showing weaker dairy prices. On the hourly chart on AUDNZD, price action has formed a doji near the top end of the rally with prices consolidating into a steep wedge pattern. Near term support at 1.0858 is the initial obstacle as a break below this level could signal further downside towards 1.0761. Also, watch for a potential inside bar formation on the hourly chart for AUDNZD which will be another clue for the downside in price action.

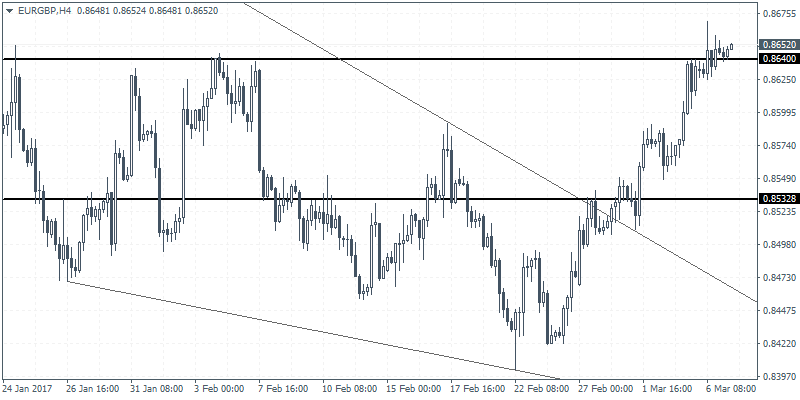

EURGBP intra-day analysis

EURGBP (0.8652): EURGBP resumed its bullish trail once again with prices seen testing 0.8640 resistance level yesterday. The rally to 0.8640 comes following the upside breakout from the triangle/wedge pattern near the support level at 0.8532. Further upside is expected in EURGBP which will see prices eventually rally towards the next main resistance level at 0.8778 which is pending a retest of resistance. Establishing resistance here will signal downside in prices with the overall bearish trend likely to be rekindled.

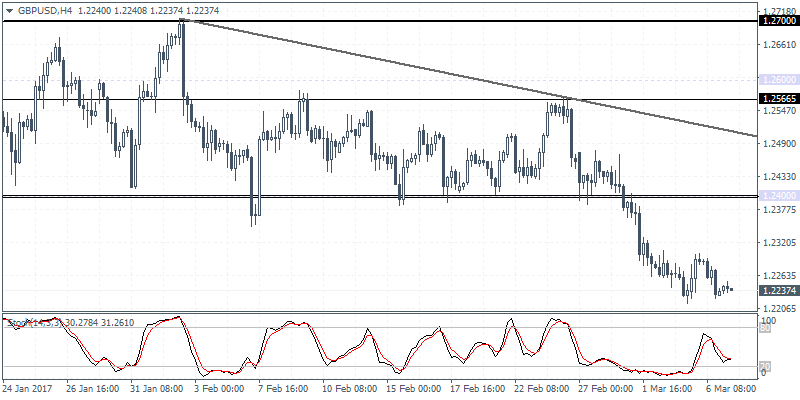

GBPUSD intra-day analysis

GBPUSD (1.2237): GBPUSD turned bearish yesterday, and the intraday price action looks to be targeting the support level at 1.2200. From the 4-hour charts, the price action is starting to look vulnerable for further downside following the descending triangle pattern that was formed and the breakdown below the support level at 1.2400. Further declines are expected towards 1.2200 with the continuation in the bearish price action likely to see declines towards 1.2100.