AUD/USD posted modest gains last week, with the pair closing at 0.7552. This week’s key events are CPI reports. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, manufacturing and employment numbers beat expectations. Philly Fed Manufacturing Index continued to climb higher and unemployment claims beat expectations for a fourth straight week. Australian job numbers were solid, as Employment Change posted a strong gain and beat expectations.

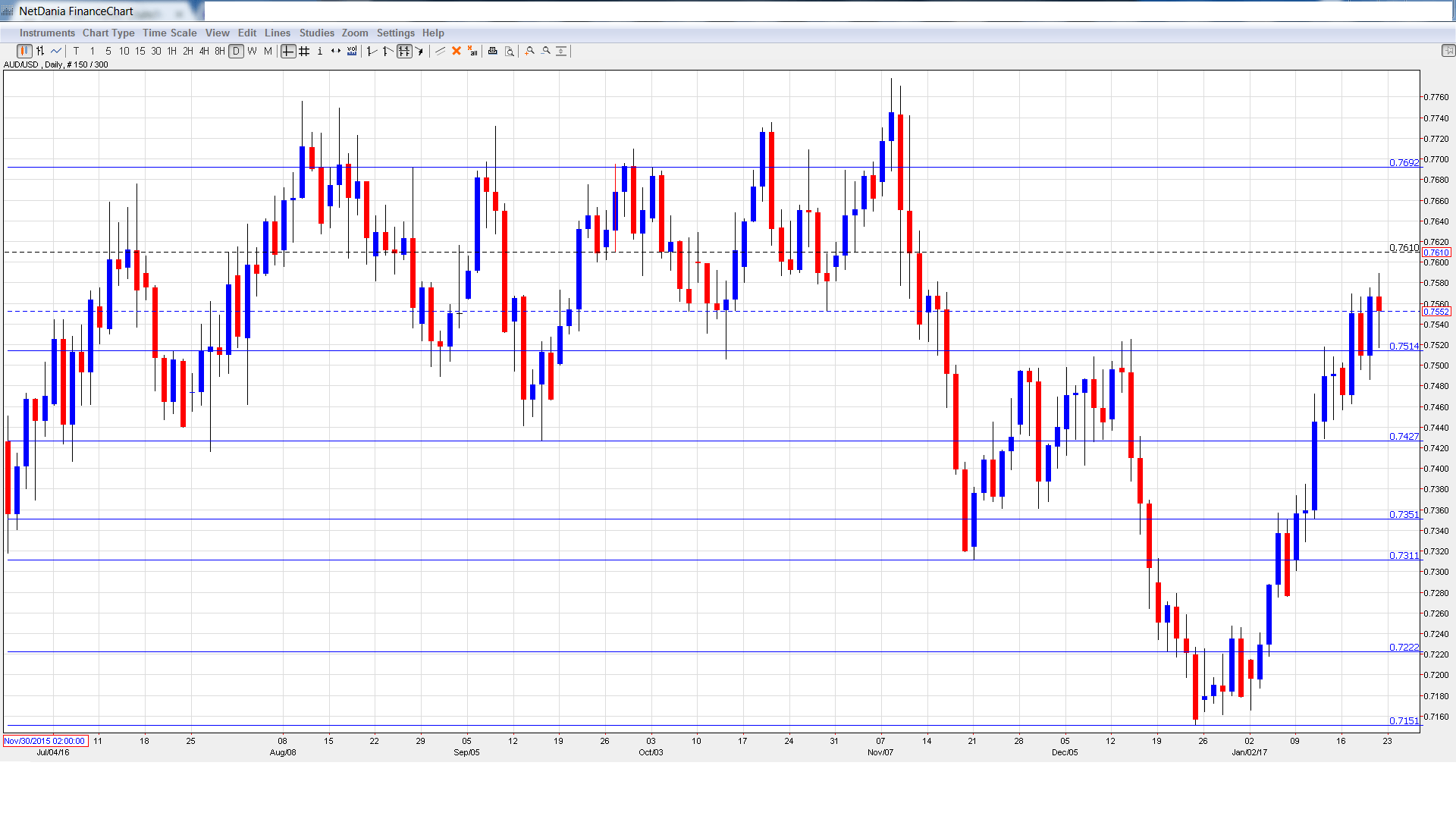

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- CB Leading Index: Tuesday, 15:30. The index declined 0.4% in October, its first decline since February. Will the indicator rebound in November?

- MI Leading Index: Tuesday, 23:30. The indicator has been steady and posted a flat reading of 0.0% in December.

- CPI: Wednesday, 00:30.CPI continues to move higher and climbed 0.7% in Q3, beating the estimate of 0.5%. The markets are expecting the index to remain at 0.7% in Q4.

- Trimmed Mean CPI: Wednesday, 00:30. This indicator excludes the most volatile indicators which comprise CPI.

- Import Prices: Friday, 00:30. Import Prices continues to point downwards, having posted four straight declines. The indicator is expected to rebound in Q4 with an estimate of 0.4%.

- PPI: Friday, 00:30. PPI improved to 0.3% in Q3, short of the forecast of 0.6%. The index is expected to edge lower to 0.2% in Q4.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7497 and quickly touched a low of 0.7457, as support held firm at 0.7427 (discussed last week). AUD/USD then reversed directions and climbed to a high of 0.7589. AUD/USD closed the week at 0.7552.

Live chart of AUD/USD:

Technical lines from top to bottom:

We start with resistance at 0.7938.

0.7835 has held firm since April 2016.

0.7691 was a cap for much of October.

0.7513 was a cushion in April 2015.

0.7427 is next.

0.7311 marked a low point in November.

0.7223 is next.

0.7151 has held in support since mid-December. It is the final support level for now.

I am bearish on AUD/USD

There are concerns as Donald Trump takes over as president, as his economic policies remain unclear. However, the economy is strong and if inflation levels move higher, we could see the Fed step in with additional rate hikes.

Our latest podcast is titled Monetary Matters – FED, ECB and BOE movements

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.