Idea of the Day

The war of words between US politicians is really starting to heat up as the possibility of crashing into the debt ceiling becomes more of a reality. As much as you’d think they would not like to see the ceiling hit and therefore risk plunging the world’s biggest economy back into recession, there’s almost a feeling that some of the pig-headed politicians would actually take that risk if it meant getting their way. There’s a hope that a compromise will be reached at the week end, but as we’ve seen in the past this is unlikely and discussions will probably go down to the wire. Without today’s non-farms you would expect the dollar to be out of focus, but it remains the one to watch having taken a bit of a bath in the last few weeks. One of the main beneficiaries has been the Kiwi which has rallied over 7% in just over a month. I little bit of profit taking has put an end to the move for now but if the dollar continues to decline it’s the Kiwi that could continue to reap the rewards.

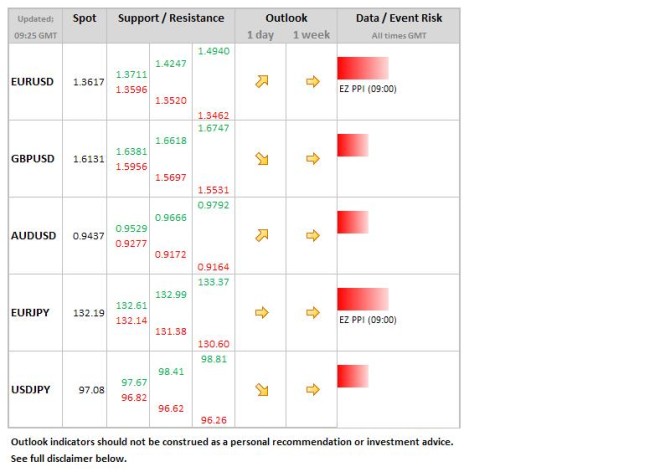

Data/Event Risks

USD: Despite the government shutdown the weekly jobless data was released and we saw better than expected claims numbers although, it was a small rise on the week before. Unfortunately, the same cannot be said for the non-farm payroll which should be released today, so we are unlikely to see the usual volatility we get on the first Friday of the month this time round. That said, without a resolution the looming debt ceiling headline of 17th October approaches, so markets may not be that tranquil.

EUR: Inflation data in the form of PPI is released from the Eurozone this morning showing the change of prices of goods sold by manufacturers. The figure is due to dip from the surprise spike to 0.3% last month to 0.1% indicating deflationary pressures for producers in the Eurozone are slowly abating.

Latest FX News

GBP: The UK services sector has now expanded at its strongest rate for fifteen years giving further indication that the UK economy is in much better shape than many have been predicting. Sterling strengthened initially, but the bullish momentum dried up later in the session pulling GBP/USD back from its highs so support at 1.6100 will be closely monitored.

USD: The ISM’s non-manufacturing index fell from 58.6 to 54.4 in September. Expectations were for a drop to 57.4. The release just added to the bearishness that had set in and doesn’t give the greatest of pictures considering that the figure includes industries that range from utilities and retail to health care, housing and finance and make up almost 90 % of the economy.

JPY: The dollar’s recent strength must be an annoyance to the Japanese monetary policy makers who kept their benchmark interest rate unchanged at 0.1%. There was also little in the way of any other changes and the statement that followed turned out to be rather uneventful.

Further reading:

With No Default Expected, the Dollar May Finally Catch a Break

ISM Non-Manufacturing PMI disappoints with 54.4 points – USD falls