The Australian dollar is under pressure. A series of lower highs was followed by lower lows. AUD/USD is currently trading just around 0.74, after having dipped below this round number. The pair is at its lowest since January 11th, a near 4-month low.

Why is the Aussie suffering? Here are five reasons and the next technical levels to watch.

AUD/USD fall: blame China and also the US

China continues having an outsized influence over the Australian dollar. The world’s second-largest economy is Australia’s No. 1 trading partner. The influence of data from China seemed to have waned in recent months. Not anymore.

- Caixin The independent measure of China’s manufacturing sector showed a significant slowdown. The index was already rising towards 52 and now it is on the edge of 50, the level that separates growth from expansion.

- Iron ore: Mostly a result of weaker credit conditions in China, the price of Australia’s main export is falling. There is a correlation, albeit far from holy, between the Aussie and the price of this basic metal.

- Oil prices: And the US can also be blamed on several fronts. The rising production of shale oil in America compensates for the OPEC cuts. This keeps the price of the black gold in check. A drop in oil prices impacts the loonie first and foremost. However, the Aussie suffers from commodity currency contagion.

- Fed: Another immediate negative influence comes from the Federal Reserve. Yellen and co. shrugged off the slowdown in the US economy and remained optimistic. The US dollar rallied on the news. After some time, some currencies recovered. The Aussie was not one of them.

- Australia’s trade balance: The most recent data point from Australia was not that great. The trade balance surplus, which helps the currency remain bid, came out below expectations at 3.11 billion.

AUD/USD Levels

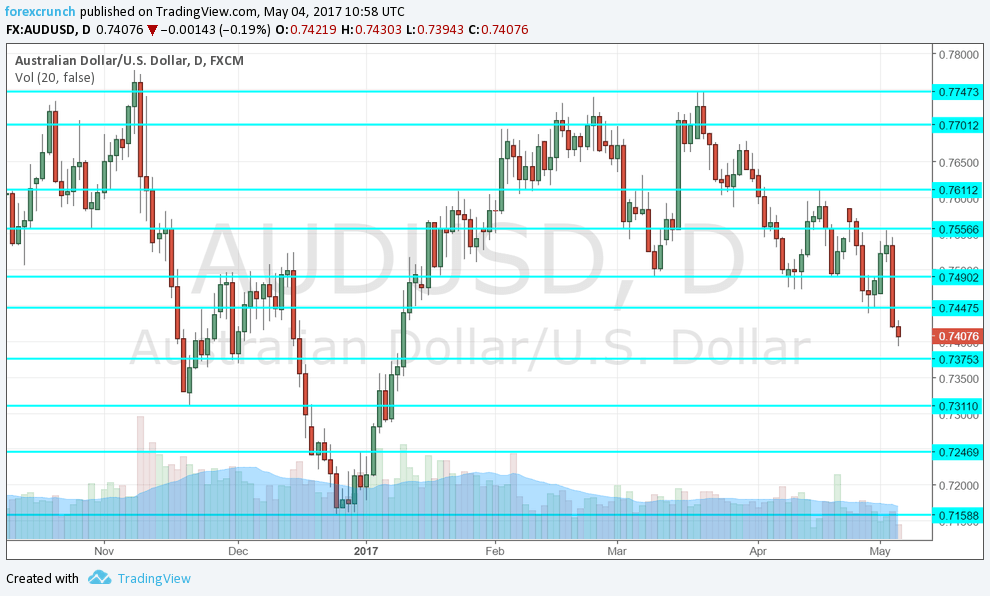

At current trading levels, the Australian dollar faces immediate support at 0.7375, a level which served as support at the turn of the year. Further support awaits at 0.7310, the trough seen in November.

Even lower, 0.7250 was a temporary peak at the turn of the year. The last line worth mentioning is 0.7160, a level where the pair began its big turnaround.

Looking up, we are at the more familiar ground: 0.7450 was a level of support in April. It is followed by 0.7480, which worked as cushion back in March.

0.7566 was the pair’s last hurrah before succumbing to pressure and dropping to lower levels. And the last level of resistance in case of a recovery is 0.7610. This line both served as a cushion when the pair enjoyed a high range and as resistance more recently.

More: Elliott Wave Analysis: AUDUSD Showing Signs Of More Weakness

Here is the AUD/USD chart: