Idea of the Day

No surprise with the RBA keeping rates steady at 2.50% overnight, but the currency is weaker by some 0.3% on the basis that the statement describes the currency as “uncomfortably high”. The move on the Aussie is pretty small given this sentiment, but reflects the belief that there is nothing solid behind this sentiment, in other words there is little the RBA can do near-term to counteract currency strength. This statement comes after comments from RBA governor Stevens last month also reflecting the overvaluation of the currency. For now at least, it appears that the Aussie is set to remain in the lower half of the year’s range, with any push above the mid-point (0.9724) likely to be all too brief as the market fears more pointed remarks from the central bank.

Data/Event Risks

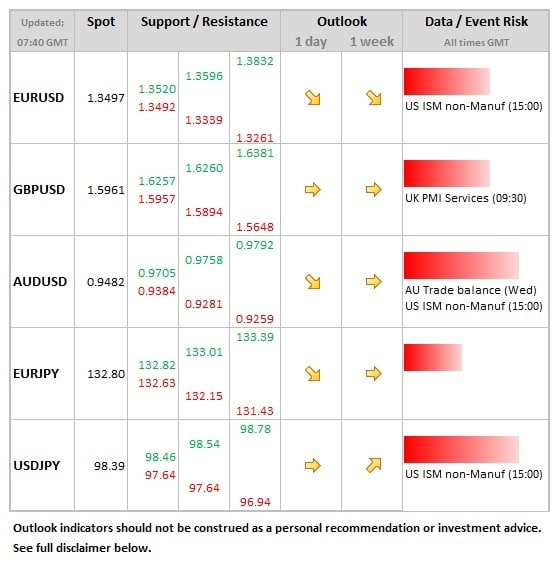

USD: Non-manufacturing ISM data at 15:00 GMT. Headline index is seen falling from 54.4 to 54.0, but as usual, volatility risks on the data at least are greater given the government shutdown. The dollar should largely shrug off any volatility though.

Latest FX News

USD: Trading modestly weaker during Monday, but the ranges were tight enough not to place too much significance on the move. On the majors, the EUR and CHF were the main gainers.

EUR: Final PMI data was in line, leaving talk around the ECB to be the main focus. Rate cut expectations seem low, partly because the focus is on the liquidity side and the scope for more liquidity provision into year end. Don’t rule out a cut in the deposit rate as well before the year is out.

GOLD: We wrote in the middle of last month how the prospects were looking a little better for gold after what has, for the most part, been a fairly disappointing year. This still remains the case, but the ability to break through the highs seen in late August remains lacking right now, with a push towards the $1,300 level being the near term risk.

Further reading: