US stocks initially traded higher after the better than expected NFP but then we have seen a pullback into Friday’s close on tensions in Ukraine. US yields also fell sharply following the NFP which is also causing downside pressure on stocks.

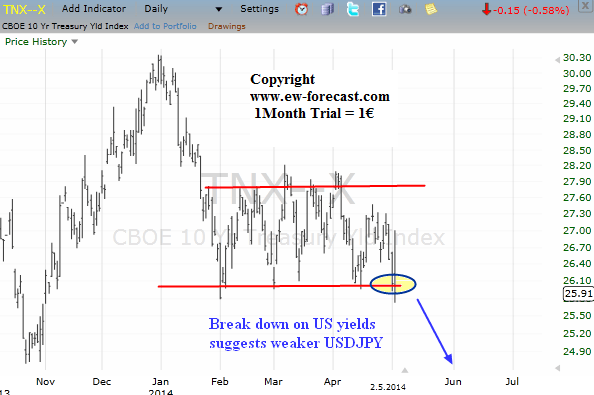

Below we have a chart of 10 year US yields where we can see that price close out side of the 3-month range that could lead to lower prices in May.

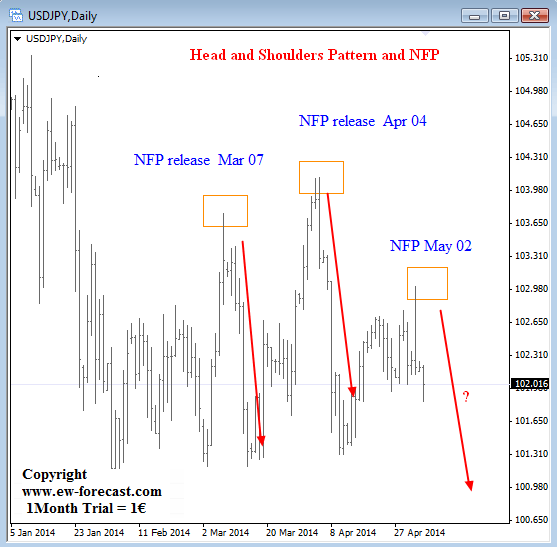

If yields continue to the downside then stocks and especially USDJPY will be moving south as well. In fact, we were looking for a bearish reversal from 103.00 on USDJPY and we got it on Friday. In fact, a reversal is looking strong so ideally it’s start of a larger decline.

Another very interesting view is a comparison of the USDJPY waves to the reaction following the NFP back from March and April when the pair fell sharply, so we would not be surprised to see something similar now at the start of May. A bearish head and shoulders pattern is suggesting the same. We are tracking this pair very closely for EPO.

USDJPY H&S and NFP