Idea of the Day

Focusing back on the single currency, which earlier in the week managed to regain the losses seen in the wake of last week’s surprise rate cut. Some of the reasons why the single currency has done relatively well are outlined in our latest blog (see “Why the euro will do well”). In summary, the rate cut was the least effective option available to the ECB and the dynamics of a low inflation zone with a comfortable current account surplus are often positive for a currency, especially when rates are near zero on most of the other major currencies. This should be borne in mind for the bigger picture, rather than the day to day gyrations. Overnight there was a brief push above the previously broken trendline (which today comes in at 1.3402) and acts as initial resistance. The confirmation hearing of the new Fed chair Yellen takes place today and there were some initial ‘dovish’ noises yesterday which helped weaken the dollar into the close.

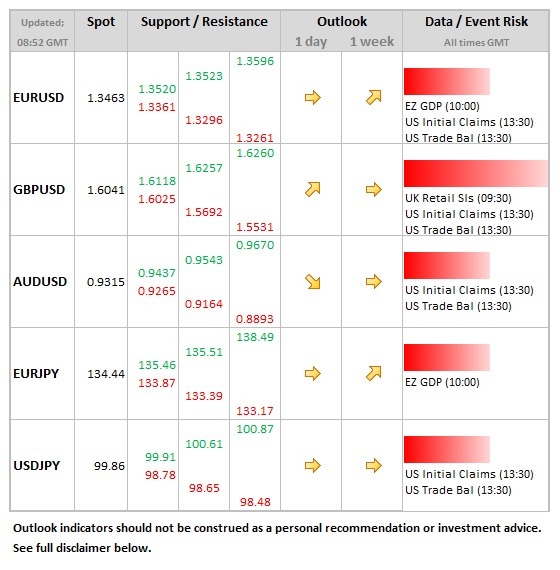

Data/Event Risks

USD: The new Fed Chair begins her nomination hearing today, when she will be rigorously questioned regarding her views on the economy, labour market and lots of other subjects besides during her appearance on Capitol Hill. She is seen as a ‘dove’ and if this is further confirmed, the dollar will be vulnerable to further losses.

EUR: Initial expectations were for eurozone GDP to expand by 0.1% QoQ, but after slightly weaker than expected numbers from France this morning, this could turn out flat. The single currency would be more vulnerable to a negative reading, give the risk of the eurozone moving back into recession.

Latest FX News

USD: Prepared testimony released ahead of Yellen’s confirmation hearing today proved to be modestly bearish for the dollar, saying that the economy and labour markets were performing “far short of their potential”, suggesting both must improve before stimulus is withdrawn. Tapering bets for December were reduced and the dollar was at 1 week low on the dollar index before seeing a modest recovery during Asia trade.

Further reading:

USD/CAD: Continues To Maintain Up Bias Triggered Off The 1.0181 Level