Idea of the Day

The AUDUSD pair has probably suffered more than most since the general risk aversion that hit markets back in May and June. At the time back then it was still treading water above the 1.0000 mark but when it broke below there’s been somewhat of a one way ticket since then. Earlier this month after a dip below 0.9000 the Aussie bulls were starting to perk up again however overnight the RBA seems to have poured cold water on any prospect of a return to anywhere near the highs a couple of months ago. They were quiet clear in saying that the exchange rate will play an important part in their policy decisions going forward and so traders have taken that as a signal that they favour a lower currency. With the medium term trend looking bearish there could be further room for downside in AUDUSD.

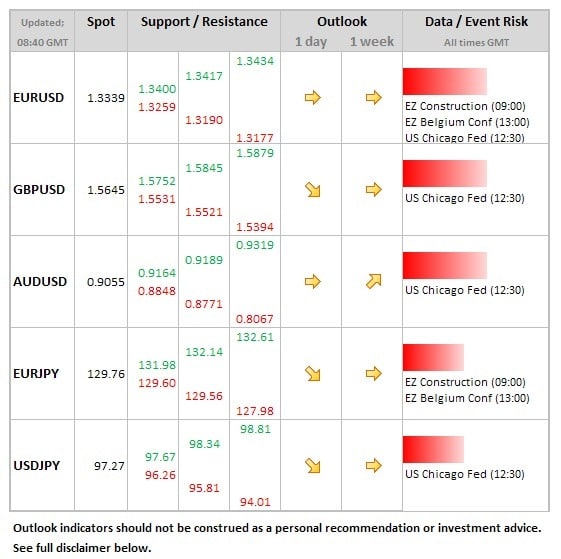

Data/Event Risks

EUR: The data from the Eurozone today is not expected to be a huge market mover. Despite signs that the region is recovering from a six quarter contraction traders continue to remain relatively wary of any upside potential for the single currency as the consensus seems to be that the ECB will have to be more specific about its forward guidance just as the BOE has done most recently following their less obvious commitment to keep rates low for an extended period.

USD: Yet another day of quietness on the economic data front as even the release of the Chicago Fed National Activity is not expected to jolt markets. The dollar will remain in focus however as we near the release of the FOMC Minutes tomorrow.

Latest FX News

AUD: As discussed in the Idea of the Day the Aussie came under pressure overnight as the RBA’s minutes had a decidedly dovish tone to them and already this morning is testing its overnight lows around 0.9040.

GBP: Yesterday saw sterling receive another boost after the CBI upgraded its growth forecasts for the UK although the strength was not sustained. The CBI now expects GDP to rise 1.2% this year, up from 1% and 2.3% in 2014, up from 2%.

EUR: We’ve already had PPI data from Germany this morning which has come in lower than expected. Yesterday Germany’s Bundesbank made some hawkish comments that kept the euro supported throughout the day and so upside resistance levels remain in focus.

Further reading: