Euro dollar bounced off downtrend resistance and continued to lower ground. S&P downgraded Spain by two notches, just before unemployment jumped once again. Other European indicators don’t look good either. In the US, figures were mixed, but leaning lower. The focus is on the first release of GDP for Q1, which is expected to remind us of the economy’s strength before recent sluggishness. Will Friday provide strong moves?

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

- Asian session: EUR/USD fell sharply on the S&P downgrade and managed to partially recover in the European session.

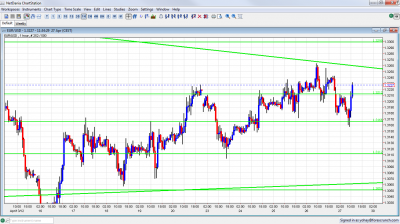

- Current range: 1.3212 to 1.33.

- Further levels in both directions: Below: 1.3165, 1.3110, 1.3050, 1.30, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2623.

- Above: 1.33, 1.34, 1.3437, 1.3486 and 1.3550.

- Downtrend resistance was successfully challenged. The narrowing channel see above in the hourly chart (daily chart here) works well so far. Eventually the pair will leave the channel. The direction is unclear.

- 1.3212 is now weak resistance.

- Significant support is at 1.3110.

Euro/Dollar stopped by Spanish downgrade – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:00 German GfK Consumer Climate. Exp. 5.9 points. Actual 5.6.

- 6:00 German Import Prices. Exp. +0.9%. Actual +0.7%.

- 6:45 French Consumer Spending. Exp. -1.6%. Actual -2.9%.

- 7:15 Spanish unemployment rate. Exp. 23.5%. Actual 24.4%. European figures all disappoint.

- 12:30 US GDP (first release). Exp. +2.6%. See how to trade this event with EUR/USD.

- 12:30 US GDP Price Index. Exp. +2.3%.

- 12:30 US Employment Cost Index. Exp. +0.5%.

- 13:55 US UoM Consumer Sentiment. Exp. 75.8 points.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Spanish downgrade: Rating agency S&P cut two notches off Spain’s credit rating and set it at BBB+ which means “adequate payment capacity”, at the same level with Italy. According to Fitch and Moody’s, Spain’s rating is higher, at the equivalent of “strong payment capacity”. This will force some institutional managers to sell Spanish bonds, which are already under severe pressure. Spain has a toxic mix of economic issues, with the high unemployment rate being only one of them. Spain is in a serious crisis. See the Spanish prospects.

- Italy pays higher prices: A fresh auction for 10 year Italian bonds yielded higher yields once again, at 5.84%, higher than the secondary market that prices the bonds at a yield of 5.73% at the time of writing.

- US economy: strong Q1 but uncertain present: The rise in weekly jobless claims wasn’t a one time event. Figures remain high for 3 consecutive weeks, pushing the moving average above 380K. This weighs on the dollar as it raises the chances for QE3. On the other hand, pending home sales shot up by 4.1%, much better than expected. All in all, Q1 was quite good in the US, but the world’s no. 1 economy is now slowing down as well. Another US recession seems unlikely at this point, but the US isn’t the locomotive either. The GDP figure will be closely watched.

- Bernanke keeps mixed message: Ben Bernanke didn’t rule out QE3, but as time passes by, this option seems quite unlikely, and even Bill Gross seems to back off his certainty that this move will come. For those lovers of English nuances, the Fed referred to inflation as having “picked up” rather than being “subdued”. Of course, traders are more concerned, and rightly so, with the market reaction to the Fed announcment rather than linguistic acrobatics.

- European recession is serious: Weak spending in France and lower confidence in Germany join the weak PMI data released from the Euro-zone released earlier. The recession seems deeper, and not only restricted to peripheral countries. The official recession in the UK is another ominous sign for the continent.

- Greek and French elections loom: In France, Socialist challenger Francois Hollande will face President Nicholas Sarkozy in the presidential run-off after inconclusive results in the first round. Hollande is not considered pro-market, and the Euro could be affected, at least initially, if Hollande wins the election. Greece will also hold elections on the same day, and the voters face a choice of backing current coalition, austerity supporting parties, or smaller anti-austerity parties. The EU is worried.