AUD/USD rebounded this week, as the pair climbed above the 1.04 level, and then gave up some of its gains, to close at 1.0370.The upcoming week has five releases. Here is an outlook for the Australian events, and an updated technical analysis for AUD/USD.

The Australian dollar lost ground at the end of the week, after Chinese GDP figures came in below the market forecast. Chinese GDP posted a reading of 8.1%, a sharp drop from the previous quarter’s reading of 8.9%, and below the market forecast of 8.4%. The downward movement by AUD/USD underscores how economic releases from China, such as GDP, can rapidly affect the direction of the pair.

Updates: Although there are no releases scheduled for Monday, the markets are anxiously awaiting Tuesday’s release of the Monetary Policy Meeting Minutes from the most recent meeting of the central bank. AUD/USD is steady, trading at 1.0357. The central bank’s Monetary Policy Meeting Minutes were released earlier today, and AUD/USD could make a move after the markets digest the report. New Motor Vehicle Sales jumped 4%, the best numbers since August 2011. The Leading Index posted a reading of 0.2%, a sharp drop from the 0.6% increase in March. AUD/USD managed to stay above 1.04 for only a brief period, as the pair retracted. It is trading at 1.0368.

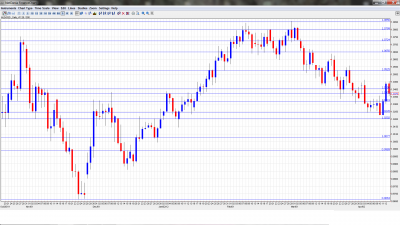

AUD/USD graph with support and resistance lines on it. Click to enlarge:

-

Monetary Policy Meeting Minutes: Tuesday, 1:30. The markets will be looking for some monetary policy clues from the minutes of the most recent policy meeting of the central bank. A report that is more hawkish than expected is bullish for the Australian dollar.

-

New Motor Vehicle Sales: Tuesday, 1:30. The indicator posted a flat 0.0% reading in March. A positive reading this month would be sign of increased consumer spending, which is sorely needed by the sluggish Australian economy.

-

MI Leading Index: Wednesday, 00:30. This composite index indicator hit 0.6% in March, its best reading since October 2011. Will the index continue this upswing?

-

NAB Quarterly Business Confidence: Thursday, 1:30. This imporant indicator has posted weak numbers for the past two readings. The figures for February were in positive territory, although just barely, with a reading of 1. Will the indicator make some headway and move upwards in April?

-

Import Prices: Friday, 1:30. This quarterly indicator jumped 2.5% in January, its highest reading since January 2009. The market forecast for the April reading calls for a flat reading of 0.0%, another indication of weak economic activity.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD opened at 1.0290. The pair dropped to a low of 1.0227, as the support line of 1.02 (discussed last week) continued to hold firm. The pair then rebounded sharply upwards, hitting a high of 1.0453, before retracting, to close the week on a positive note, at 1.0370.

Technical levels from top to bottom:

We begin with resistance at the line of 1.0886, which was last breached in August 2011. Next, there is resistance at the round number of 1.08, which AUD/USD last tested in February. Below, there is resistance at 1.0724, which has strengthened as the pair has traded at lower levels since early March.

This is followed by strong resistance at 1.0650. The pair exhibited quite a bit of movement around the 1.0525 line in March. This line continues act in a resistance role. Below, 1.0402 was again breached this week as the aussie showed some strength. This line is providing weak resistance to AUD/USD.

Close by, 1.0372 is providing resistance to the pair. This line has been tested several times in April, and we could see this line continue to come under further attack. The pair closed the week just shy of this line, at 1.0370.

The line of 1.0320 which was providing resistance just last week, is now acting in a support role. Below, 1.0250 had been providing strong support, but was briefly breached this week on the short downswing by AUD/USD. If the aussie shows some weakness, this line could be tested.

Next is the support level at the round figure of 1.02. This line has provided strong support to AUD/USD since January. Below, the pair is supported at 1.0080, which is protecting the all-important parity level. Although parity has not been breached since December 2011, a sustained rally by the US dollar could put this psychologically important level within reach. The final support level for now is at 0.9964, a strong support level dating back to December 2011.

I am neutral on AUD/USD.

Although the Australian dollar showed some strenght last week, the trend since early March has been southward. Weaker global activity, especially in China, Australia’s number one trading partner, is weighing on the Australian dollar, as confirmed by the weak Chinese GDP figures, which hurt the aussie. The Australian economy continues to sputter, but the markets are not pleased with the weak employment figures coming out of the US. Will the Australian build on last week’s strong performance, or will this prove to be no more than a blip in the greenback’s sustained push against its Australian counterpart?

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.