The Australian dollar was already the weakest link. We outlined three reasons for the weakness and now the pair dropped on the other driver of the pair: the USD. The Fed went to the hawkish side, leaving a wider door open for a June rate hike. While they remain data dependent, the bullish tone comes as a surprise after several dovish talks from Yellen and despite her colleagues sounding more upbeat.

For AUD/USD, this implies lower levels and it may eye a deeper dive.

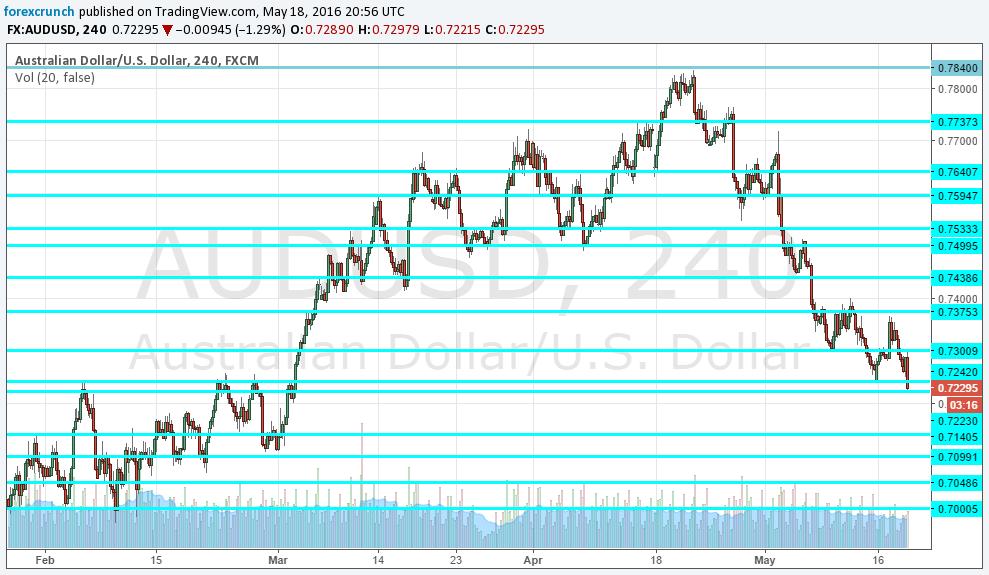

AUD/USD levels after the Fed minutes

Aussie/USD dropped to the veteran support line of 0.7220, below the cycle low of 0.7240. That came after yet another attempt to recover that was rejected at the round number of 0.73.

So far, 0.7220 holds. Upon a breakdown, we can find more support at 0.7140, which served as support for the pair in mid-March. Further below, 0.7090 also served as support around the same time.

0.7050 is already an older line and it works as the last cushion before the round number of 0.70. A fall over that cliff opens the door to the old double bottom of 0.6940.

On the upside we have 0.7375 and 0.7440, lines which worked very nicely as support in recent weeks, and now switch to a new role as resistance.

Here is the AUD/USD chart:

More: