The Australian dollar took a break from gains but remains on the high ground. What’s next?

Here is their view, courtesy of eFXnews:

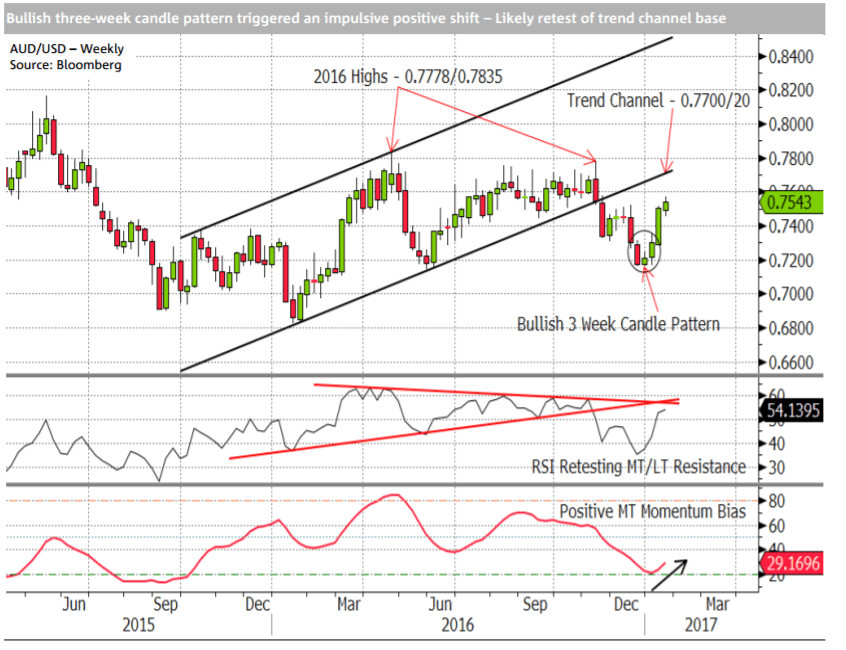

Trend: Price broke down from its broad 2016 triangle in Q4 2016 and challenged the bottom of the nine-month range and our downside target at 0.7150/00 in December. The response to nine-month lows at 0.7150/00 has been positive, however, completing a bullish three-week candle pattern in early January that triggered an aggressive, positive extension last week. The break of late 2016 highs at 0.7525 this week confirms the sustainability of the interim upswing.

At a minimum, we anticipate that this confirmation justifies a retest of the base of the broken uptrend channel at 0.7700/20 in the coming weeks. Beyond this, we note 2016 highs at 0.7778/0.7835 as a difficult hurdle that would need to be overcome to establish a more sustainable MT uptrend.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Outlook: Price achieved our downside target at 0.7150/00 in late December. Bullish three-week candle pattern completed in early January confirms the hold of nine-month lows at 0.7150/00 and implies that range lows will hang on a multi-week basis.

Upward correction targets a retest of trend channel base at 0.7700/20. A more sustainable uptrend would require a break of 0.7835, confirmed by a weekly RSI breakout.