AUD/USD sustained its largest weekly loss in almost a year, plunging 340 points. The pair closed at 0.6947. This week’s key indicator is employment change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Aussie lost ground on weak Chinese data, as services and manufacturing PMIs missed expectations, as the Chinese slowdown continues. In the US, the NFP report was outstanding, bolstering the greenback.

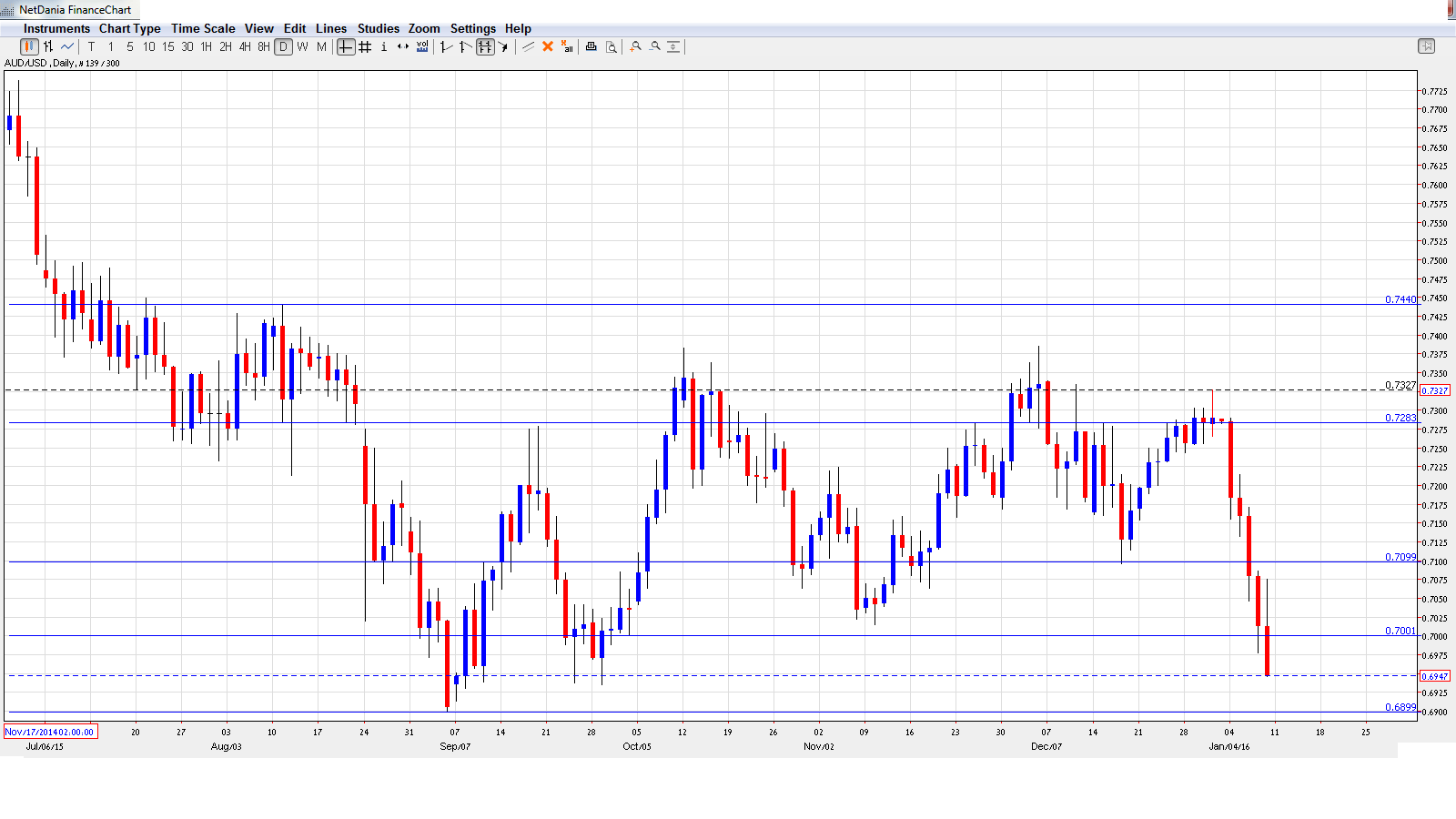

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- ANZ Job Advertisements: Monday, 00:30. This indicator provides a snapshot of the employment market in Australia. The indicator improved in November, with a strong gain of 1.3%. Will we see another solid gain in the December report?

- Chinese Trade Balance: Wednesday, Tentative. Chinese key indicators can have a strong impact on the Australian dollar, as China is Australia’s largest trading partner. The indicator slipped to $343 billion in November, well short of the forecast of $395 billion. The downward trend is expected to continue in December, with an estimate of $339 billion.

- Employment Change: Thursday, 00:30. This is one of the most important economic indicators and an unexpected reading can have a sharp impact on the movement of AUD/USD. The indicator has posted excellent gains in the past two releases, easily beating the forecasts. However, the markets are braced for a sharp turnaround in the December report, with an estimate of -10.3 billion. Will the indicator beat this prediction? The unemployment rate is expected to edge above to 5.9%.

- Home Loans: Friday, 00:30. Home Loans softened in November, posting a decline of -0.5%. This was the indicator’s first decline in five months. Little change is expected in December, with an estimate of -0.4%.

* All times are GMT.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7285. The pair quickly touched a high of 0.7290, before reversing directions and sliding to a low of 0.6946, breaking below support at 0.70 (discussed last week). The pair closed the week at 0.6947.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

With the Australian dollar posting huge losses, we start at lower levels:

0.7440 capped the pair in August.

0.7284 is next.

The pair easily breached below the 0.71 line.

The round number of 0.70 worked as a cushion in August. It was also breached and has switched to a resistance role.

0.6899 has provided support since September. It is a weak line.

0.6775 is the next support level.

0.6686 was an important cap back in January 2000. It is the final support level for now.

I am bearish on AUD/USD

The US dollar remains the market’s darling after the Fed rate hike in December. With the Fed set to raise rates again early in the New Year, risky currencies like the Aussie could lose ground against the greenback.

In our latest podcast we explain China and grill the Fed

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.