The Aussie had quite a rough week, ending significantly lower and erasing previous gains. Another busy week awaits us. Employment data is the highlight of 11 events. Here is an outlook for the events and an updated technical analysis for AUD/USD.

Glenn Stevens acknowledged the global slowdown and easing inflation and cut the interest rate to 4.50%. This weighed heavily on the pair, as well as no new hints on QE3 in the US.

Update: the ANZ report showed a squeeze of 0.7%. This is discouraging towards the official release. In addition, the crisis in Italy, with Berlusconi still hanging to power, also weighs on the Aussie. Here is how to trade the Australian job figures. Job figures came out within expectations, with a minor surprise from the unemployment rate, which dropped to 5.2%. On the other hand, China’s trade balance surplus squeezed, and this hurt the Aussie. Also the ongoing mess in Italy weighs on the Australian dollar.

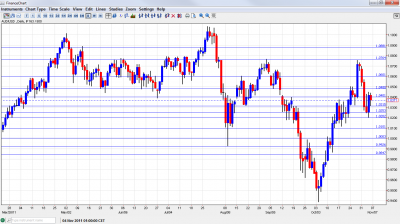

AUD/USD daily chart with support and resistance lines on it. Click to enlarge:

- AIG Construction Index: Sunday, 22:30. According to the Australian Industry Group, the construction sector is close to rock bottom. The PMI-‘like indicator dropped to 30 points. 50 is the equilibrium between growth and contraction. This contraction has been going on for a about a year and a half. A similar score is expected now.

- ANZ Job Advertisements: Monday, 00:30. ANZ measures the job market via the number of ads in the media. It has proven to an excellent gauge in predicting the official figures published later in the week. Last month this indicator fell by 2.1% and paced the way for the disappointing job numbers.

- Trade Balance: Tuesday, 00:30. Australia enjoyed a nice rise in its surplus in the month of August to 3.1 billion. The surplus in the balance of trade is expected to remain at the same levels in September – above 3 billion.

- NAB Business Confidence: Tuesday, 00:30. This survey by the National Australia Bank has been negative in the past 2 months, indicating deteriorating economic conditions. Another negative number is likely now, similar to last month’s -2.

- Westpac Consumer Sentiment: Tuesday, 23:30. This bank looks into consumers, and has a very volatile indicator, that tends to leap and plunge. For a change, the indicator rose by a modest 0.4% last month. A significant drop is expected now.

- Home Loans: Wednesday, 00:30. Contrary to other housing sector indicators, this one managed to rise for 5 consecutive months and help the Aussie. A rise of 1.7% is expected to follow last month’s gain of 1.2%.

- Chinese CPI: Wednesday, 1:00. Australia’s No. 1 trade partner managed to cool down inflation according to its own estimates: it ticked down from a peak of 6.5% to 6.1% last month. A more serious drop is expected now, down to 5.4%. Lower inflation means looser monetary policy, and this helps Australia.

- Philip Lowe talks: Wednesday, 22:30. Dr. Lowe is the assistant governor in the RBA. In a speech held in Melbourne, Lowe will have the opportunity to shed some light on the decision to cut the interest rate in Australia to 4.50%.

- MI Inflation Expectations: Wednesday, 23:30. Official CPI numbers have shown a slowdown in price rises in Q3. The Melbourne Institute provides us with an unofficial look into October. Inflation expectations rose to 3.1% in September, and are likely to slide now.

- Employment data: Thursday, 00:30. After two months of job losses, Australia enjoyed a strong gain of 20.4K jobs last month and also a surprising drop in the unemployment rate from 5.3% to 5.2%. The rate is now expected to tick back up to 5.3%, while a more modest gain of 10.3K is expected. Any outcome will rock the Aussie in this very important event.

- Chinese Trade Balance: Thursday. China’s huge surplus squeezed in the past two months to figures under 20 billion and was quite disappointing. Australia’s main trade partner is now expected to report a strong surplus of 26.3 billion.

* All times are GMT.

AUD/USD Technical Analysis

Aussie/dollar fell early in the week. It managed to put up an initial struggle around 1.06 (mentioned last week) before descending lower and eventually closing at 1.0370 – back to the point it was two weeks ago.

Technical levels from top to bottom:

1.0880 was a peak in April and later provided support when the pair was trading in a higher range. 1.0764 was a swing high in August and also during May, and was approached in October. It now looks like a spike in the graph.

The round number of 1.06 worked in both directions in recent months. 1.0480 was weak support in August and is now weaker after pierced on the way down.

The round number of 1.04 was a swing low in June and also the peak of a failed recovery attempt in September. It was also a cap in October, but is more vulnerable now. 1.0314 was a stepping stone on the way up many months ago and also a line of support in August. In November is provided some support.

The 2010 peak of 1.0254 is now weaker than earlier, but it is still of importance. It is closely followed by 1.02, which cushioned a fall during November.

1.01 was the area of a cushion around July and also provided support after the recent surge in October, for two weeks in a row. The next line is obvious: AUD/USD parity. The very round number has strengthened in September after capping a recovery attempt. It also proved its importance in October.

Below parity, 0.9930 is weak resistance after holding back in August. The last line for now is 0.9850, which worked in both directions recently.

I remain bearish on AUD/USD.

The rate cut isn’t a single event. More could follow as the housing sector is showing signs of weakness and also China’s situation is questionable. The relative strength of the US helps the greenback.

If you are interested in an alternative way of trading currencies, check out the weekly binary options setups, including AUD/USD, EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.