The Australian dollar remains under pressure and it extends its falls. A drop of over 50 pips on the day sends it to a low of 0.7153, the lowest since early March.

The incessant talk about China’s credit bubble is weighing on the A$. A new report suggesting a big burst of China’s private credit “binge” is doing the rounds. The topic of debt is not new but it has received more attention since The Economist highlighted the severity of the issue.

The move lower is also fueled by the strength of the greenback. The US dollar has been rising since the hawkish meeting minutes by the Fed last week. Prospects of a rate hike have risen and the dollar is also gaining ground against other currencies, with commodity currencies such as the Aussie showing the biggest signs of weakness.

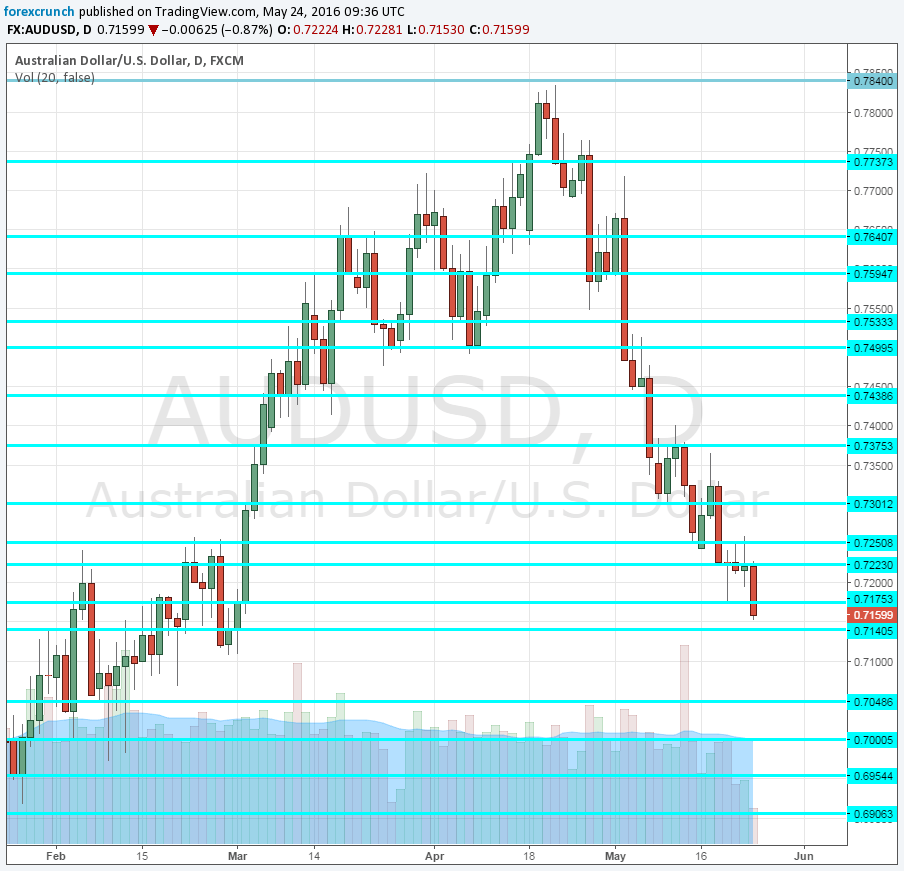

Here is how the fall of the Aussie looks on the daily chart. Basically, the rises seen in March have been reversed. The pair moved higher quite rapidly, made some attempts to rise to higher ground, met a veteran resistance line at 0.7840 and then began a gradual fall to the current levels, nearly 700 pips from the top.

Support is quite close at 0.7150, which supported the pair in the past. This is followed by 0.7050 that supported the pair before that. The round number of 0.70 is the obvious cushion below. It is followed by 0.6940. On the topside, we have 0.7240 and 0.73 as strong lines of resistance.