The Australian dollar stabilized on high ground, consolidating previous gains. What’s next? Australian capital expenditure and Chinese data stand out in a busier week. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Australia’s CB Leading Index advanced by 0.5%, better than 0% seen beforehand. In the US, Trump’s talk hurt the greenback, despite stable data from the housing sector. Yellen sent the pound lower in Jackson Hole, and this helped Aussie/USD. The pair will hopefully wake up now.

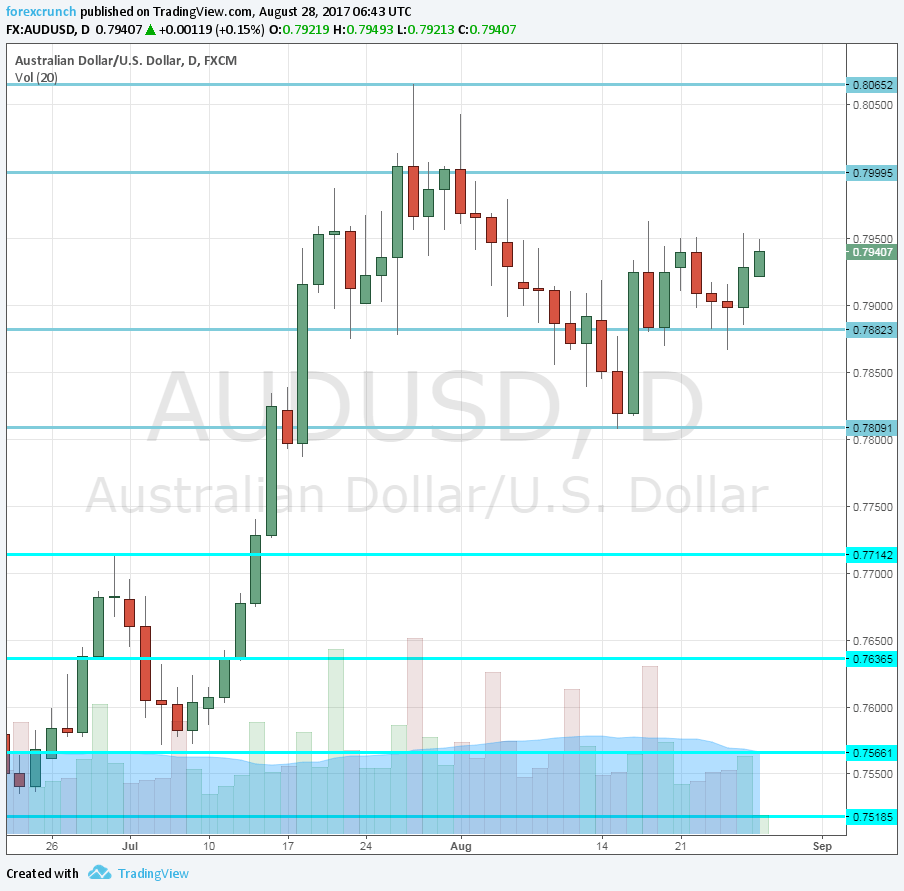

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Approvals: Wednesday, 1:30. This gauge of the housing sector is somewhat volatile but still provides an interesting insight. A rise of 10.9% in June will probably be followed by a drop now: 5.1% is predicted.

- Construction Work Done: Wednesday, 1:30. In the past two years, this quarterly gauge was always revised to the upside after initial disappointments. According to the initial data for Q1 2017, the value of construction projects fell by 0.7%. We will now receive the data for Q2. A slide of 1.1% is predicted.

- HIA New Home Sales: Thursday, 1:00. Sales of new homes, similar to building approvals, are quite volatile. A drop of 6.9% was recorded in June. A rise could be seen now.

- Chinese official Manufacturing PMI: Thursday, 1:00. While many cast doubts regarding official data coming out of China, this measure of the manufacturing sector is released early. A score of 51.4 points was seen in July, within the recent ranges. A score of 51.3 is projected now.

- Private Capital Expenditure: Thursday, 1:30. Capital expenditure reflects investment and is closely watched by the RBA. A rise of 0.3% was seen in Q1 2017, within early expectations. A rise of 0.2% is forecast.

- Private Sector Credit: Thursday, 1:30. This monthly measure of debt provides another insight on economic activity. Growth accelerated to 0.6% in June, after slower months beforehand. An increase of 0.5% is expected.

- AIG Manufacturing Index: Thursday, 23:30. The manufacturing sector continues growing nicely according to the Australian Industry Group, with a score of 56 in July, the highest since April.

- Chinese Caixin Manufacturing PMI: Friday, 1:45. The Caixin PMI is already an independent measure of the manufacturing sector of Australia’s No. 1 trading partner and tends to have a significant impact on the Aussie. In July, the figure beat expectations and reached 51.1 points. However, this still reflects slower growth than in past years. 51 is estimated.

- Commodity Prices: Friday, 6:30. Prices of commodities, Australia’s key exports, continue rising on a yearly basis, but the pace is not as rapid as in the past. A growth rate of 17.1% was seen in July, below 23.7% that was seen beforehand.

AUD/USD Technical Analysis

The Australian dollar traded in a narrower range early in the week and did not go very far.

Technical lines from top to bottom:

0.83 was a swing high seen in early 2015 and is our top line. 0.8165 was another swing high, back in May 2015.

0.8065 is the most recent high seen in 2017. It is followed by the psychological round level of 0.80.

0.7920 was the low point the pair reached after the pair moved to the highs. The round number of 0.7810 provided support in August and replaces the veteran 0.7835 level.

Below, we find 0.7740, that was a high point in June 2017 and also beforehand. 0.7635 was a stepping-stone on the way up, also in June.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I am neutral on AUD/USD

The Australian dollar seems to have entered a period of consolidation, and this may last for another week.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!