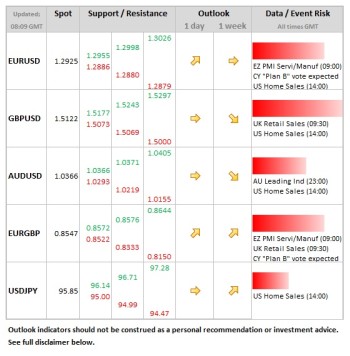

- EUR: There is talk of a ‘Plan B’ being presented by the President in Cyprus today so eyes will be firmly on events there. The market pricing remains hopeful for a compromise resolution, so potential for volatility remains high given that no deal today would mean taking things down to the wire once again. More: Pressure on euro remains.

- GBP: It’s not over for sterling yet, with retail sales and public sector borrowing data released today. Stronger sales would help undermine the view that the UK is heading for a ‘triple-dip’ recession, thereby adding further support to GBPUSD above the 1.50 level.

Idea of the Day

The indications coming out of Cyprus and Russia is that a ‘Plan B’ will be presented today, combining a number of elements to make up the short-fall. We wrote about the options yesterday (see “Seeing through Cyprus“) and for now the third option we outlined (the classic EU-style ‘fudge’) is the path being taken, with talk of Russia eyeing both natural resource and banking assets. The way both FX and other markets have been trading suggest that they are priced for such a compromise outcome, but clearly there will be losers and longer-term implications. For the single currency, the upside on a successful compromise from Cyprus is most likely less than the downside from a continuation of the current uncertainty into the weekend.

Latest FX News

- EUR: Despite the lack of resolution to events in Cyprus, the euro performed relatively well during Wednesday, stopping just shy of the 1.30 level on EURUSD. Other indicators suggest that the market is hopeful of a compromise deal for Cyprus.

- GBP: A volatile day, thanks to the message from the Bank of England minutes as some members cautioned against further QE. There was also relief on the budget, which introduced the potential for greater flexibility on the part of the central bank, which was better than the loosening of the bank’s remit that some had feared. GBPUSD is holding above the 1.51 level for the time being.

- NZD: Around 0.5% firmer overnight to 0.8270 on the back of stronger than expected GDP data for Q4. The economy expanded 1.5% (expected 0.9%), after a modest 0.2% gain in Q3. Of course, all this is rather backward looking, but a boost for the kiwi nevertheless.

- JPY: Weaker during the Asia session. With a new leader (Kuroda) at the helm of the BoJ, expectations are rising for near-term policy action from the Bank of Japan, with unattributed press reports suggesting this will happen soon and via a number of measures. There was a brief push above 96.00 overnight, with high of 96.14 the near-term resistance level to watch.

- USD: All steady from the Fed in terms of policy and the messages from the statement and news conference.

- AUD: Marginally softer overnight, although largely unmoved by the political wobbles surrounding the current PM Gillard. No candidates stood in the potential leadership ballot. Aussie still looking comfortable in the bigger picture, with the 1.0367/71 area still key in terms of near-term support.

Further reading: