With more drama in euro-zone, events over the weekend impact the markets dramatically at the open. Recent elections in France and Greece were an excellent example, and certainly not the last one.

These gaps have interesting characteristics to be aware of, not only if you trade the markets at the open.

Markets reopen in Sydney’s morning time. Volume is very thin but trading is very active. Reactions to the news can be strong and choppy.

If your analysis (fundamental, technical or both) doesn’t justify this gap, the early hours are a good chance to act. If the gap will close, there is a higher chance it will happen before Tokyo joins in.

Things begin stabilizing around midnight GMT, when Japan joins. The session in Tokyo adds more volume. At this point, the gap might have already closed, or it can begin drifting in towards a close early in the Asian session. A close of the gap means that the news was surprising, but not enough to totally change things.

Gaps tend to close: the mass of market participants tends to send prices back to where they were on Friday before taking a new direction.

If this doesn’t happen in the Asian session, the chances of a gap close in the European session is already much lower. If the gap isn’t closed, this is certainly a sign that things are changing and a new trend is taking shape, depending on events of course.

Example

The results of the French elections were predicted, but still euro negative. The Greek elections resulted in a political deadlock which was worse than expected.

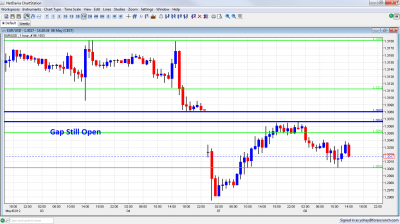

Sydney and Wellington opened with a big weekend gap that sent EUR/USD below 1.30. As gaps tend to move towards closure, the pair moved back up, yet also after the US session and some promising news from Spain, the gap was not closed.

Are we set for a big move down in this case? We shall see.

Further reading: 5 Most Predictable Currency Pairs – Q2 2012

The problems in Greece and Spain can certainly produce more gaps in the near future.