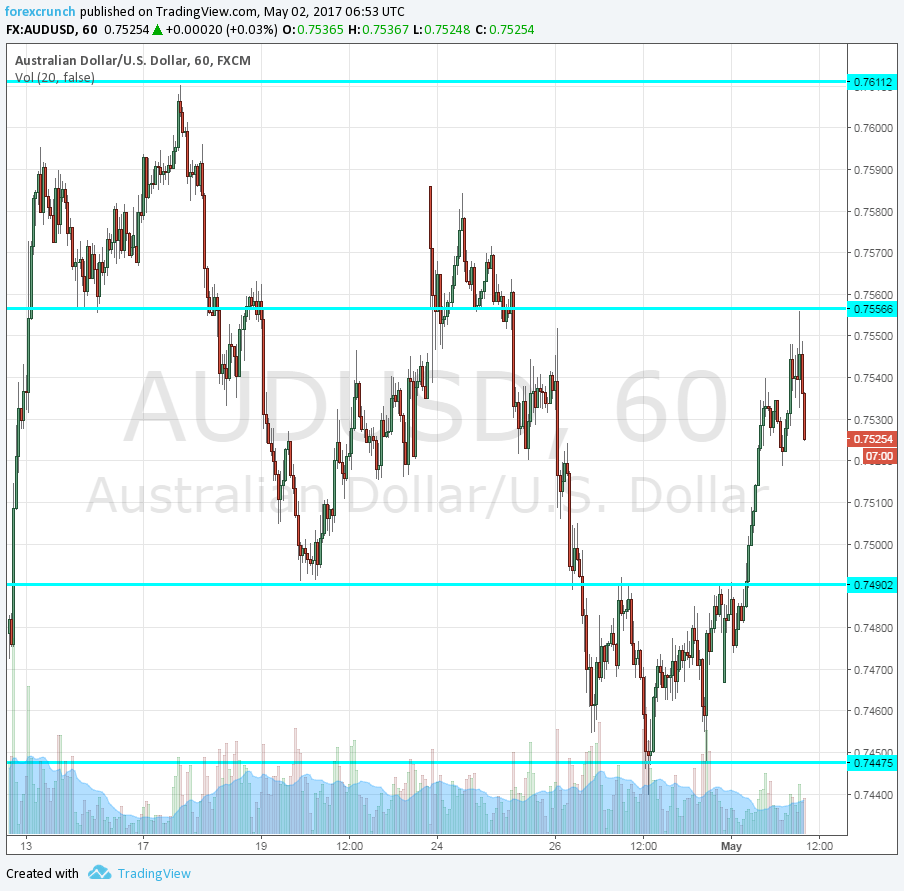

AUD/USD currently trades above 0.75. The pair is off the low support levels of 0.7450 but certainly not going anywhere fast.

There are several factors moving the Australian dollar, keeping it at its current levels. While Australian data is OK, China and the US do not look that inspiring.

RBA holds as expected

At its home turf, the Reserve Bank of Australia left the interest rate unchanged at 1.50%. They see inflation as rising “more gradually” than they had thought earlier. The rise in commodity prices is a plus for the national income and looking forward indicators are favorable for future growth.

On the downside, the team led by Phillip Lowe stated that the housing prices are rising “briskly” in some markets. They repeat their statement about the Australian dollar: a rising exchange rate could complicate the transition away from mining.

About China, the RBA mentions the high level of debt in the world’s No. 2 economy and Australia’s No. 1 partner as a source of worry. However, Australia’s terms of trade have improved.

Chinese PMI slips

Speaking of China, we received the independent forward-looking measure of China’s manufacturing sector, a client of Australian commodities. The picture is not pretty: a 7-month low at 50.3 and a miss on 51.3 expected.

The accompanying comments consist of words such as “weaker”, “slower” and more. Employment has declined and production growth has softened according to the purchasing managers that were surveyed. Cost pressures are easing and inflation is softening. While growth is projected to continue in the Middle Kingdom, the level of confidence is the lowest in 2017 so far.

Also, China’s official PMI released over the weekend fell short, with 51.2 against 51.7 forecast.

US dollar woes

On the other side of the currency pair, the US dollar enjoyed the news of averting a government shutdown. However, data coming out of the US was quite disappointing: the ISM Manufacturing PMI slipped and inflation has slowed down.

With no change from the RBA and a weak figure from China, the soft data from the US keeps things balanced for A$/USD.

AUD/USD levels

At current levels, the pair could face resistance at 0.7560, the highs of the day. Further resistance awaits at 0.7610, which served as support when the pair traded on higher ground.

Support awaits at 0.7490, followed by 0.7450 which is stubborn support.

More: AUD/USD at the lowest since January – levels to watch