Everything is going against the Australian dollar. The latest blow came from the publication of retail sales. The volume of sales in April dropped by 0.1% against expectations for +0.3%. To add insult to injury, the figure for March was revised down by 0.1%.

Year over year, consumption is up 2.1%. By another measure, q/q sales rose by a modest 0.1% instead of 0.5% expected. The disappointing domestic news joined worrying signs from China.

Here are 5 reasons for the previous AUD/USD crash. We have new ones coming on a daily basis.

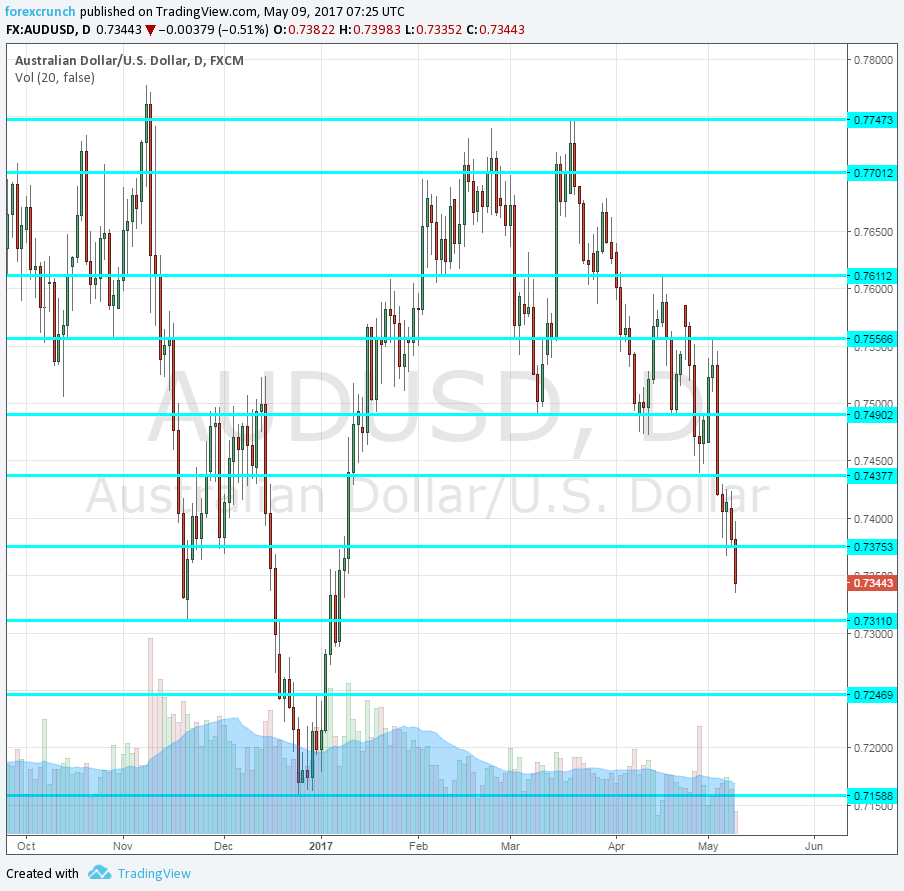

AUD/USD now trades at 0.73743, the lowest since the early days of 2017. After breaking out of range, The Aussie seems to be in a free-fall after losing the 0.7440 level that held it up for some time.

Further support awaits at 0.7310, which was a swing low in November 2016. Even lower, 0.7250 could serve as a cushion ahead of the ultimate support line at 0.7160.

On the topside, AUD/USD could face resistance at 0.7375, a support line back in November. 0.7440 remains significant.