Australia posted a trade balance surplus of only 0.86 million, around half the early expectations of 1.7 billion. The publication comes on top of a downwards revision for the previous month: 2.02 billion against 2.47 billion originally reported.

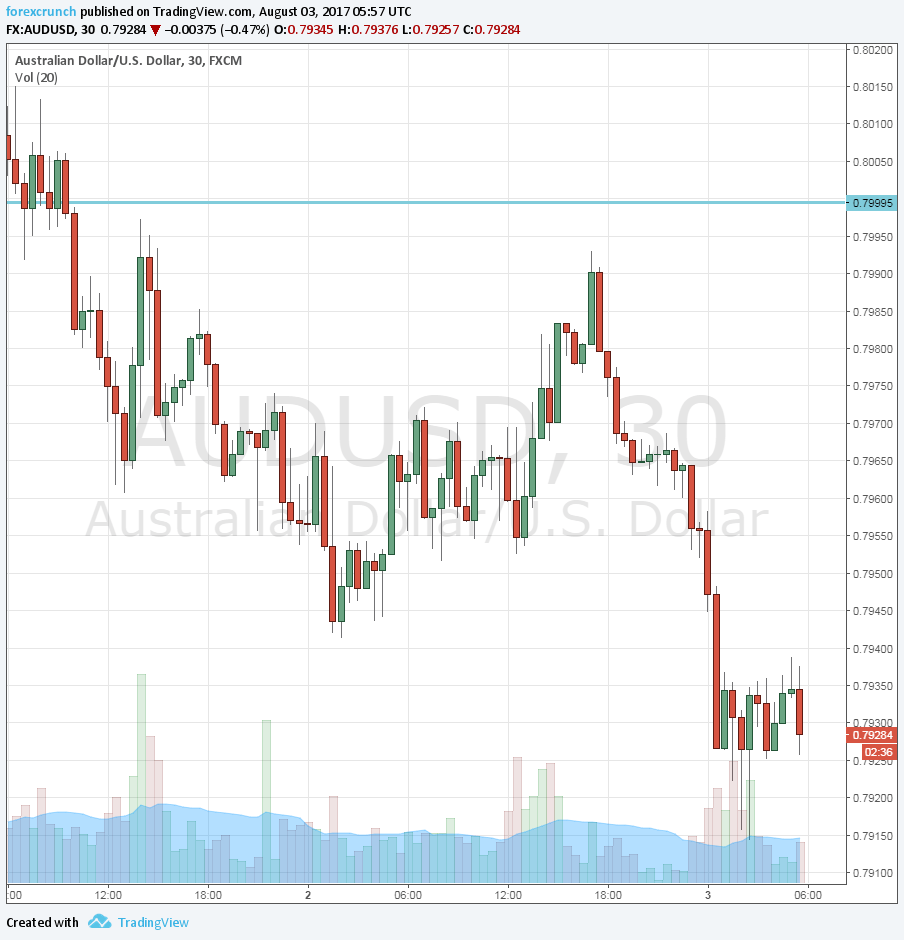

AUD/USD was already in a mode of retreat from the 0.80 level it had briefly topped earlier this week. The Aussie was vulnerable after the RBA left the outlook unchanged and this release serves as another blow.

AUD/USD trades around 0.7925 after having reached a bottom at 0.7914. Further support awaits at 0.7835. Resistance is at the round number of 0.80.

What’s next? Retail sales and another report from the RBA are released early on Friday in Australia. For the US dollar, we have the all-important Non-Farm Payrolls on Friday, with a warm-up on Thursday: the ISM Non-Manufacturing PMI.

Here is how the fall looks on the AUD/USD chart. The pair’s attempts to recover have failed so far.