EUR/USD is now sliding after testing higher ground at the beginning of the week. The hopes for a powerful ECB intervention currently overcome the doubts, and the growing fears about Greece after the troika left Athens. Also the positive US Non-Farm Payrolls help in risk taking. Is a big breakout awaiting us?

Here’s an update about technical lines, fundamental indicators and sentiment regarding EUR/USD.

EUR/USD Technical

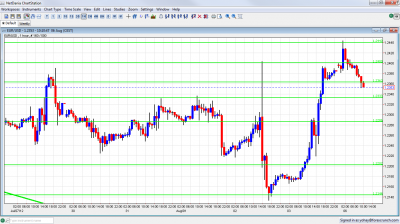

- Asian session: Euro/dollar tested higher ground and bounced off the 1.2440 resistance line before retreating.

- Current range: 1.2330 to 1.2360.

Further levels in both directions:

- Below: 1.2330, 1.2288, 1.22, 1.2144, 1.2043, 1.20, 1.1876 and 1.17.

- Above: 1.2360, 1.24, 1.2440, 1.2520, 1.2623, 1.2670, 1.2743 and 1.2814.

- The battle over 1.24 is still going on. 1.2440 proved its importance once again.

- 1.2330 is stronger support than 1.2360.

Euro/Dollar consolidating – click on the graph to enlarge.

EUR/USD Fundamentals

- 8:30 Euro-zone Sentix Investor Confidence. Exp. -30.8 points.

- 13:00 US Fed Chairman Ben Bernanke speaks. He may elaborate on the recent decision not to act.

EUR/USD Sentiment

- Draghi’s words begin helping: After Draghi said he will do “everything” to save the euro, markets expected much more action and not so many words, especially regarding bond buys. Draghi declared that bond yields are unacceptable, and that the ECB will explore ways to act in the coming weeks. These bond buys would be limited to the short end of the curve, but could be unsterilized – full QE. This is a significant move forward. Opposition came only from Germany, and not from other northern countries. . Apart from the exploration, the actions also depend on a formal aid request. After many weeks of denial, Spain’s leader changed the tone and said he wanted to see what the ECB has to offer. He practically opened the door for an aid request. Things move slowly in Europe, but this may be the beginning of the change. Other ECB officials echoed Draghi’s words about the irreversibility of the euro.

- Greece: troika leaves Athens: The EU / ECB / IMF delegation left Athens and said there was progress. It is expected to return only in September, after Greece has a scheduled bond repayment to the ECB. It is unclear where it will get the money from. In a personal vote of no-confidence, the former head of ATEbank, Theodoros Pantalakis, moved 8 million euros abroad. While this is probably legal, it doesn’t look good. The odds for Greece exiting the euro-zone until the end of 2012 are rising.

- Non-Farm Payrolls Surprise – After a long period of mixed data, the gain of 163K jobs in the US was great news. However, this may have been a one time event. More positive data is needed from the US, but this all important figure is a step forward.

- Fed stays on sidelines, again: The Federal Reserve opted to refrain from implementing fresh easing measures, despite troubling data from the US economy. The Fed took note that economic growth was stagnant in 2012, and reiterated that it stood ready to act if necessary. This is a repeat of what Bernanke said in the past, and the change of wording is subtle. Some participants see easing coming in December, while others see it very soon. The QE3 camp seems to miss a simple reality.

- German economy slowing down: If the euro still is a new Deutschmark, there are enough reasons to be worried. PMIs, retail sales and business confidence all disappointed. The markets are clearly getting nervous, as a Germany in decline could spell disaster for the struggling Euro-zone and send the euro tumbling. Just to add oil to the fire, Moody’s reduced the outlook on Germany, the Netherlands and Luxembourg from stable to negative.

- Spanish regions want in on the bailout: The euro-zone’s fourth largest economy is trying to focus the crisis on the banks, but also its regions are in deep trouble. No less than 6 regions may ask to tap into the national bailout fund. National sentiment is strongly felt in Catalonia, which banned a budget meeting. The regions are part of the complex picture. Currently, optimism from Draghi pushes yields lower: 6.77% on the 10 year bonds.

- High yields and crushing debt weigh on Italy: Doubts about Draghi’s seriousness can be seen in his own country. The area’s third largest economy raised money in the markets with a yield of 5.96%, higher than 5.82% seen last time. The specter of early elections in which the anti-euro sentiment will gain traction also weighs on Italy, that now has a debt-to-GDP ratio of 123%, and a contracting GDP.