AUD/USD sparkled last week, as the pair jumped 150 points. AUD/USD closed at 0.7333. This week’s key events are NAB Business Confidence and Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, Janet Yellen provided strong hints that the Fed will raise rates next week, lauding the labor market and dismissing persistently weak inflation. The critical NFP came in above expectations, but both PMI reports disappointed.

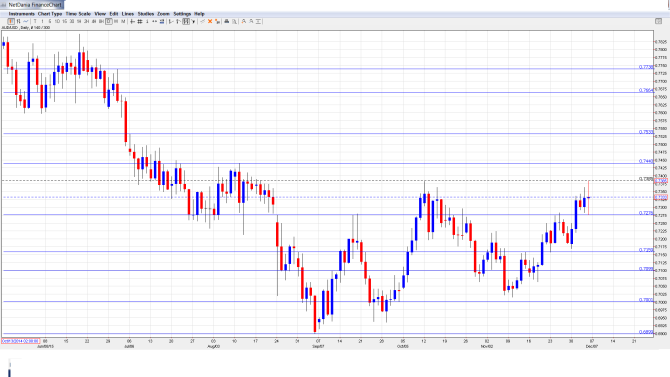

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- AIG Construction Index: Sunday, 22:30. The index continues to post gains above the 50-level, indicative of expansion in the construction sector. The October reading came in at 52.1 points.

- ANZ Job Advertisements: Monday, 00:30. This indicator provides a snapshot of the health of the Australian labor market. In October, the indicator softened with a weak gain of 0.4%, marking a 3-month low. Will we see a rebound in the November report?

- NAB Business Confidence: Tuesday, 00:30. Analysts keep a close eye on this event, as improved business confidence can translate into increased spending and hiring, which is critical for economic growth. In October, the indicator dropped from 5 to 2 points.

- Chinese Trade Balance: Tuesday, Tentative. The Australian dollar is sensitive to key Chinese data such as Trade Balance, as China is Australia’s largest trading partner. The indicator has risen steadily in the past three readings, handily beating the estimate each time. The October reading improved to $393 billion, well above the estimate of $367 billion. The upward trend is expected to continue in November, with a forecast of $395 billion.

- Westpac Consumer Sentiment: Tuesday, 23:30. Consumer sentiment often translates into consumer spending, a key driver of economic growth. The indicator has posted strong gains for two consecutive readings, with a gain of 3.9% in October.

- Home Loans: Wednesday, 00:30. Home Loans softened to 2.0% in September, but this was much stronger than the estimate of 0.1%. This important housing indicator has now posted gains for four straight months. However, October may spell trouble, as the estimate stands at -1.0%.

- Chinese CPI: Wednesday, 1:30. Chinese CPI has slipped in recent releases and dropped to just 1.3% in October, shy of the forecast of 1.5%. The estimate for the November reading stands at 1.4%.

- MI Inflation Expectations: Thursday, 00:00. Analysts rely on this indicator to help project future inflation trends. The indicator has been steady, with two consecutive readings of 3.5%.

- Employment Change: Thursday, 00:30. Employment Change is one of the most important indicators, and an unexpected reading can have a sharp impact on the movement of AUD/USD. The indicator surged in October, with a reading of 58.6 thousand, crushing the estimate of 14.8 thousand. However, the markets are expecting a sharp downturn in the November reading, with the estimate standing at -10. thousand. Will the indicator repeat and beat the prediction?

- Chinese Industrial Production: Saturday, 5:30. Industrial Production has weakened in the second half of 2015, reflective of a slowdown in the world’s second largest economy. The indicator softened to 5.6% in October, short of the forecast of 5.8%. The markets are expecting a slow improvement in the November reading, with an estimate of 5.7%.

* All times are GMT.

AUD/USD Technical Analysis

AUD/USD started the week at 0.7183 and quickly touched a low of 0.7169, as support held firm at 0.7160 (discussed last week). The pair then climbed to a high of 0.7385. The pair closed at 0.7333.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 0.7738.

0.7664 is a strong resistance line.

0.7533 has remained intact since July.

0.7440 capped the pair in August and remains key resistance.

0.7284 is an immediate resistance line.

0.7160 has strengthened in support as the pair trades at higher levels.

0.7100 is next.

The round number of 0.70 worked as a cushion in August and is a strong support level.

0.6899 has provided support since September. It is the final support level for now.

I am neutral on AUD/USD

The markets are expecting weak Australian job numbers, which could weigh on the Aussie. With more hints that the Fed will press the rate trigger next week, we could see some consolidation from the greenback.

Our latest podcast is about Expectations and Disappointments in EUR, USD and Oil

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.