Australia’s inflation is decelerating. The headline consumer price index rose by 0.5% in Q4, lower than 0.7% seen in Q3 and expected for the last quarter as well. Trimmed Mean CPI (known as core inflation elsewhere) also fell short of early predictions, advancing by 0.4% instead of 0.5% projected. Also year over year, inflation missed with 1.5% against 1.6% estimated and core inflation is also at 1.6%, in this case, according to forecast.

Australia publishes its CPI data only once per quarter, enhancing the impact of every release and we are seeing the impact. This time, the data feeds into the first meeting of the Reserve Bank of Australia after the January break.

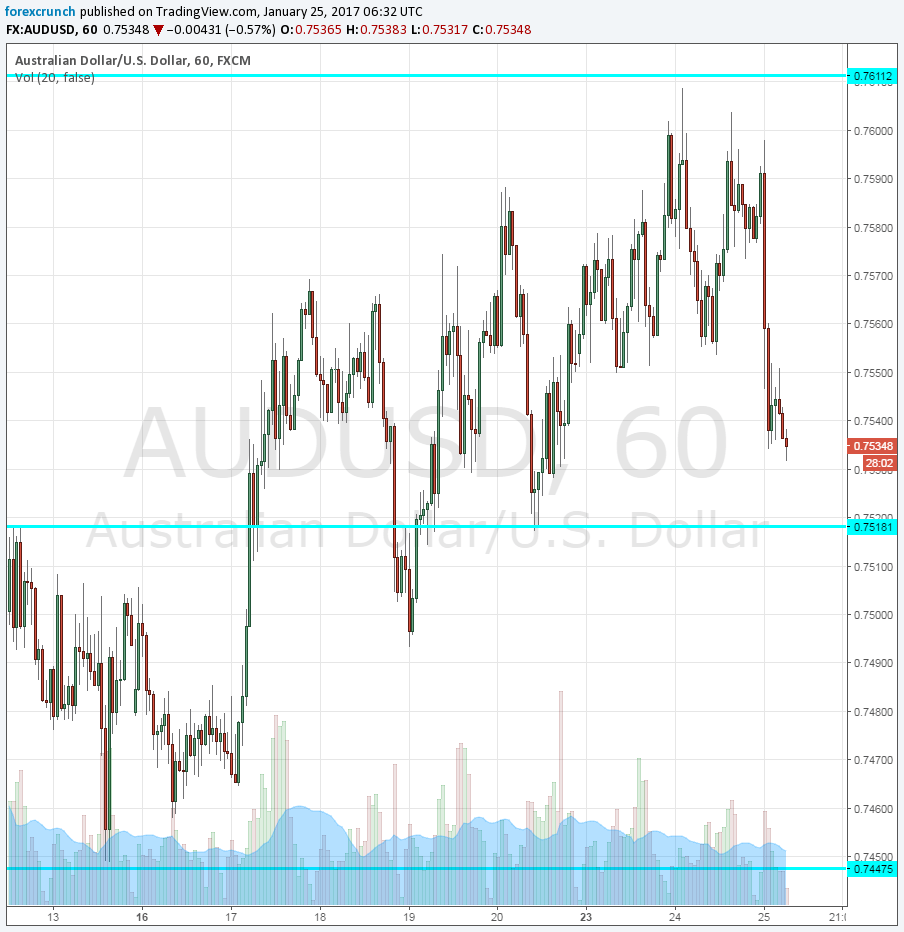

AUD/USD had already topped the 0.76 line ahead of the event and is down some 0.5% on the day to 0.7536 at the time of writing.

Lower inflation means lower chances for a rate hike from the RBA anytime soon. Will they even consider cutting rates? The new governor, Phillip Lowe, seems relatively reluctant to rock the boat too much. Rocking the boat did not come from Moody’s which left Australia’s perfect AAA rating intact.

Support for AUD/USD awaits at 0.7520, the immediate bottom of the range. 0.7375 is the next cushion to the downside. On the topside, 0.76 is the immediate level of resistance.

More: AUD/USD: Upward Correction Targeting 0.7700/20 Against 0.7150/00 – NAB

Here is the hourly chart of A$/USD: