Is the recovery of AUD/USD over? The RBA released its meeting minutes from the last meeting, in which it decided to cut the rate to 2.50% and remove some of the dovish bias. Well, the minutes revealed that the central bank hasn’t really closed the door on more monetary stimulus.

The Australian dollar didn’t like and extended its falls. Can it lose the 0.90 line?

How did the Reserve Bank of Australia leave an open door: it said the forecast for the August meeting didn’t lessen the scope to cut rates.

It also repeated the known stance that the Australian dollar remains elevated in comparison with historical standards and that the economy is growing below trend pace. The situation in China is also not exactly positive: Chinese growth is unlikely to pick up in coming quarters.

Perhaps these words are less dovish than previous minutes, but they still allow for further stimulus. The next rate cut is therefore not that distant in the future.

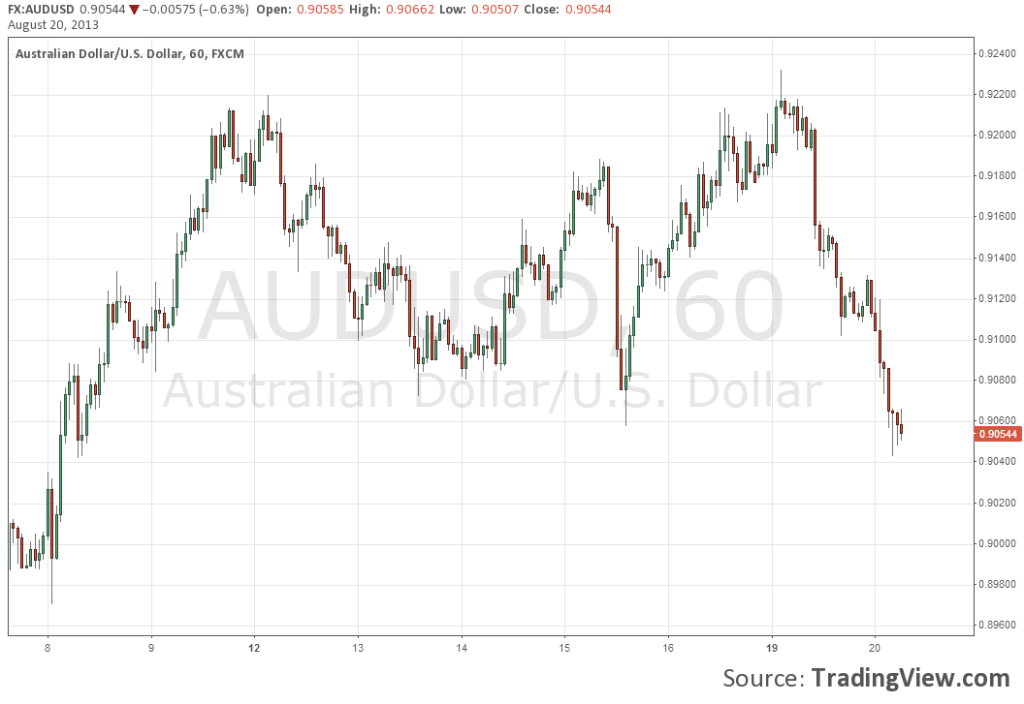

AUD/USD reaction

The Aussie already climbed higher at the wake of the new week, but has turned downwards after peaking just above 0.9230. It managed to hold on above 0.9110 but the minutes sent it to a low of 0.9040. The very round and very important 0.90 provides support.

For more lines, events and analysis, see the AUDUSD forecast.