- The AUD/USD suffered from the strength of the US Dollar and was not helped by local data.

- A busy week with the RBA meeting, Retail Sales, and Chinese PMIs awaits.

- The technical picture shows somewhat oversold conditions after the sharp fall.

Higher US yields, mediocre Australian inflation

US 10-year bond yields broke above the closely-watched level of 3% and reached the highest level since 2011. The advance of US yields buoyed the US Dollar across the board, and the AUD/USD suffered. Also, US GDP came out slightly above expectations at 2.3% annualized for Q1, also providing support for the greenback.

In Australia, the quarterly inflation report came out slightly below expectations with 0.4% QoQ on the headline against 0.5% expected. The Trimmed Mean figure met expectations at 0.5% QoQ. Other Australian inflation data was better: PPI came out at 0.5% QoQ against 0.4% expected while Import Prices came out at 2.1% instead of 1.3% projected. Nevertheless, the most critical data point was the CPI figure, and it was not helpful.

The Summit in Korea cheered markets and helped stabilize the Australian Dollar after the falls.

Australian events: RBA and lots more

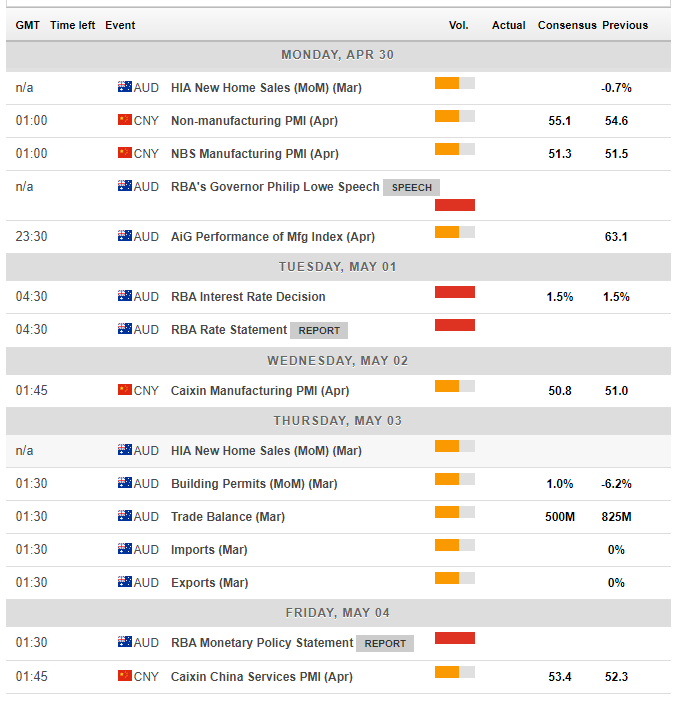

The upcoming week is much busier. Early on Monday, China releases its official purchasing managers’ indices. The Manufacturing PMI is expected to tick down to 51.3, and that may weigh on the Aussie. The Governor of the Reserve Bank of Australia Phillip Lowe will speak before the rate decision and given this timing; he may refrain from addressing monetary policy.

The rate decision on Tuesday is expected to be yet another “unchanged.” The RBA has not changed its rates since 2016 and also indicated stability moving forward. It will be interesting to hear if they are more pleased with the fall of the A$ and conversely if they are worried about the drop in consumer inflation.

Wednesday sees the release of the more significant Chinese data: the independent Caixin Manufacturing PMI. Also here, a drop is on the cards: to 50.8 in April after 51 beforehand.

On Thursday, a slew of Australian data are published: Building Permits are expected to rise in March after dropping beforehand. The trade balance is projected to show a surplus also in March after one in February.

The RBA has another opportunity to impact the markets on Friday with the RBA Monetary Policy Statement. The quarterly report may shed more light on the economy and perhaps give more clarity on when the RBA may move on interest rates. In the past, this has been a market moving event.

Here are the events that will shape the Australian dollar as they appear on the economic calendar:

US events: Fed decision, Non-Farm Payrolls

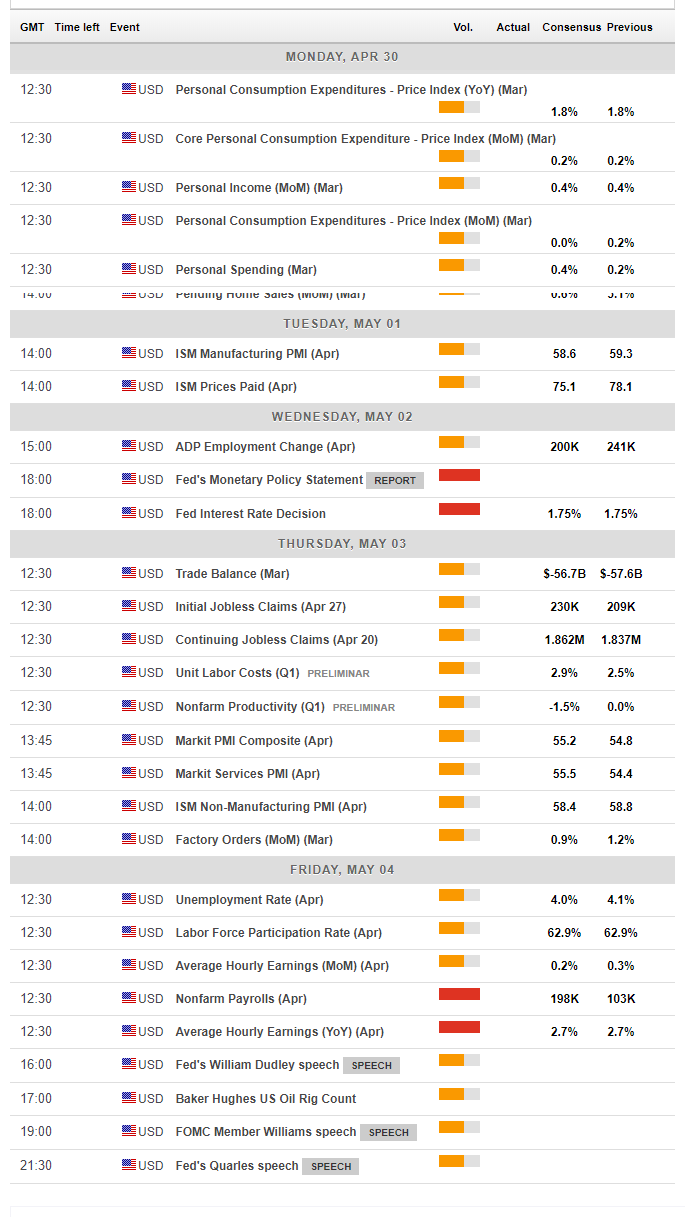

The turn of the month features quite a few economic gauges in the US. The all-important Core PCE Price Index, the Fed’s favorite measure of inflation, is expected to rise in the publication on Monday.

The ISM Manufacturing PMI provides the first hint for the Non-Farm Payrolls and comes out on Tuesday. Another clue is the ADP Non-Farm Payrolls which carry expectations for around 200,00 private jobs gained.

The Fed makes its decision on Wednesday. No change is expected as there is no press conference nor new forecasts. With the recent upbeat data, Jerome Powell and his colleagues will likely prepare markets for a rate hike in June. Expectations for interest rates have risen.

The highlight of a busy Thursday is the publication of the ISM Non-Manufacturing PM, another hint towards Friday’s Non-Farm Payrolls. Unit Labour Costs will be of interest as another measure of wage inflation, and factory orders are also eyed.

Friday’s Non-Farm Payrolls report for April is expected to show a gain of nearly 200,000 jobs, back to the new normal after a disappointing increase of only 103,000 for April. Wages remain in the limelight, and they are expected to rise by 2.7% YoY once again. Salary growth will have the last word of the week.

Here are the upcoming US events:

AUD/USD Technical Analysis – a bit oversold?

The RSI is hovering and flirting with the 30 level on the daily RSI, bordering oversold territory. Will the pair bounce from here? Momentum remains strong, and the 50-day Simple Moving Average is below the 200-day one.

On the downside, 0.7550 was a temporary low in December. The late-April trough of 0.7530 awaits nearby. The round 0.7500 line marks the low point in December, from where the uptrend began. Even lower, 0.7410 is notable.

On the upside, 0.7590 was a temporary support line in mid-April. It is followed by 0.7640 which is already a critical level after holding the pair from falling back in March. Even higher, 0.7715 capped the pair in March and is worth watching.

What’s next for AUD/USD?

The AUD/USD has good reasons to fall, with data and central bank approaches undoubtedly favoring the greenback. Despite somewhat oversold conditions, it is hard to see a meaningful recovery.

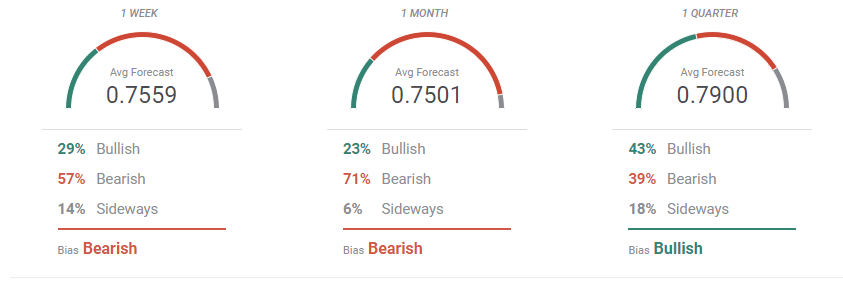

The FXStreet Forecast Poll shows a bearish tendency in the near and medium terms, in line with the views expressed here.

-636604339151640074.png)