AUD/USD had an uneventful week and posted slight gains. The pair closed at 0.7150. The upcoming week has five events on the schedule. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

- RBA Assistant Governor Guy Debelle Speaks: Sunday, 22:10. Debelle will deliver remarks at an event in Sydney. A speech that is more hawkish than expected is bullish for the Australian dollar.

- CB Leading Index: Monday, 15:30. The index posted a gain of 0.3% in December, breaking a nasty streak of three straight declines. Will we see another reading in positive territory in January?

- Construction Work Done: Wednesday, 00:30. This indicator is released on a quarterly basis, magnifying the impact of each release. The indicator posted a sharp decline in Q3, with a reading of -3.6%. This was a much softer reading than the estimate of -1.8%. Another decline is expected in the Q4 release, with an estimate of -2.1%.

- Wage Price Index: Wednesday, 00:30. This event is a leading indicator of consumer inflation. The index has been very steady, and the third quarter reading of 0.6% matched the forecast. No change is expected in the fourth quarter report.

- Private Capital Expenditure: Thursday, 00:30. This key indicator provides a snapshot of the level of activity in the business sector. The indicator has posted four straight declines, and the Q3 reading of -9.2% was much worse than the estimate of -2.8%. Another decline is expected in Q4, with an estimate of -3.0%.

* All times are GMT

AUD/USD Technical Analysis

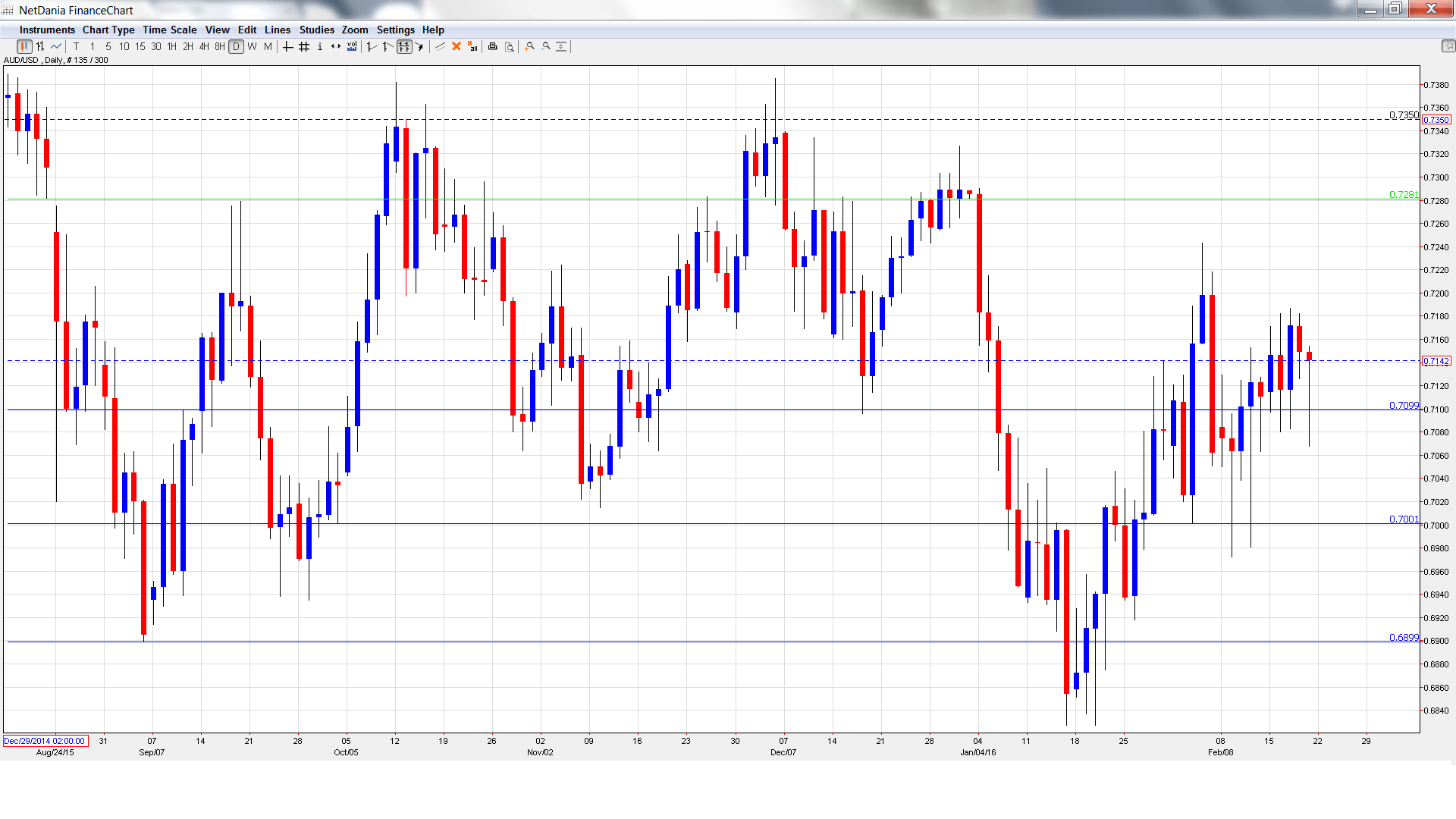

AUD/USD opened the week at 0.7114 and climbed to a high of 0.7187. The pair then reversed directions and dropped to 0.7068, testing support at 0.7100 (discussed last week). AUD/USD closed the week at 0.7142.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We start with resistance at 0.7533.

0.7440 capped the pair in August.

0.7284 is next.

0.7100 remains busy and was tested as AUD/USD lost ground before recovering.

The round number of 0.70 worked as a cushion in August.

0.6899 has provided support since September.

0.6775 is the next support level.

0.6686 was an important cap back in January 2000. It is the final support level for now.

I am bearish on AUD/USD

The RBA continues to maintain a bias towards monetary easing, and could cut rates if inflation levels weaken. Although the US economy has slowed down in 2016, last week’s employment and inflation numbers beat expectations, so a March rate hike is again on the table. This monetary divergence is bullish for the US dollar.

Our latest podcast is titled Oil’n’gold merry go round

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast