The US dollar buyers are in pain for the last several weeks now. The US dollar has consistently declined after setting a high at around the 81.30 level. Most majors, including the EURUSD and GBPUSD are on the rise and trading around multi year highs.

This week also the US dollar is trading in a range, as the market is eyeing the fed interest rate decision. The investors seem to be nervous, as there are mixed projections of whether the Fed will reduce the bond purchases again in the upcoming meeting or not. Let’s look at some of the things that could impact the US dollar.

In line CPI data

Yesterday, at GMT 12:30 PM, the US inflation data was published by the US Bureau of Labor Statistics. The outcome was mostly in line with the expectations, as for all urban consumers CPI increased 0.1 percent in February on a seasonally adjusted basis as expected by the market. However, over the last 12 months, all items CPI increased 1.1 percent before seasonal adjustment, missing the expectations of 1.2%. I do not believe that this outcome will change the mood of the fed members. So, inflation at the moment is floating in line with the fed’s expectations.

FOMC Impact

The Fed rate decision is lined up later during the day. The market is broadly expecting another $10B reduction in the bond buying program. So, there are three possible scenarios:

- $10B cut – USD positive, and the pairs to watch for a rollover are EURUSD and NZDUSD

- No taper – USD negative – Watch for a spike in GBPUSD.

- $5B reduction – Mild reaction possible, mostly USD negative – USDJPY could bounce.

More: 6 Reasons for Taper 3

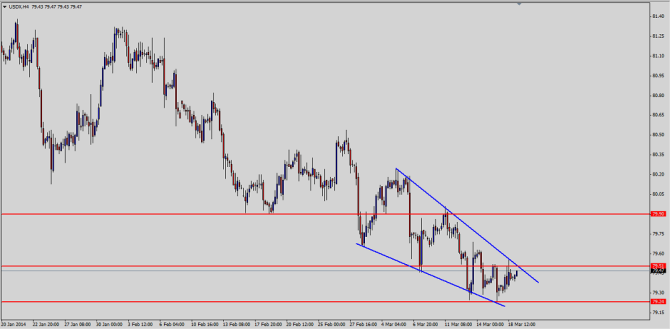

Unavoidable break in the USD

The US dollar is shaping up for a big move in the coming days for sure, There is a contracting triangle forming on the 4 hour chart. The resistance lies at around the 79.50 level, and support lies at around the 79.20 level. Considering the events lined up, one can expect a breakout. An upside swing could take the USD all the way back up to 79.90 level.